Key takeaways

- DraftKings Makes Higher Bid Than Fanatics For PointsBet's US Assets.

- $195M Bid Exceeds Fanatics" of $45 million.

- PointsBet said it would review the deal as shareholders are expected to vote on the Fanatics deal this month.

A bidding war is underway for parts of Australian sportsbook site PointsBet.

The game and Boston-based online sports entertainment company DraftKings (DKNG) has offered $195 million in cash for PointsBet's US assets. That's $45 million more than rival Fanatics agreed to pay last month.

DraftKings CEO Jason Robins wrote in a letter to PointsBet stating that its proposal is superior to that of Fanatics, “both because of the value it would bring to your shareholders and our expected ability to more quickly complete the proposed transaction”.

PointsBet said it received the unsolicited offer and the administrators and their advisers are considering it. However, he noted that “subject to the outcome” of its review, the board “continues to recommend that shareholders vote in favor” of Fanatics' offer.

Investors in the company should vote at an extraordinary general meeting to be held on June 30.

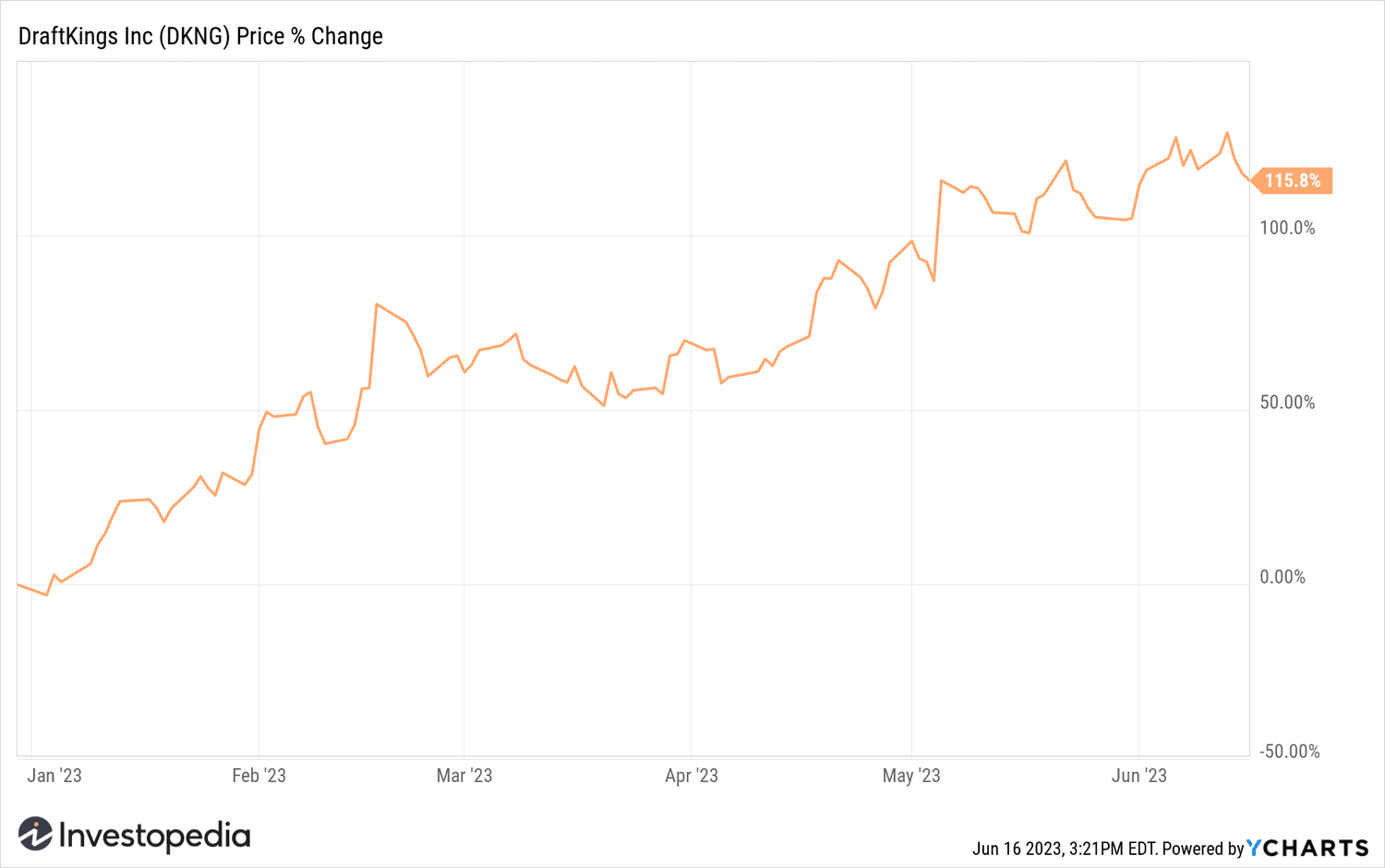

DraftKings shares fell 1.3% on Friday after the news.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com