Key Points

- Eli Lilly has agreed to purchase privately-held biopharmaceutical company Versanis for up to $1.93 billion.

- The purchase is intended to strengthen Lilly's reach in the cancer drug market. obesity.

- Lilly reported last month that its experimental obesity drug has been very successful in reducing patients' weight.

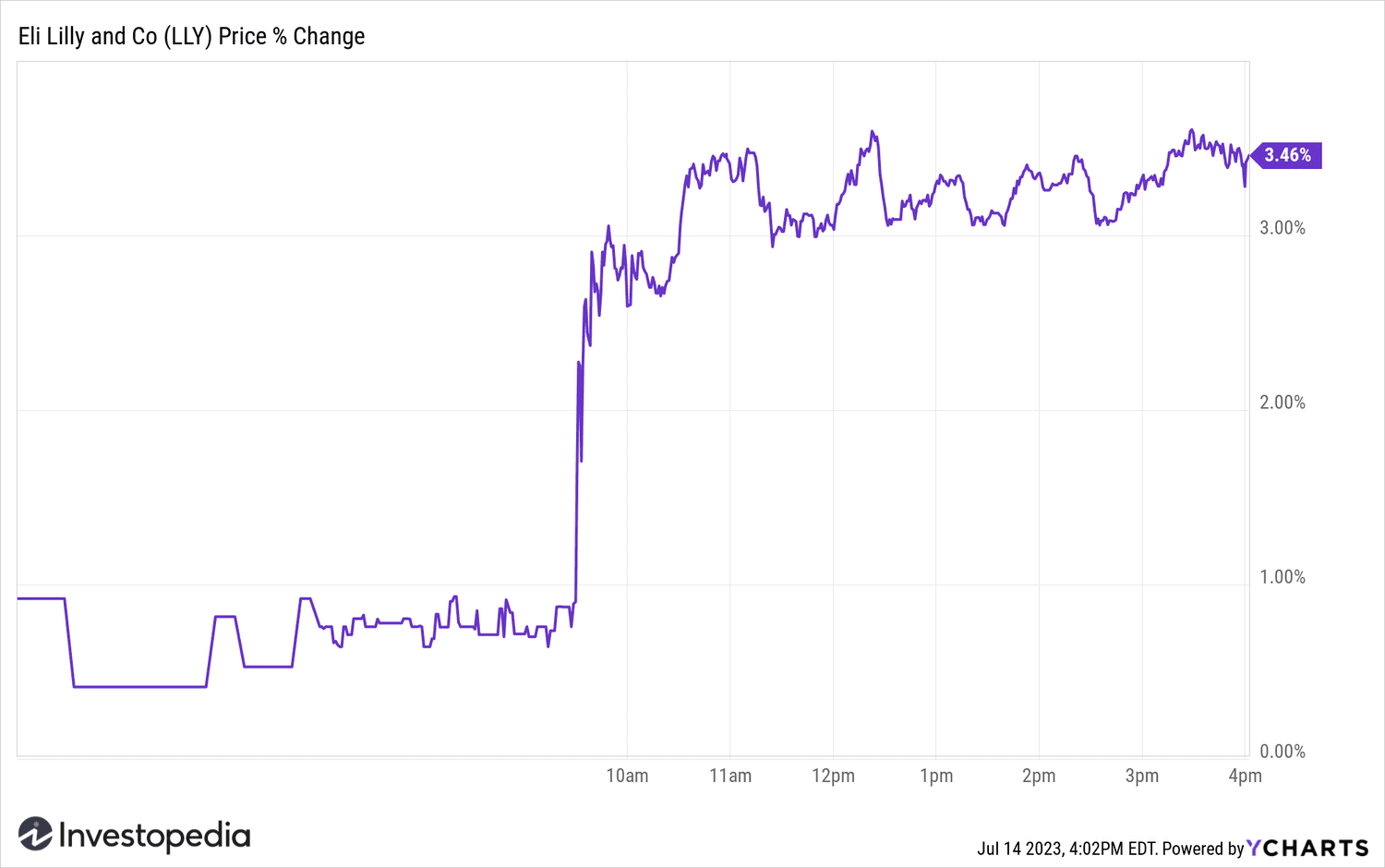

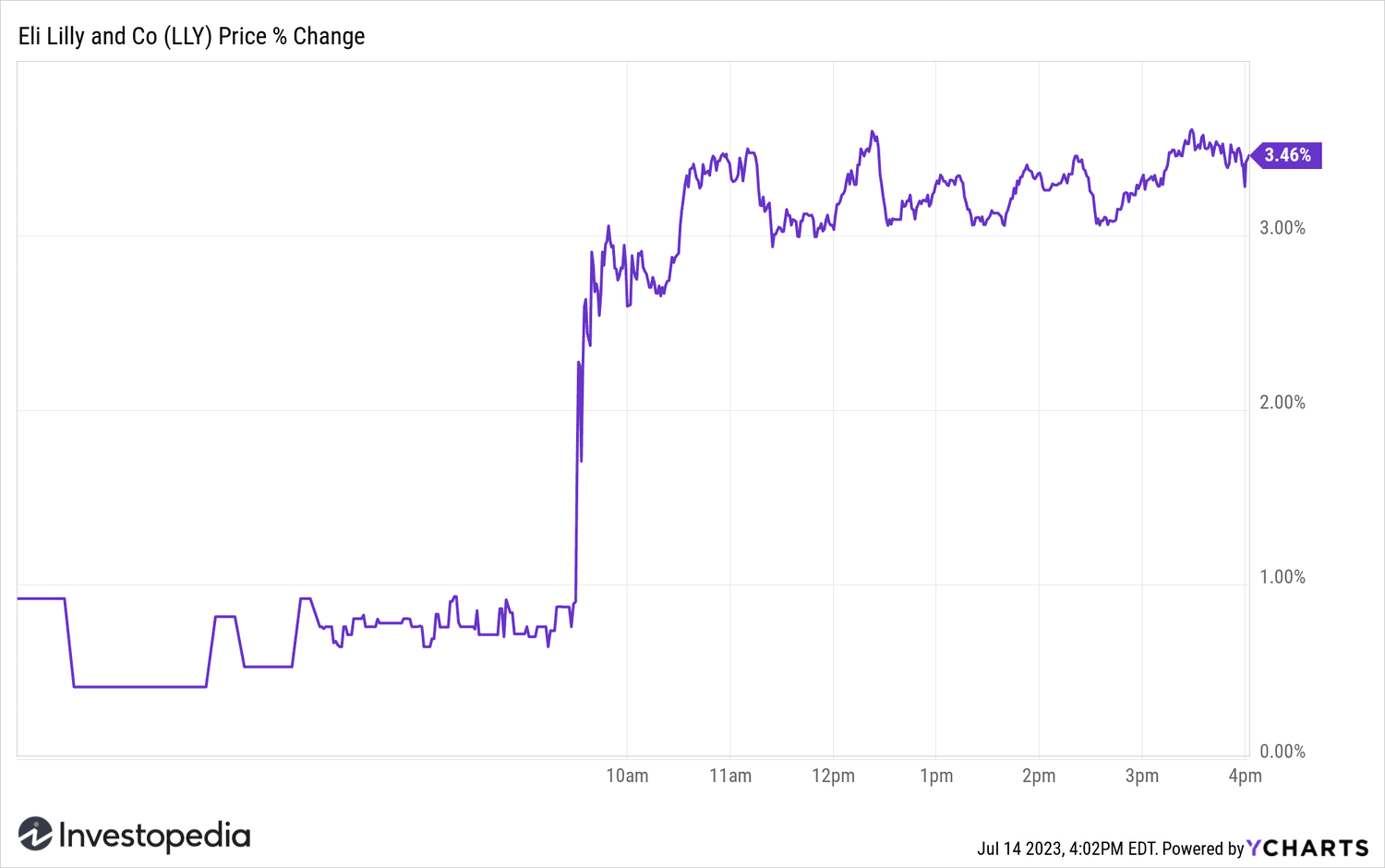

Eli Lilly (LLY) was one of top performing stocks in the S&P 500 on Friday after the drugmaker agreed to buy biopharmaceutical company Versanis to expand its portfolio of obesity treatments.

Lilly noted that under Under the agreement, Versanis shareholders could receive up to $1.925 billion in cash, including an upfront payment and subsequent payments based on the achievement of certain development and sales milestones.

The company pointed out that Versantis' main active, bigmagrumab, has the potential to reduce fat mass while preserving muscle mass in people who are obese or suffer from obesity-related complications. Bigmagrumab is currently in a phase 2b study.

Lilly hopes to capitalize on the growing demand for drugs that promote weight loss, fueled by the success of Ozempic and Wagovy de Novo Nordisk (NVO). Last month, Lilly reported that a Phase 2 trial of its obesity and diabetes treatment with retatrutide showed patients lost an average of 24% of their body weight after having it. used for 24 weeks.

Companies don' haven't indicated when they expect the deal to close.

Eli action Lilly gained 3.4% on the Friday following the news.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com