Key Points

- Eli Lilly shares hit an all-time high after the company completed two acquisitions earlier this year.

- The deals expand Lilly's reach into potential treatments for diabetes and obesity

- Together, the two transactions could have a total value of over $2 billion, if certain conditions are met.

Eli Lilly (LLY) stock hit an all-time high as manufacturer pharmaceuticals made two acquisitions, one of which related to the booming market for weight-loss treatments.

The company said it has completed the; purchase in July of Versanis Bio, including its main active ingredient, bimagrumab. Bimagrumab is being studied in a Phase 2b study alone and in combination with the drug in Novo Nordisk's (NVO) Ozempic and Wegovy to treat overweight and obese adults.

The deal could value Versanis Bio up to $1.925 billion, depending on the achievement of certain development and sales milestones.

In a separate statement, Lilly said it completed the purchase of Sigilon Therapeutics in June. Sigilon focuses on medicines for a wide range of acute and chronic diseases and has worked with Lilly since 2018 on a treatment for patients with type 1 diabetes.

Sigilon investors get $14.92 per share upfront, and they get a non-exchangeable Contingent Value Right (CVR) per share, which could be worth an additional $111.64 in cash. This brings the potential transaction to approximately $309.6 million, excluding shares held by Lilly.

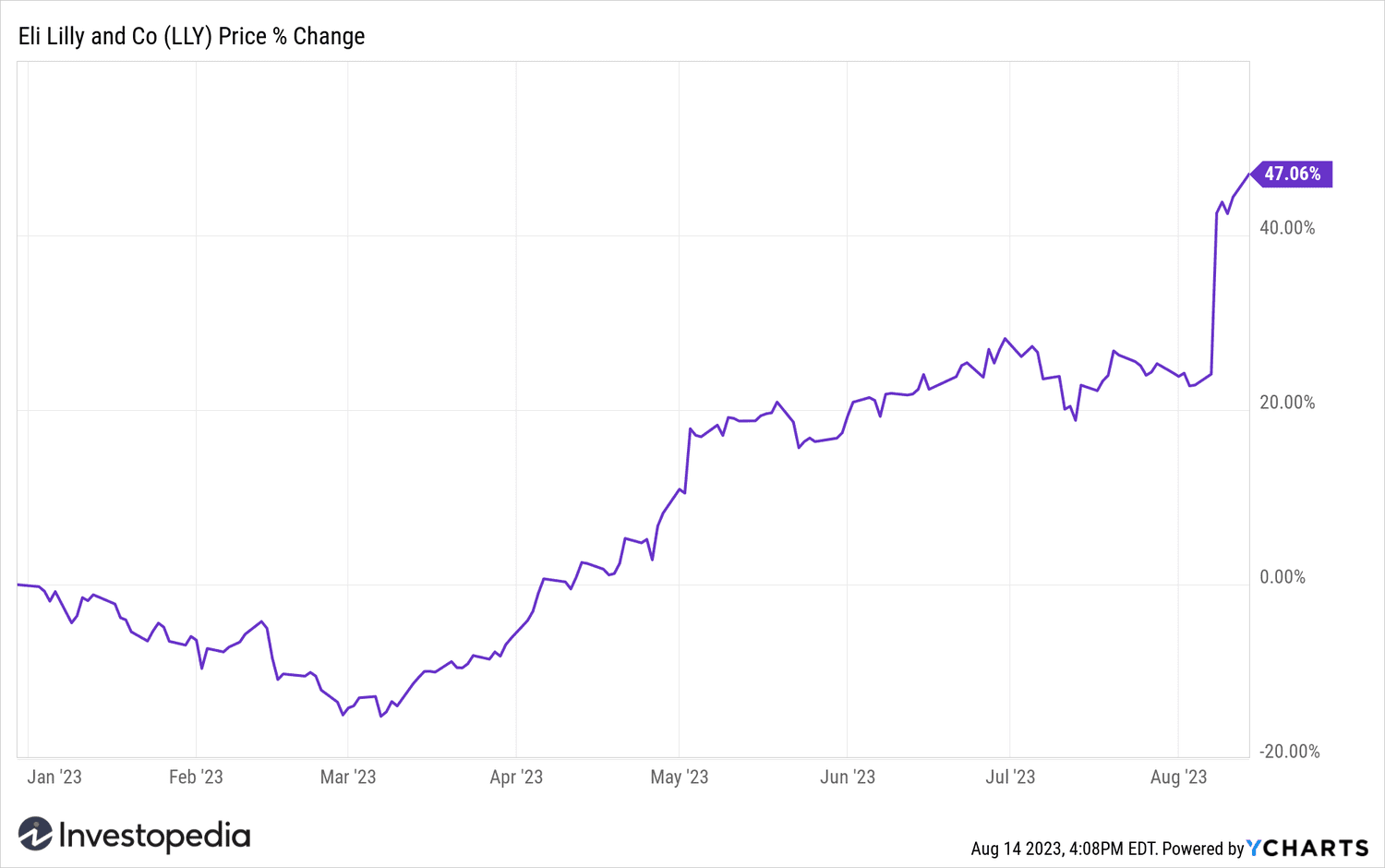

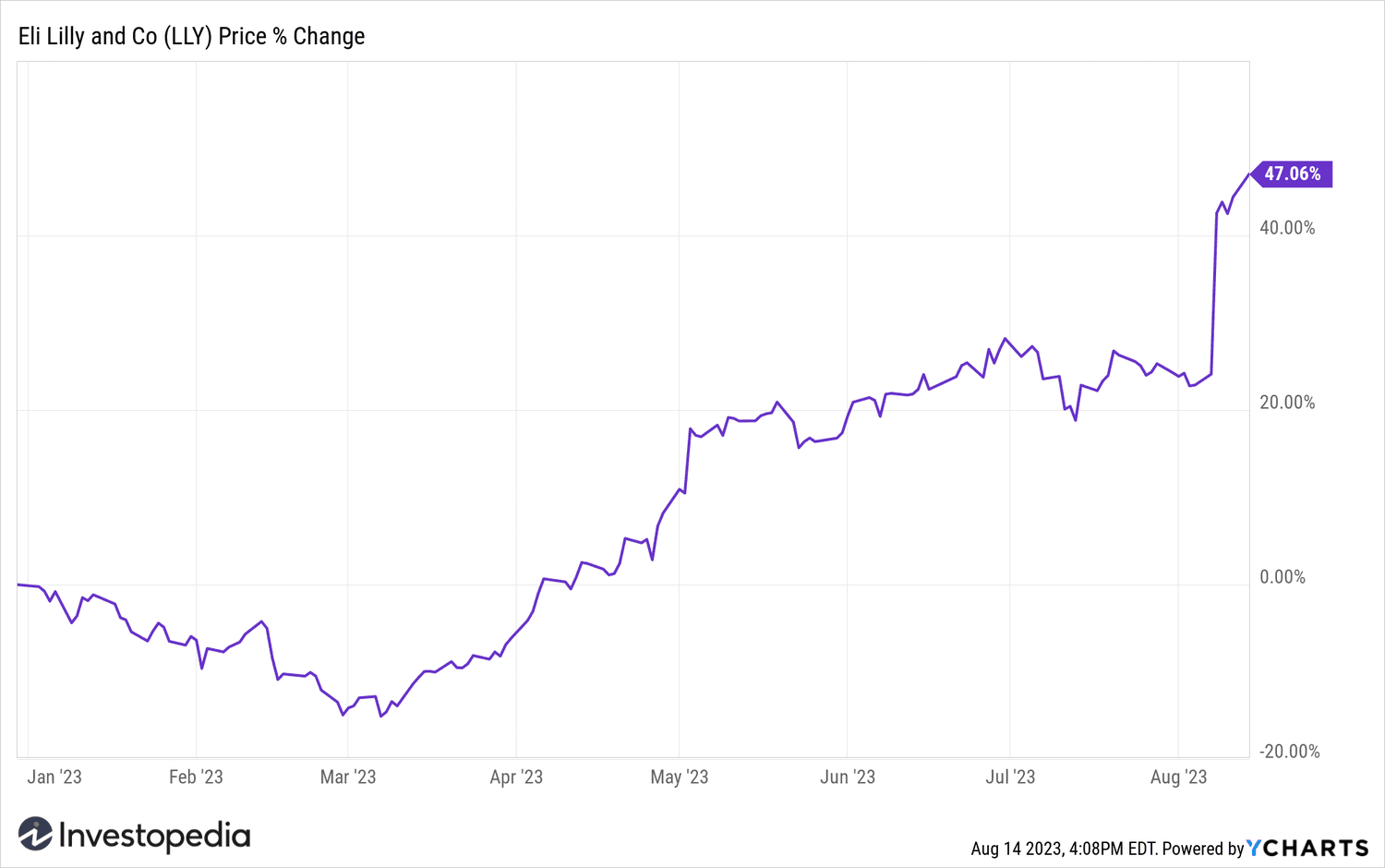

The actions of Eli Lilly gained 1.8% on Monday and are up nearly 50% so far this year.

YCharts

Do you have any news tip for journalists in & #39;Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com