Takeaways

- Eli Lilly has agreed to buy POINT Biopharma Global for $1.4 billion, expanding its reach into cancer treatments.

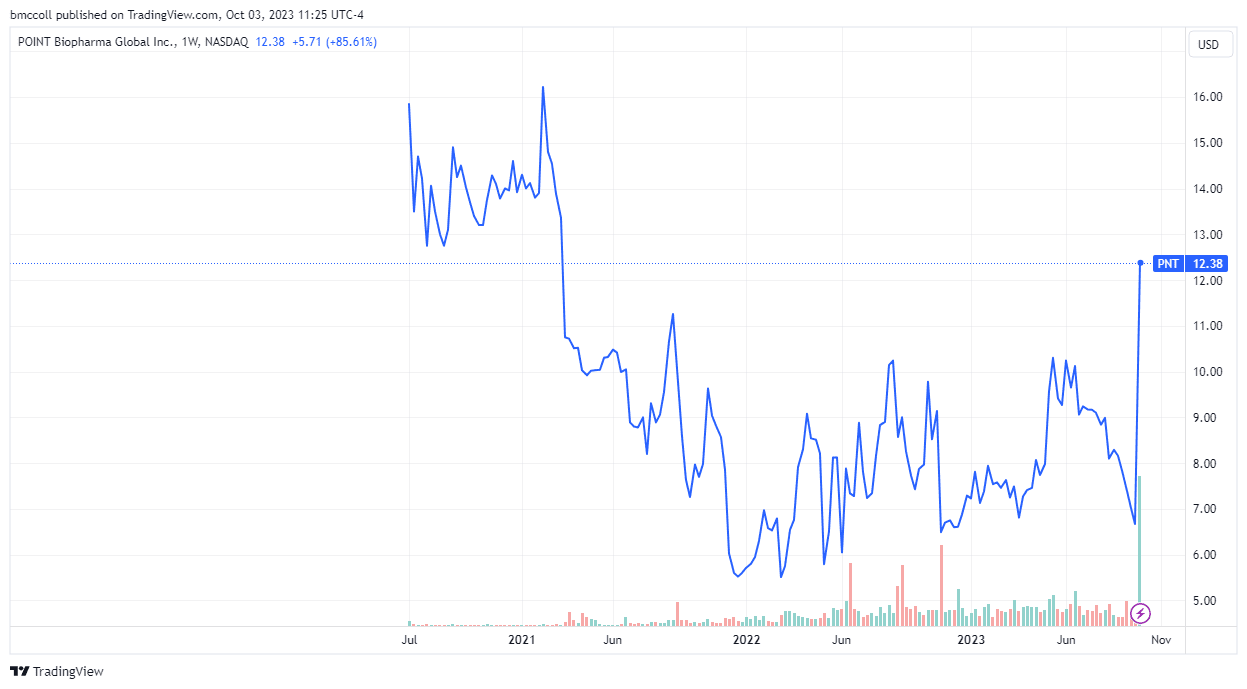

- Lilly will pay $12.50 per share for POINT, a 87% premium to the company's closing price on Monday. .

- POINT has a pipeline of clinical and preclinical stage therapies using targeted radiation against cancer cells.

POINT Biopharma Global (PNT) shares have soared more than 80% in early trading Tuesday after Eli Lilly (LLY) agreed to buy the radiopharmaceutical company for $1.4 billion to expand its cancer treatments.

Lilly said it would pay $12.50 per share for POINT, an 87% premium to the company's closing price Monday. He noted that the all-cash transaction is not subject to any financing conditions and is expected to be completed towards the end of this year.

Lilly explained that POINT has a pipeline of clinical solutions and preclinical stage therapies using targeted radiation methods, known as radioligand therapy (RLT), to kill cancer cells. He added that RLT provides significant anti-tumor efficacy while limiting the impact on healthy tissues.

The agreement also gives Lilly access to POINT's radiopharmaceutical manufacturing campus in Indianapolis, Indiana, and its radiopharmaceutical research and development center in Toronto.

Jacob Van Naarden, president of L' Lilly's oncology unit noted that the company views this acquisition as “the beginning of our investment in the development of several meaningful radioligand drugs for difficult-to-treat cancers.”

POINT Biopharma Global shares surged to their highest level since March 2021 following the news. Shares of Eli Lilly lost ground and were down 3.6% as of 11:30 a.m. ET.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com