Key Points

- EPAM Systems cut its revenue and earnings outlook for the current quarter and for the full year.

- The company said it found customers were “being more cautious” about spending.

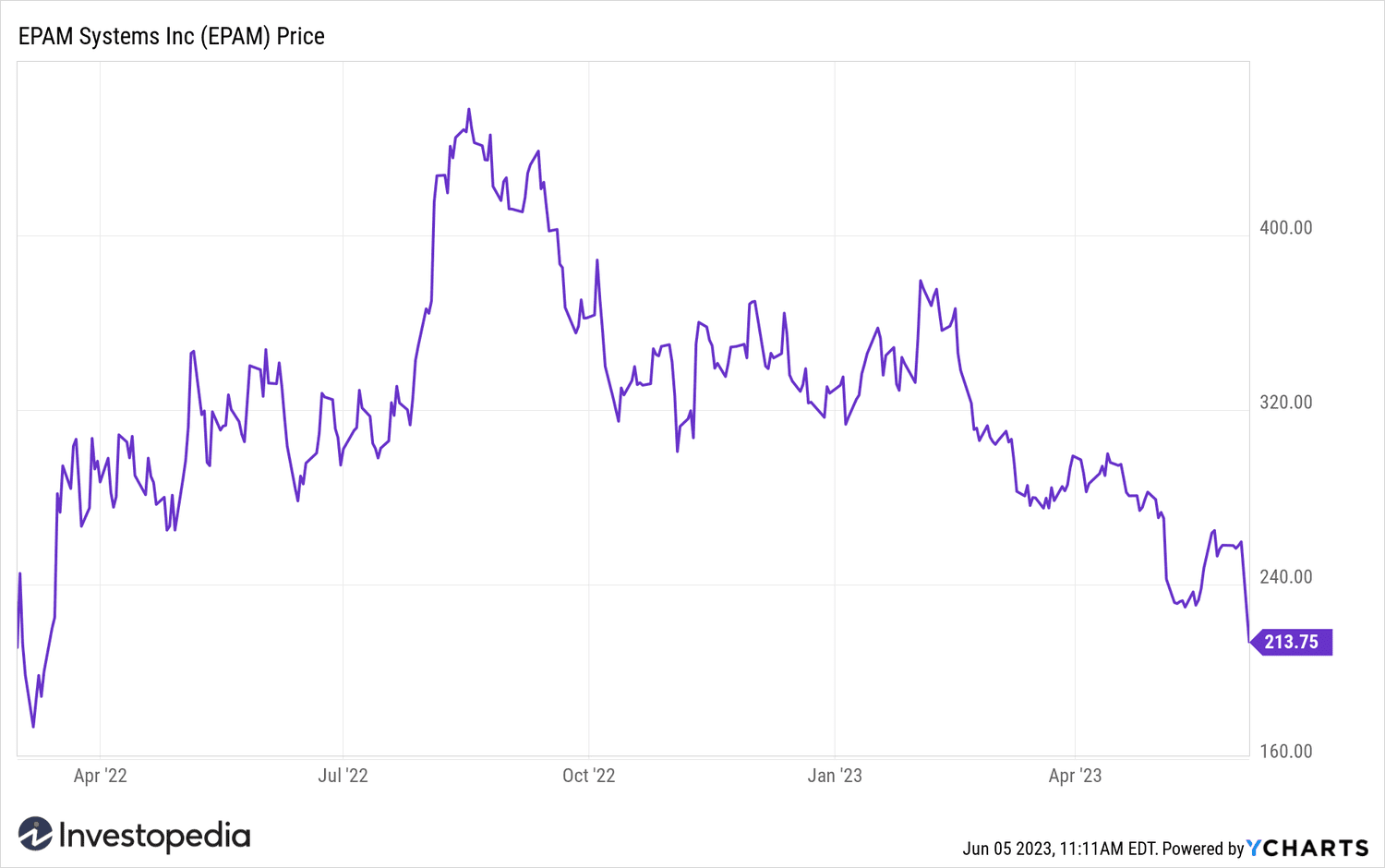

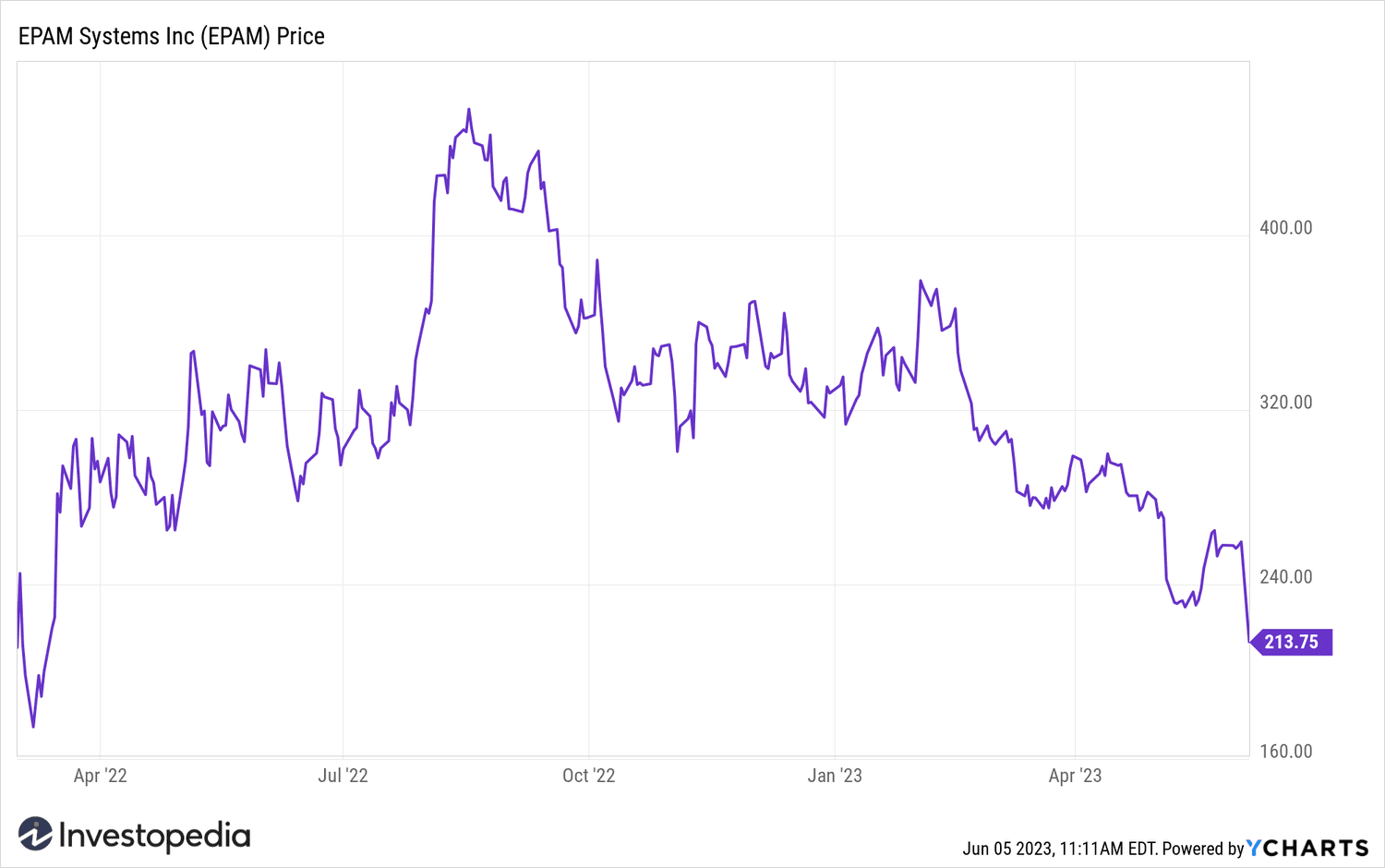

- Stocks fell nearly 18% on Monday morning to their lowest level in more than a year.

The shares of EPAM Systems (EPAM ) fell on Monday morning as the engineering software provider cut its forecast, citing a pullback in customer spending.

EPAM cut its current quarter revenue outlook to a range of $1.16 billion to $1.17 billion and earnings per share (EPS) to between $2.33 and $2.40 . It previously forecast revenue of $1.195 billion to $1.205 billion and EPS of $2.38 to $2.46.

For the full year, it sees revenue of $4.65 billion to $4.8 billion, with EPS of $9.80 to $10.20. Its previous estimate was for revenue between $4.95 billion and $5 billion and EPS of $10.60 to $10.80.

CEO Arkadiy Dobkin explained that since the company's first quarter earnings call in early May, “we've seen our customers become even more cautious about spending, particularly in the 'construction' segment of the global IT services market.”

He noted that after reviewing changes in EPAM forecast data in May and June, the company realized that “pipeline conversions are occurring at slower rates than previously expected” and that it also sees some reduction in the total pipeline.

Dobkin added that the company is confident that EPAM will once again be well positioned for long-term growth “once industry demand returns”.

EPAM shares fell by nearly 18% of early trading on Monday at their lowest level since March 2022.

YCharts

Source: investopedia.com