eBay Inc. (EBAY) report of the second quarter of 2020 earnings after Tuesday’s closing bell, with analysts expecting a profit of $1.06 per share, on $ 2.8 billion in sales. The stock closed up after the company beat first quarter estimates and raised its second quarter guidance in April, before a strong upward trend, which has carved a series of summits. Similarly, the quarter was marked by June of the indictments of the former employees accused of threats against a writer critical of the e-commerce giant, allegedly at the direction of the frames.

Key Takeaways

- eBay stock has posted a 60 per cent so far in the year 2020.

- The stock appears to be fully evaluated in advance of the results.

- An intermediate correction could shake hands low and to reach the top $40.

The company has benefited from rapid market-share gains in the digital retail space, as a consequence of the COVID-19 pandemic. However, the stock price has more than doubled since the lows of March and published of 60% up to now in 2020, raising legitimate questions about the assessment. In addition, the relative strength of the oscillators have now reached the most overbought level of the company in 22 years of public history, raising the odds for a correction that shakes too complacent with respect to shareholders.

Wall Street does not seem fazed by eBay fast of the price increase, with a consensus at a “Moderate Buy” rating, based on 10 to “Buy”, 14 “Hold” and 1 a “Sell” recommendation. Price targets currently range from a low of $44 for the Street high of$ 77, while the stock is trading at less than $2 below the median $59 target. Given this investment, other to the to may require to beat the current expectations in the confessional.

The assessment is the analytical process of determining the value of an asset or a business. There are many techniques used to make an assessment. An analyst to place a value on a company is reviewing the business management, the composition of its capital structure, prospect of future earnings, and the market value of its assets, among other measures.

eBay Long-Term Chart (1998 – 2020)

TradingView.com

eBay stock exploded higher after the entry of the public at a split-adjusted $0.88 in September 1998, rising to $12.15 in April 1999. A failure of the March 2000 attempt to breakout provided of aggressive selling pressure, dropping the stock to $2.78 at the beginning of 2001. That marked a buying opportunity, in advance of the 2003 breakout head to the mid-$20 in 2005. The decline held above the 2001 low, when the market ended in 2009, setting the stage for a 100% retracement in the state of the decade in 2013.

This level has marked an impenetrable barrier in 2016 breakout that stalled in the middle of$40 by 2018. The stock tested breakout support, in December of this year and again in March 2020, the establishment of a long-term floor of the exchange, in advance of a June breakout that has added about 15 points in July all-time high at $61.06. The price action between March and July, carved not of declines, adding to the instability, which now increases the chances of a deep correction.

A pullback is a pause or moderate the decline in a stock or commodity price chart of recent summits that occur inside a continuation of the upward trend. A pullback is very similar to retracement or consolidation, and the terms are sometimes used interchangeably. The term regression is usually applied to the fixing of the price drops that are relatively short-lived.

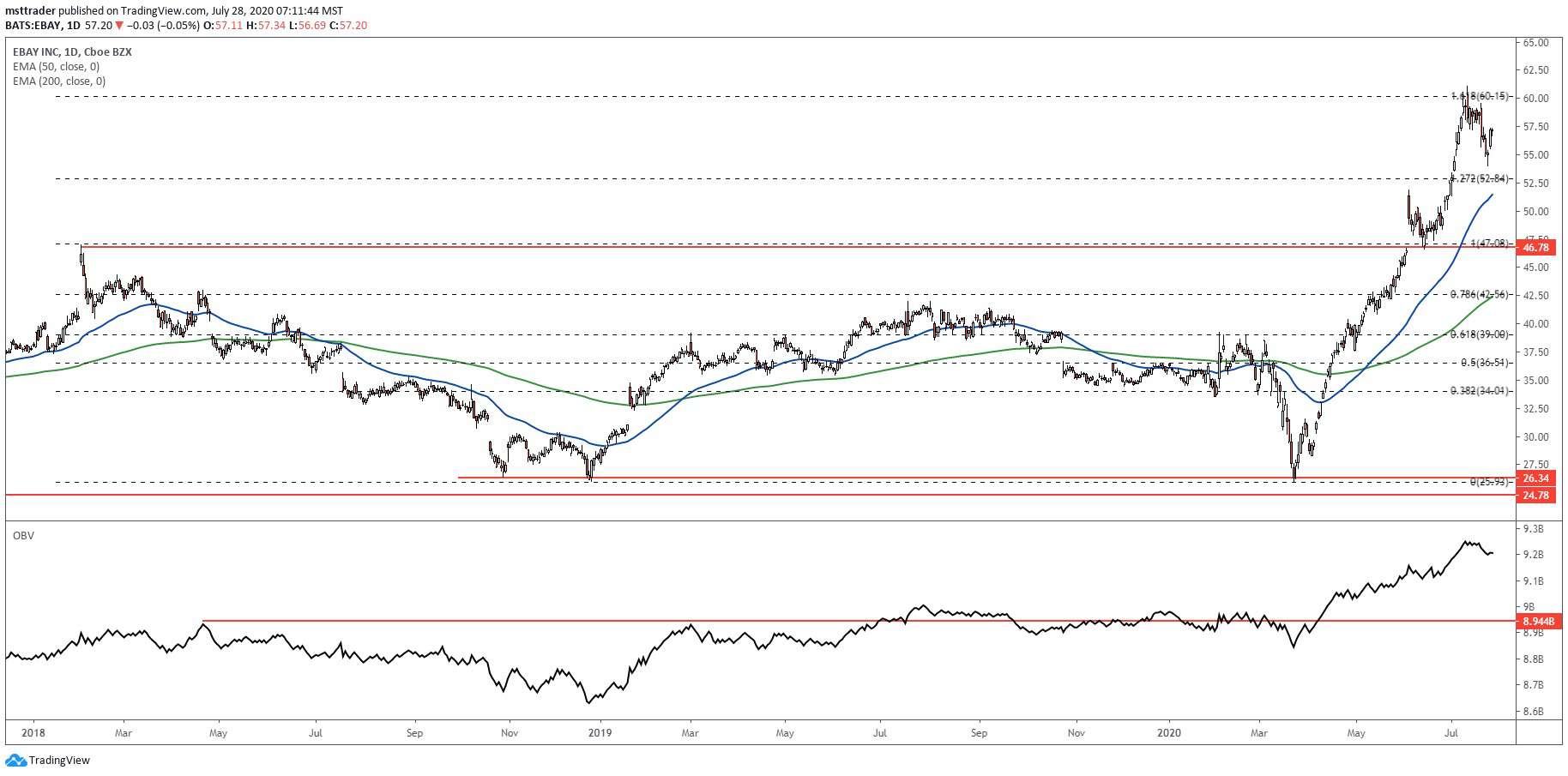

eBay Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator indicates an upward movement of the tale, to break well in advance of the award in April. Impressive purchasing power in July supported the increase, but OBV is now rolling over, which suggests that the momentum of the crowd is taking profits and stepping to the sidelines. Taken together with the extremely overbought relative strength readings, the stage may be set for a decline that extends to the upper part of $40.

A Fibonacci grid extended over the 2018 downward trend adds to this warning on the theme, with the rally of reversal at the 1.618 extension. It is a turning point after strong breakouts of acne, with the decline goals and objectives at the 1.27 and 1.00 levels of support. The 50-day exponential moving average (EMA) is lifted to the higher harmonic extension of nearly$ 53, marking the first sale of the target, with the potential for disadvantage in 2018 peak in the upper part of $40.

The Bottom Line

eBay stock has posted impressive gains since the month of March, but the reward-to-risk profile is not favorable to new long side entries at this time.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com