Key Points

- Eli Lilly has agreed to buy DICE Therapeutics for $2.4 billion.

- The deal values DICE shares at a nearly 40% premium to Friday's close.

- Deal strengthens Eli Lilly" ;s portfolio of autoimmune treatments.

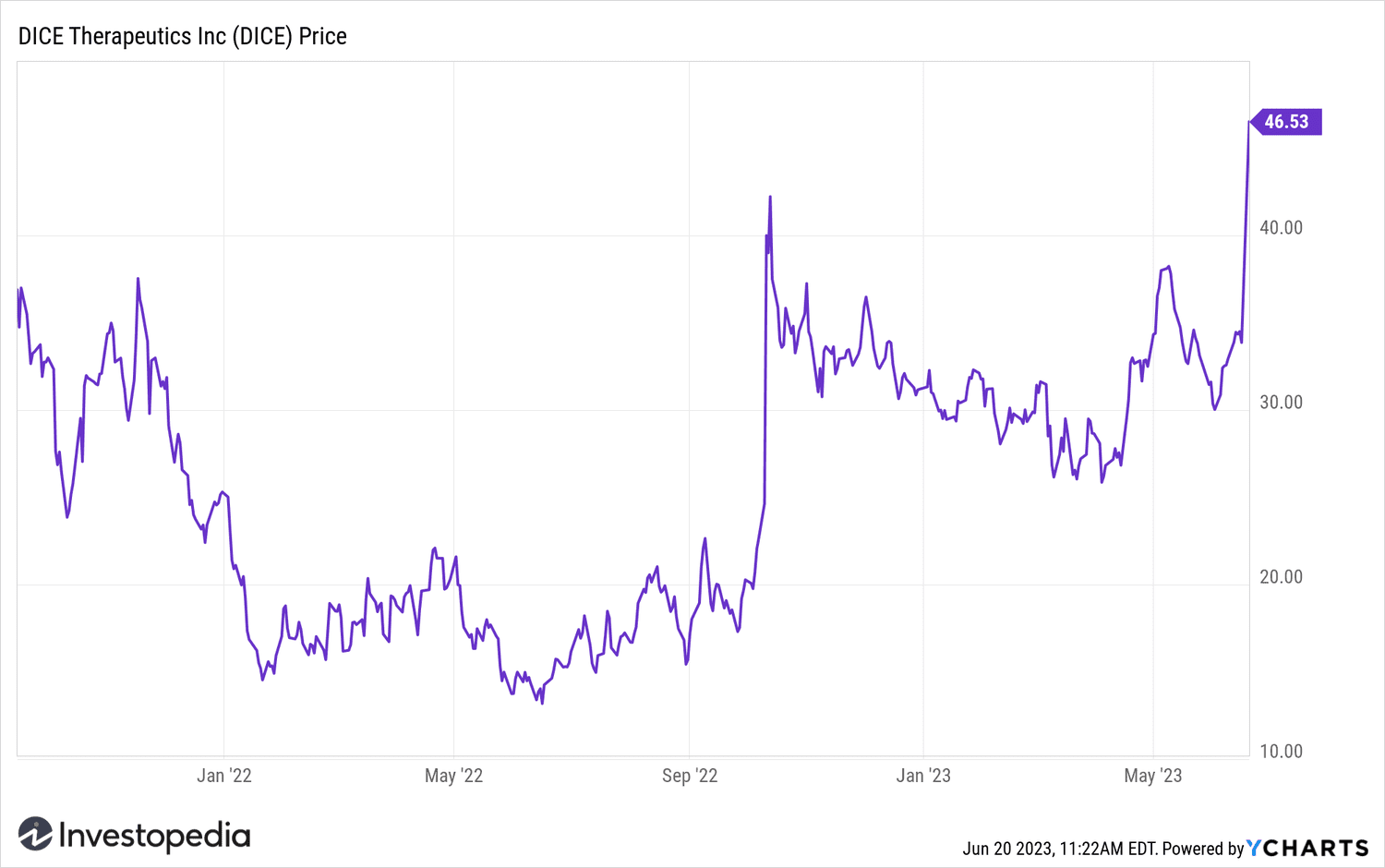

Shares of DICE Therapeutics (DICE) soared and traded at a record high on Tuesday morning after Eli Lilly (LLY) agreed to buy the biopharmaceutical company for $2.4 billion.

Eli Lilly said it would pay $48 per share for DICE, a 39.1% premium to the stock's closing price on Friday. Eli Lilly noted that the deal is not subject to any funding conditions and is expected to close in the third quarter.

The move could strengthen Eli Lilly's portfolio of treatments for autoimmune and inflammatory diseases. DICE uses a proprietary technology platform that it uses to develop oral therapeutic treatments for these diseases. Its lead program of Phase 2 trials targets psoriasis and other diseases linked to the pro-inflammatory protein Interleukin 17.

Patrik Jonsson, executive vice president, president of Lilly Immunology and Lilly USA, and chief customer officer, said the combination “will strengthen our efforts to improve the lives of people living with devastating autoimmune diseases.”

Kevin Judice, CEO of DICE , said partnering with Eli Lilly will mean its “new approach to discovering and advancing oral small molecules against validated protein-protein interaction targets has even greater potential.”

DICE Therapeutics actions have increased 37%% at 11:30 a.m. EST. Shares of Eli Lilly also rose.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com