Takeaways

- ExxonMobil Corp. Profit in the third quarter plunged from last year's all-time high for the period due to lower oil and natural gas prices.

- The company recorded the highest throughput of refining. since the merger of Exxon and Mobil in 1999.

- ExxonMobil increased its quarterly dividend from 91 cents to 95 cents.

ExxonMobil Corp.'s profit (XOM) in the third quarter fell more than half of its record last year on a decline in oil and gas prices, although the company's refineries recorded the highest throughput of all third quarters since 1999. The company also increased its quarterly dividend.

The giant of Energy earned $9.07 billion over this period, down 54% from the same quarter of 2022. Earnings per share (EPS) came in at $2.27, below the analyst forecasts. Revenue fell 19% to $90.76 billion.

ExxonMobil said the drop in profits was due to a nearly 60% drop in natural gas prices and a 14% drop in oil prices. The company also reported a 69% drop in profits at its chemicals division as raw material prices rose and industry supply exceeded Requirement. However, the refinery's throughput reached 4.2 million barrels per day, the highest figure since Exxon merged with Mobil 24 years ago.

CEO Darren Woods said the company delivered “strong operational performance, profits and cash flow”. He added that ExxonMobil's purchases during the quarter of Pioneer Natural Resources Co. (PXD) for $59.5 billion and Denbury Inc. (DEN) for $4.9 billion “will strengthen our portfolio and will position us to generate profitable growth and attractive returns for many years. come.”

The company has increased its quarterly dividend to 95 cents per share from 91 cents per share, noting that it has increased its annual dividend for 41 consecutive years.

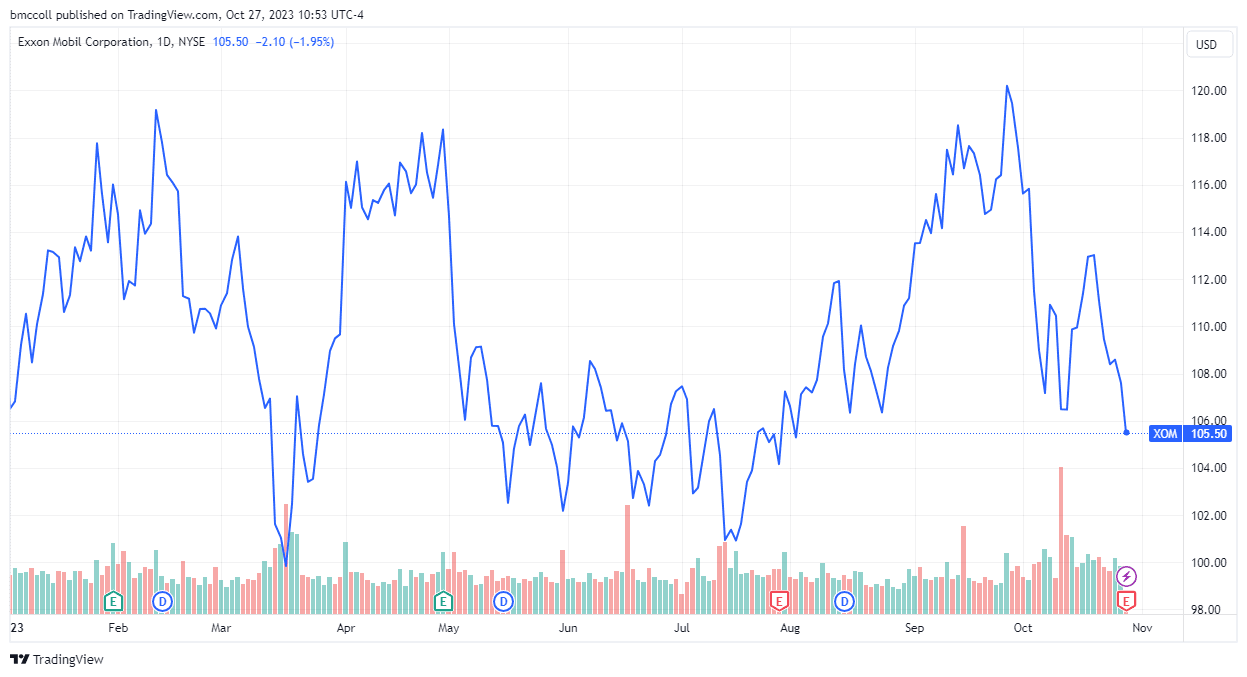

ExxonMobil shares fell more than 2% in early trading Friday, and were down 1% year to date.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com