Takeaways

- Activist investor Elliott Investment Management LP has called for a management shake-up at real estate investment trust and communications infrastructure provider Crown Castle Inc.

- Elliott said the Crown Castle's board had ignored the hedge fund. The request for changes was made more than three years ago.

- Elliott said that, if necessary, he was prepared to present his own slate of alternative candidates to the board during Crown Castle's shareholders' meeting next May. .

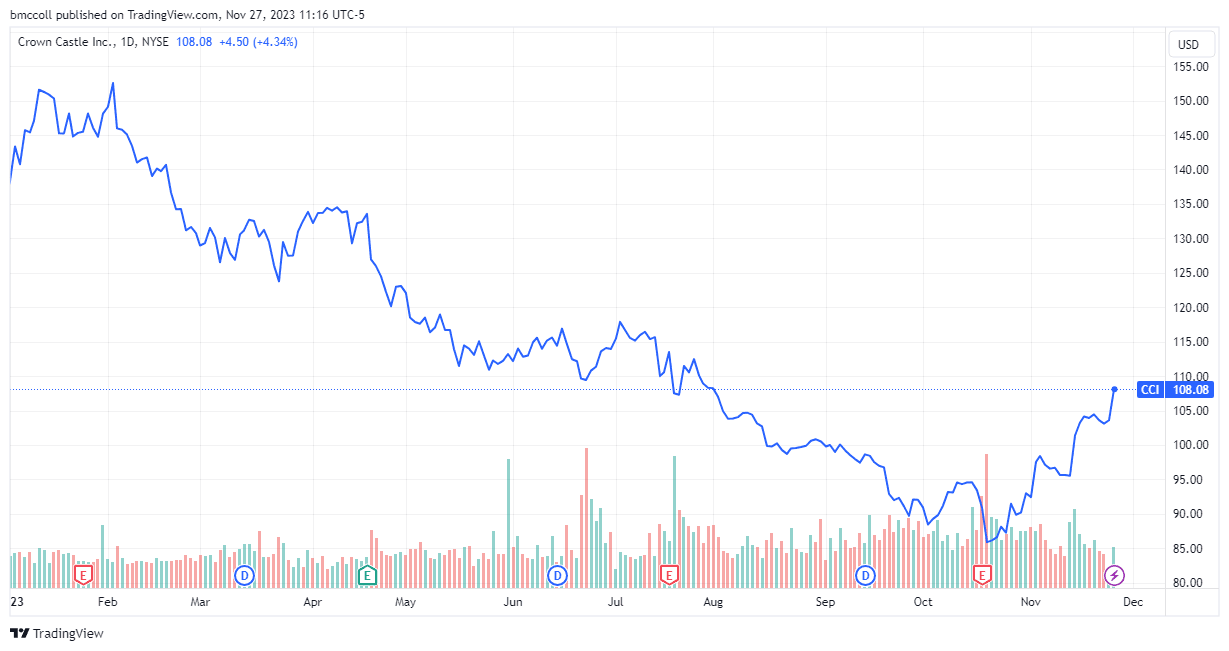

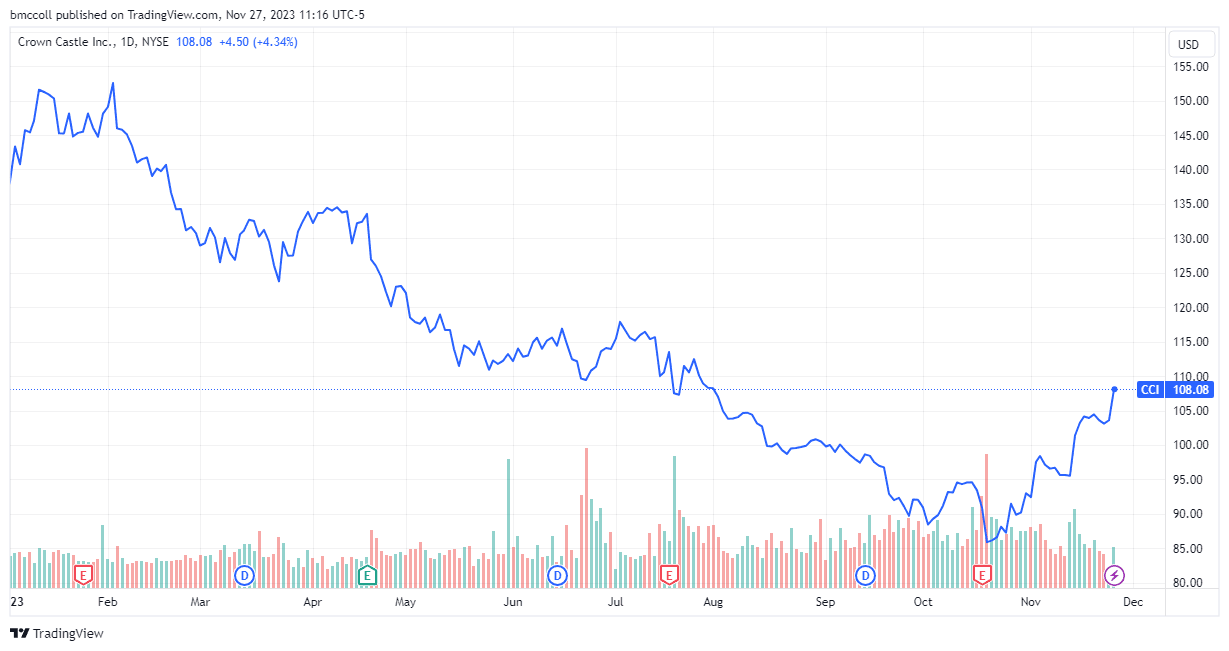

Crown Castle Inc. (CCI) Stock surged Monday after activist investor Elliott Investment Management LP tried again to shake up the provider of wireless towers and fiber-optic cables.

Elliott wrote a letter to the board calling for “significant changes”, including the arrival of a new executive and new board leadership. The activist hedge fund, which said it has a $2 billion stake in the company, said Crown Castle failed to heed its 2020 demands for “strengthened governance and regulatory improvements.” the fiber strategy”.

The investor argued that Crown Castle “suffers from a profound lack of oversight by the board of directors, which has contributed to irresponsible management and flawed financial policy.”

In addition to shaking up senior management, Elliott wants a strategic and operational review of Crown Castle's fiber business, an optimized executive incentive plan and better corporate governance.

Elliott added that, so that it “prefers to continue a constructive engagement with the Company, as it attempted in 2020”, it is also ready to defend its cause directly to shareholders by proposing a majority list of alternative directors at Crown Castle's annual meeting in May 2024.

Despite Monday's 3.6% intraday gain, Crown Castle shares are down for the year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com