Group Expedia, Inc. (EXPE) reports earnings Wednesday after the closing bell, with analysts expecting a loss of $1.29 per share on $2.15 billion in the first quarter of 2020 sales. The consensus would be the mark for a 22% decline in revenue compared to the fourth quarter of 2019, with the sars coronavirus pandemic of spawning in the event of a major disaster in the air travel and hotel occupancy. Similarly, Expedia had a hard time meeting Wall Street estimates, before the crisis, with frustrated customers move away and travel booking directly with the airline, hotel, and car rental web sites offering best deals.

The travel giant noted pressure as a result of the pandemic, approximately one month before the President Trump to stop travel of the air with Europe, but failed to realize the extent of the damage. The first sign of trouble came on Feb. 25 when the company released the details of a restructuring plan that included the elimination of 3,000 jobs. Expedia removed 2020 orientation less than three weeks later due to the impact of more than $ 30 million to $40 million range,” followed a week later with a $ 1.9 billion loan to pay the bills.

In April, the Chairman Barry Diller has warned that Expedia would spend just $ 1 billion by 2020″, the advertising, compared to $5 billion in previous years. The reflects deep pessimism about a quick return to the air travel, given the continued threat of infection and a second wave this winter. The stock is now trading roughly at the same level he did at the time, highlighting the extremely oversold technical conditions after the first quarter of the slide. Special Note: Diller is also the chairman of Dotdash parent IAC/InterActiveCorp (IAC).

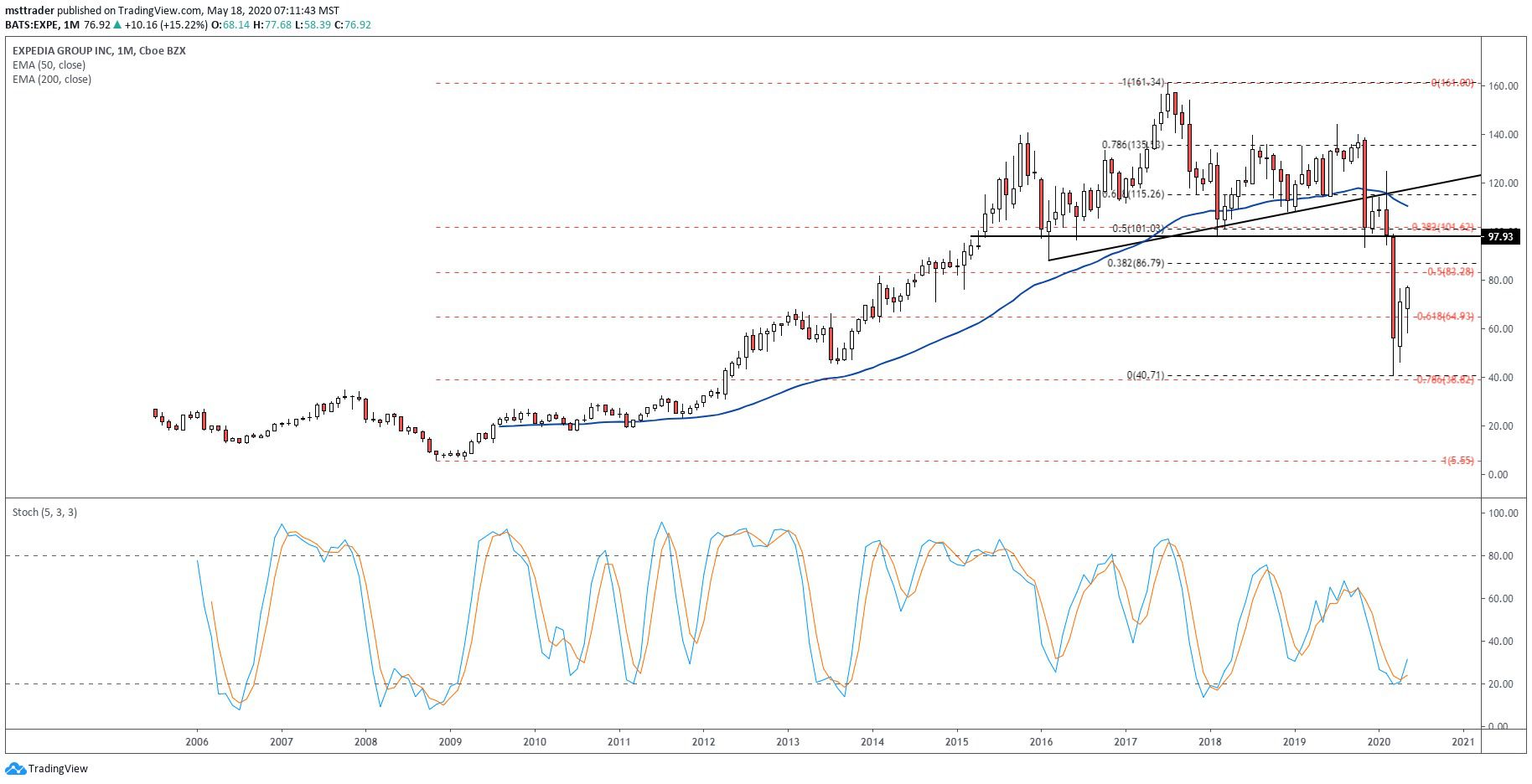

EXPE Long-Term Chart (2005 – 2020)

TradingView.com

The creation of the public company to $27.50 in July 2005 and softened in a trading range between this peak and the trough of 2006 at $12.87. 2007 escape has failed after having reached the middle of$30, giving way to a steady downtick that broke the low of 2006 during the economic collapse of 2008. The stock posted an all-time low of $5.90 in November 2008 and turned sharply higher, to complete round trip in the state of the high in 2011.

A 2012 breakout caught fire, lifting to three rallies wave in July 2017 all-time high at $161.00. The stock sold at a two-year low of $98.52 in February 2018 and held within this trading range until November 2019, when a poorly received third quarter of 2019 earnings report triggered a rupture, followed by a recovery attempt in February. This effort failed in March, confirming a four-year head and shoulders, of ventilation and of the new resistance at the neckline in the upper part of $90.

EXPE Short-Term Outlook

The March sell-off ended in a time limit of two points of the .786 retracement level of Fibonacci from the nine-year period of the upward trend, marking a high rating of location for a long-term low before a slight increase in May. The rebound has mounted the .618 retracement at$ 65, which is vulnerable to a re-test if the earnings report triggered an aggressive sell-the-news reaction, which seems unlikely, because the company financial difficulties have been well documented.

The monthly stochastic oscillator reaches the oversold zone in March and has crossed higher in April, allow six to nine months of relative strength. In turn, this could support a possible test of the head and shoulders neckline, which is closely aligned with the .382 rally retracement and .50 sell-off of retracement levels. Conversely, a major reversal before that level is reached, you greatly increase the chances that the March low breaks, and the stock gives up to the final installment of the long-term upward trend.

The Bottom Line

Expedia Group reports first quarter 2020 earnings after the closing bell, Wednesday, with well-documented and reduced the financial problems of the lowering of the odds for a sell-the-news reaction.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com