Key Points

- Dollar Shares of Tree fell 12% on Thursday after reporting thefts and changing consumer habits hurt its earnings and outlook.

- CEO Rick Dreiling said the society was “not immune”; pressures facing the industry.

- Other retailers have reported similar issues of theft and inflation affecting shoppers.

Dollar Tree (DLTR) shares fell down 12% on Thursday after the discount chain's profit forecast missed, and it cut its full-year forecast due to the effects of theft and changing consumer habits.

Dollar Tree reported its first quarter earnings per share (EPS) of $1.47, $0.05 lower than estimates. Revenue rose 6.1% to $7.32 billion, better than expected. Same store sales at namesake stores increased 3.4% and 6.6% at Family Dollar stores.

CEO Rick Dreiling explained that Dollar Tree “isn't immune” to external pressures affecting retailers, “notably, the margin impact of shrinkage and the shift in product line to consumables.”

Dollar Tree's difficulties mirror those of other players in the sector. Target (TGT) and Foot Locker (FL) recently indicated that their financial results would be affected by losses due to shoplifting. Discount stores such as Dollar Tree have also reported that due to inflation, shoppers are spending less on more profitable discretionary items, reducing their income.

Dreiling added that the company predicts shrinkage and unfavorable sales mix “will persist through the year.” Dollar Tree cut its EPS outlook to a range of $5.73-$6.13, down from the previous $6.30-$6.80. Sales are expected to be roughly in line with previous forecasts.

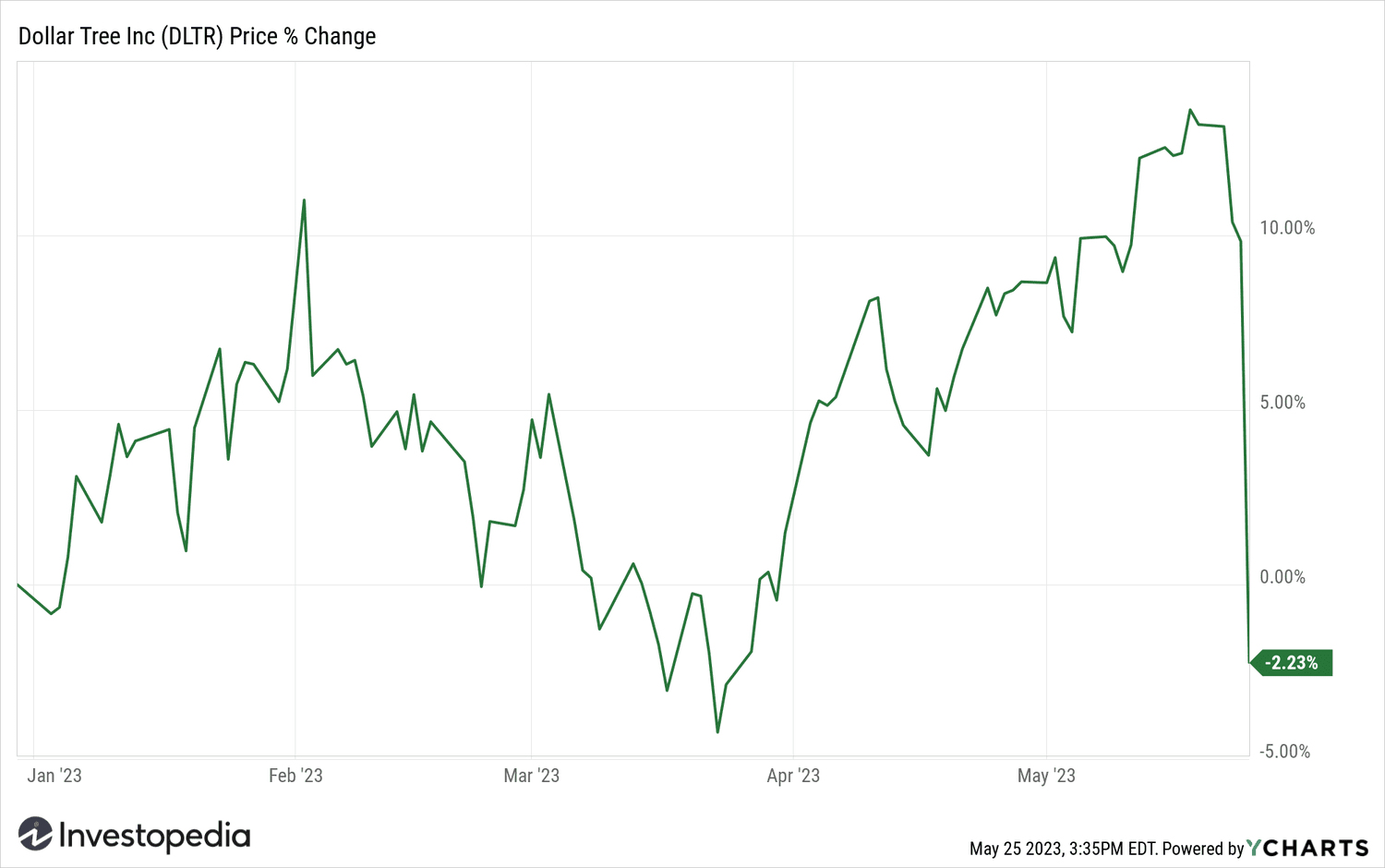

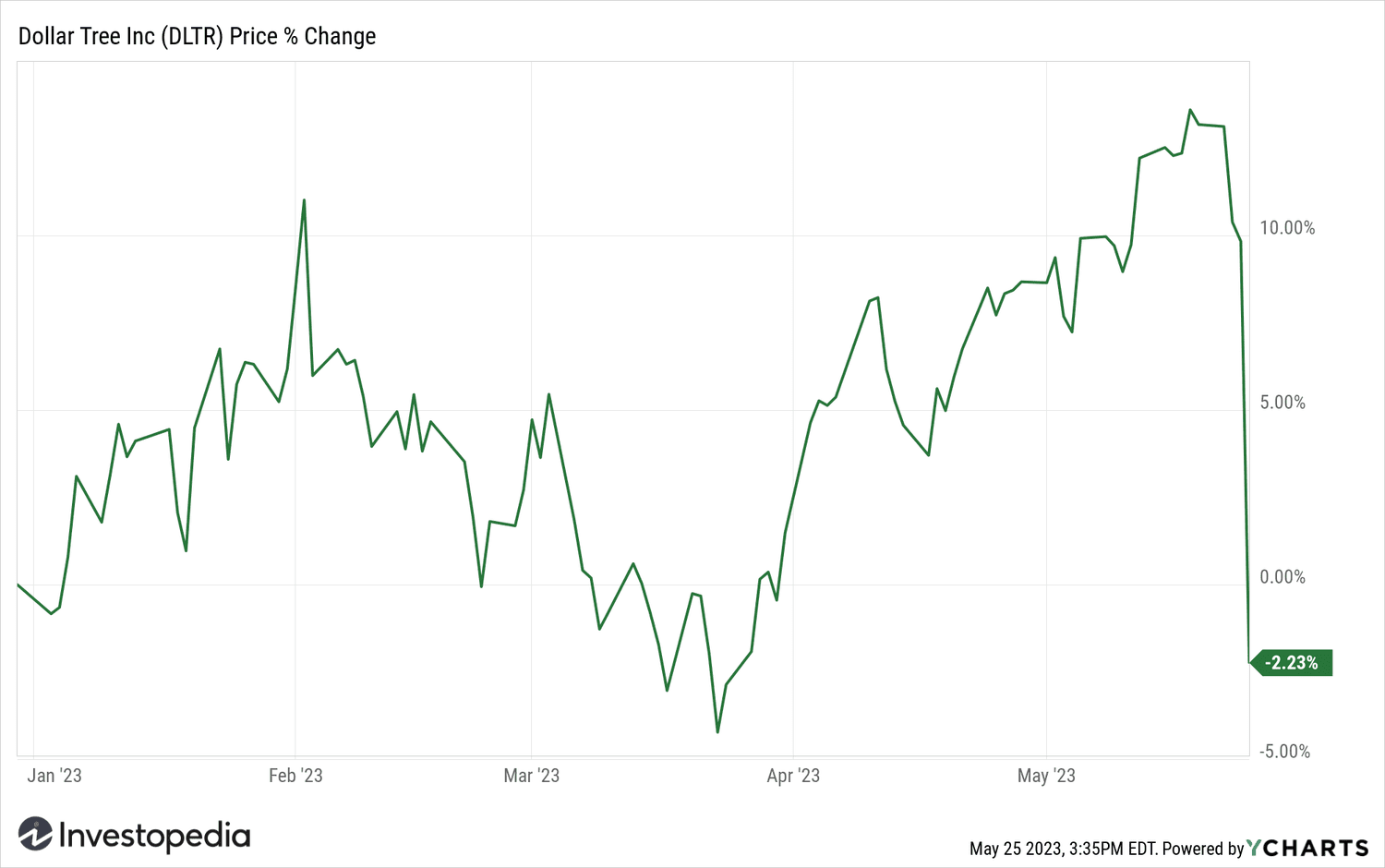

Thursday's clearance sale sent Dollar Tree shares in negative territory for the year.

Y-Graphs

Source: investopedia.com