Dominion Energy (D) said it sold its three companies gas distribution company to Canadian pipeline operator Enbridge (ENB) for $14 billion, including $4.6 billion in debt. The deal creates the largest natural gas utility franchise in North America.

Points to remember

- Dominion Energy sold three natural gas distribution companies to Enbridge for $14 billion, including debt.

- The move was part of Dominion's plan to conduct a “top-down” review low” of its business.

- The agreement will make Enbridge the largest natural gas utility franchise in North America.

Dominion said Tuesday that the three companies, East Ohio Gas Co., Public Service Co. of North Carolina and Questar Gas Co., along with its subsidiary Wexpro Co., serve some 3 million homes and businesses across the country. #39;Ohio, North Carolina, Utah, Wyoming and Idaho. They include approximately 78,000 miles of natural gas distribution, transmission, gathering and storage pipelines.

The electricity and natural gas provider noted that the decision was “consistent with previously defined commitments and priorities” it had made for its operations. Last year, Dominion announced what it called a “top-down business analysis” to boost its share price, which included preparations for the move to higher demand for electricity resulting from greater adoption of electric vehicles, expansion of data centers and relocations. phase out the use of natural gas for home heating and cooking.

Dominion CEO Bob Blue said the company continues to “evaluate effective sources of capital to solidly position our long-term balance sheet while seeking to minimize any amount of external equity financing required.”

Enbridge CEO Greg Ebel said the assets his company is acquiring “have long useful lives and natural gas utilities are 'much needed' infrastructure.” He added that the three companies are committed to achieving net zero greenhouse gas emissions by 2050 and should “play a critical role in enabling a sustainable energy transition”.

The transaction is expected to close next year after approval from federal and state regulators.

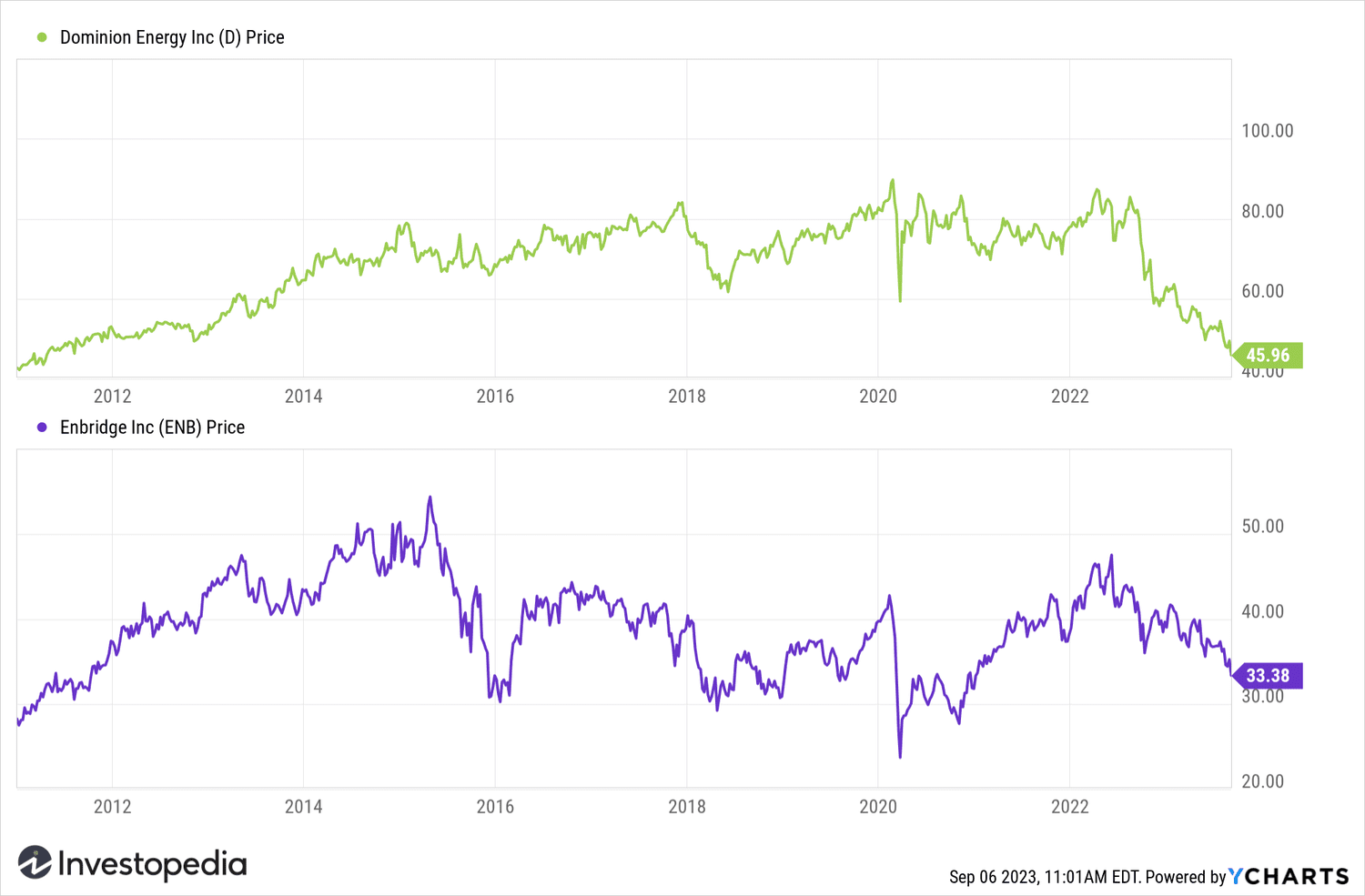

Dominion Energy shares at noon Wednesday fell nearly 2% to its lowest level since 2011. Enbridge shares also fell, down about 5.5% by midday.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com