Fashion retailer Abercrombie & Fitch (ANF) released second-quarter results on Wednesday that beat analysts' expectations. Its shares soared more than 20% after the news.

Points to remember

- Shares of fashion retailer Abercrombie & Fitch climbed more than 20% on Wednesday after the company reported second-quarter earnings that beat expectations.

- Earnings per share (EPS) of $1.10 was more than six times the consensus estimate of 17 cents.

- Abercrombie has so far weathered the broader slowdown in discretionary spending that has affected other retailers including Target, Walmart, Home Depot and Foot Locker.

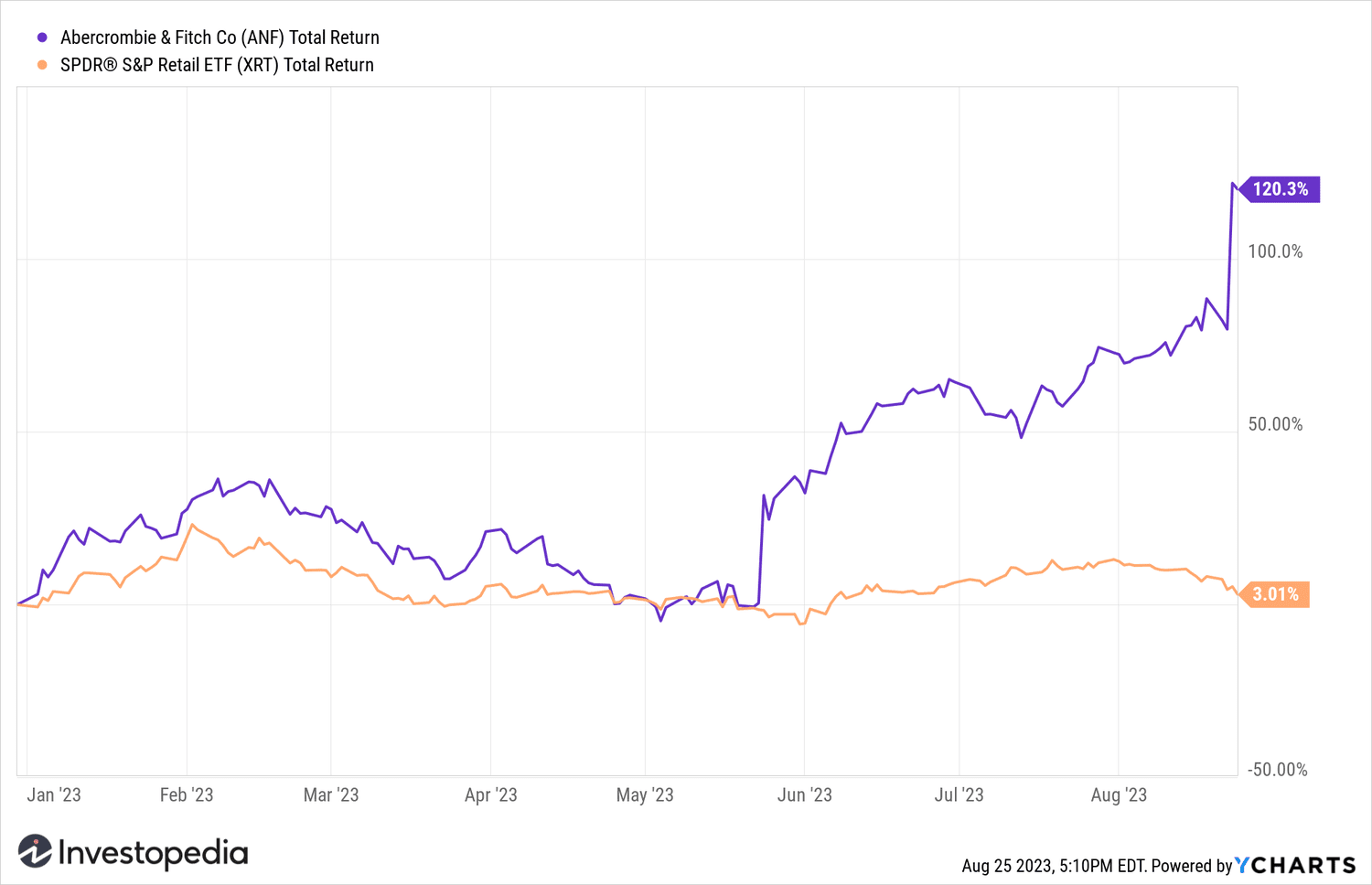

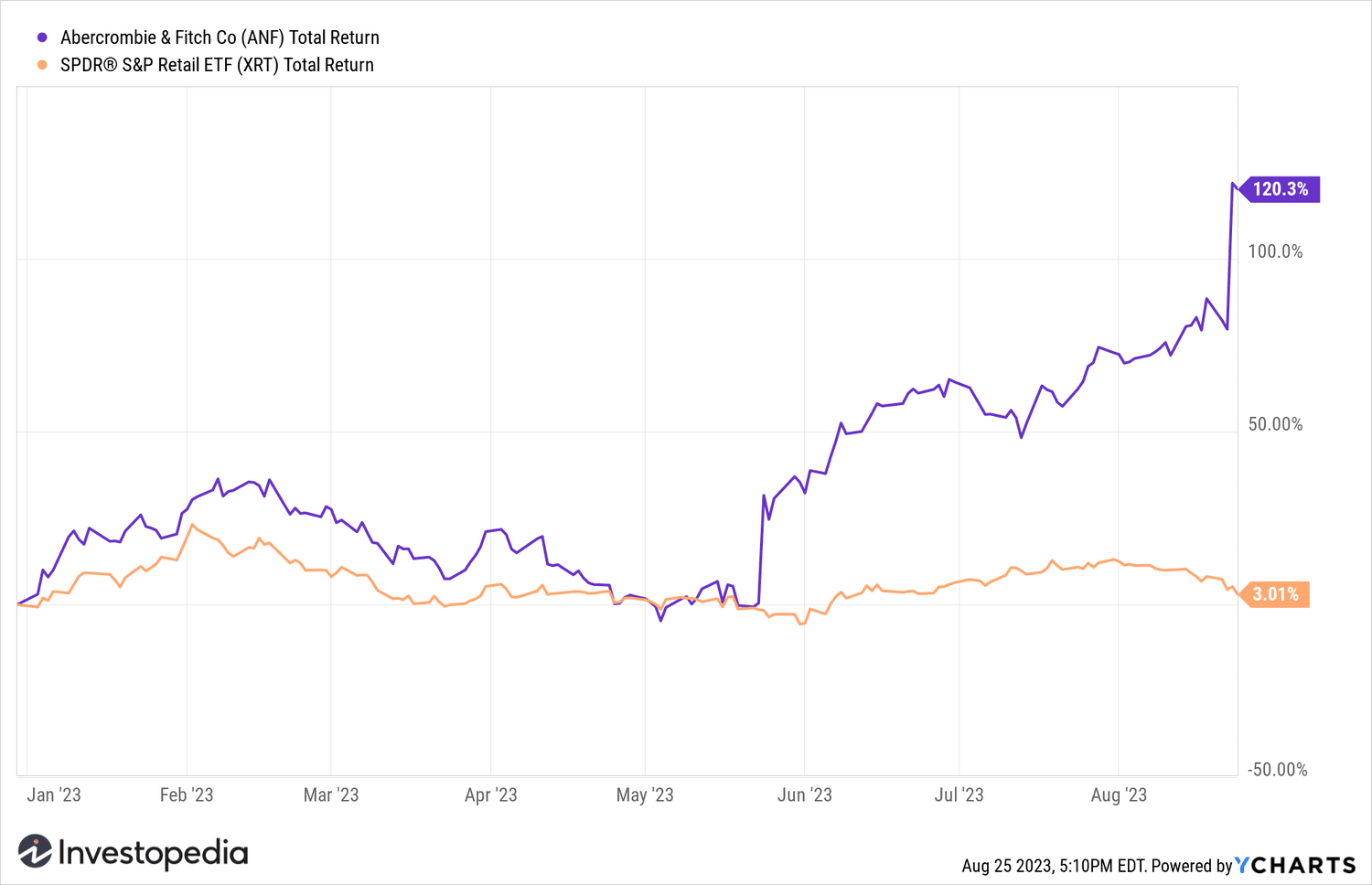

- With Wednesday's gain, Abercrombie & Fitch shares have more than doubled so far this year.

The company posted a profit of $56.9 million, down from a loss of $16.8 million in the same quarter a year earlier. Earnings per share (EPS) of $1.10 was more than six times the consensus estimate of 17 cents. Revenue, or net sales, was $935.3 million, up 16% from the year-ago quarter and also beating projections of 842, $4 million.

“Our net sales and our operating margin exceeded our expectations,” said CEO Fran Horowitz. “We continue to see strong customer receptivity to our brands and products, led by 26% net sales growth for Abercrombie brands.”

As a result, Abercrombie has upgraded its outlook for the full year. It now expects double-digit sales growth, well above the previous growth estimate of 2-4% for 2023. The retailer also expects operating margins higher, in the range of 8-9%, up from previous projections of 5%. at 6%.

Abercrombie's blistering results are a notable exception to other retailers, like Target (TGT) and Home Depot (HD), which are struggling with slowing discretionary spending. Lower discretionary sales contributed to Target's first quarterly sales decline in six years, while Home Depot revenue fell 2% as customers bought fewer big-ticket items.

Apparel retailers are among the hardest hit affected. Shares of Foot Locker (FL) lost more than a third of their value on Wednesday after same-store sales fell nearly 10%, reflecting lower spending on the company's footwear and apparel. business.

With Wednesday's gain, Abercrombie & Fitch shares have more than doubled so far this year, far outpacing the 3% rise in benchmark ETF SPDR S&P Retail (XRT), an indicator of retail sector performance. detail.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com