Trending Videos

Takeaways

- Eli Lilly shares lost ground after study found patients who use its weight loss treatments may gain weight once they stop taking the drugs.

- Those who stayed on Zepbound for an extended period lost more weight, while those given a placebo saw their weight increase.

- Zepbound received FDA approval on last month. Its active ingredient is also found in Lilly's bestselling obesity and diabetes treatment Mounjaro.

Eli Lilly shares (LLY ) fell 2.3% on Monday after a study by the drugmaker found that patients who use its weight loss treatments may gain weight once they stop taking these drugs.

Researchers looked at those who took Zepbound, which was approved last month by the Food and Drug Administration (FDA) to treat obese and overweight people, for 36 weeks. They then asked half to continue taking it for another 52 weeks, while giving the other half a placebo.

After the extended period, patients who remained on Zepbound had an additional average weight loss of 5.5%. However, those who took the placebo saw their weight increase by an average of 14%.

Dr. Jeff Emmick, senior vice president of product development at Lilly, explained that many patients, doctors and the general public do not always understand that obesity is a chronic disease that often requires ongoing treatment, but #39;they end it once the weight goals are reached. . He added that studies like this show that “continuing treatment can help obese people maintain their weight loss.”

The active ingredient Zepbound's drug, tirzepatide, is also found in Lilly's other popular weight loss and diabetes drug, Mounjaro.

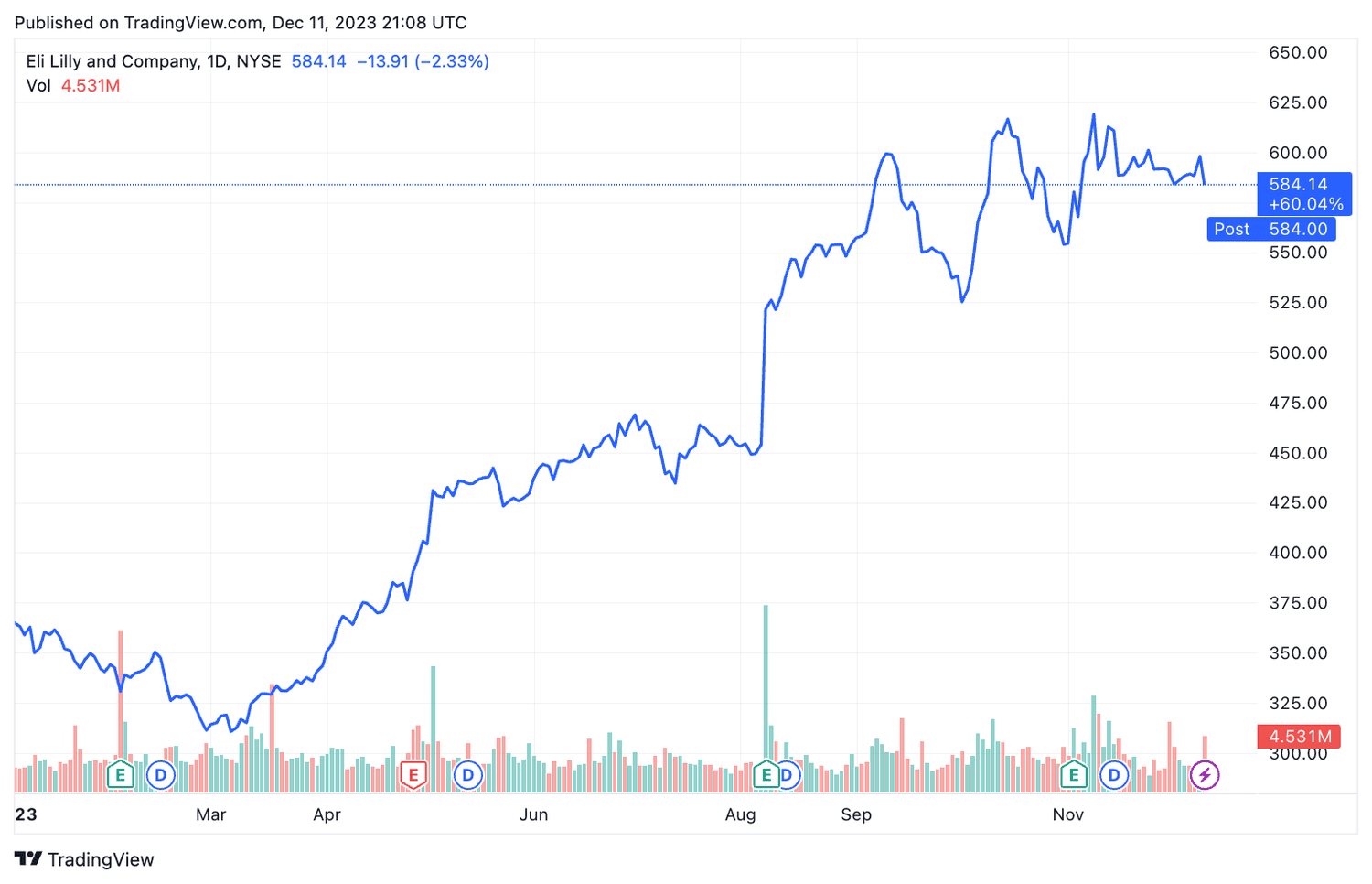

The actions of Eli Lilly hit a record high after Zepbound received regulatory approval, and despite Monday's decline, shares have gained about 60% this year.

TradingView

Have -you a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com