- The big brands have to deny Facebook ad dollars to protest against its policies in terms of content

- The movement will become global, says the boycott of the organizer.

- The slowdown in revenue growth and COVID-19 impact are additional concerns

- Facebook has announced ways it will make changes

More than 180 companies and artists have decided to withdraw from advertising on Facebook in July, according to one of the organizers of the “Stop the Hate for Profit” of the movement. The list of unfriending companies include several big names such as Verizon, Coca-Cola, UnileverUSA, The North Face, The Hershey Company, Starbucks Coffee, Patagonia, lululemon, Levi’s and Honda. A few are stopping advertising on other social media platforms as well as a part of their hate speech boycott.

Facebook has dropped 8.32% on Friday, and are flat in trading today. On Friday, CEO Mark Zuckerberg announced new policies aimed at connecting people with the information on the right to vote, crack down on voter suppression, and reduce/label hate.

It is difficult to know what the extent of the financial impact on Facebook will be. Pathmatics estimates as higher expenditure than 100 brands accounted for only $ 4.2 billion, or 6%, from the platform of advertising revenue last year. The movement may have to become larger and particularly the smaller companies that rely on social media before it really hurts the company’s bottom line. One of the organizers, Common Sense Media, recently told Reuters the campaign will start calling on major companies in Europe to join the boycott.

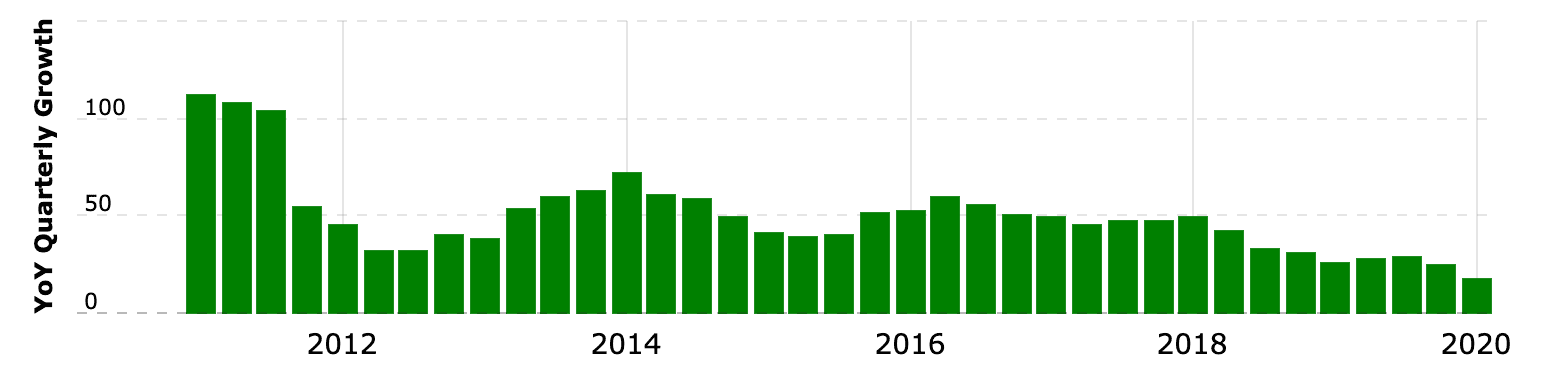

Almost all of Facebook revenue comes from advertising on its platforms. Revenue was $ 70.70 billion in 2019, up 27% year-on-year. The growth has been a concern, however, demand and prices have also been affected by the COVID-19 business closures. Revenue for Q1 2020 has increased by 18% to $17.73 billion, Facebook is the lowest quarterly growth as a public company.

“After the initial steep decline in advertising revenue in March, we saw signs of stability reflected in the first three weeks of April, where advertising revenues have been stable compared to the same period of the previous year, down 17% year-on-year growth for the first quarter of 2020,” it said in a press release. “The month of April trends reflect the weakness in all of our geographic areas as the majority of our large countries have had a kind of shelter in place guidelines are in force.”

Facebook year-on-year quarterly growth. Source: Trends.

Source: investopedia.com