Takeaways

- Dollar General's shares climbed more than 9% Friday after the discount retailer brought back its former CEO as it struggles to recover from a recent crisis.

- Todd Vasos returns to take charge of Dollar General less than a year after his departure. down after seven years as CEO.

- Dollar General also cut its full-year guidance for revenue, same-store sales and earnings per share.

Dollar General Corp. (DG) was the best-performing stock in the S&P 500 on Friday with shares up more than 9% after the company's board announced it had brought back the 39;s former chief executive officer (CEO) Todd Vasos to help the struggling discount retailer. regain its financial footing.

Vasos, who took his retirement in 2022 after seven years at the helm of the company, immediately replaces CEO Jeff Owen. Owen held this position for less than a year.

President Michael Calbert issued a statement Thursday according to which this decision was made because the board of directors “has determined that a change in management is necessary to restore stability and confidence in the company in the future.”

Dollar General's sales and profits have been hit hard by changing consumer shopping habits due to rising inflation. The company said in its second-quarter earnings report that shoppers were spending more on groceries and less on more profitable items, such as home goods and clothing. In addition, the company said it faces higher capital expenditures and higher shrinkage, the industry term for theft. ;

In its statement announcing Vasos' return, Dollar General also reduced its full-year guidance. The retailer now expects sales to increase 1.5% to 2.5%, compared to a previous range of 1.3% to 3.3%. He expects same-store sales to remain flat, or even down 1%, rather than in a range of 1% to 1% increase. The company reported that earnings per share (EPS) would be $7.10 to $7.60, a decrease of 29% to 34% from the year-ago quarter, compared to the previous year. 39;s previous estimate of $7.10 to $8.30, which equates to a decline of 22% to 34%.

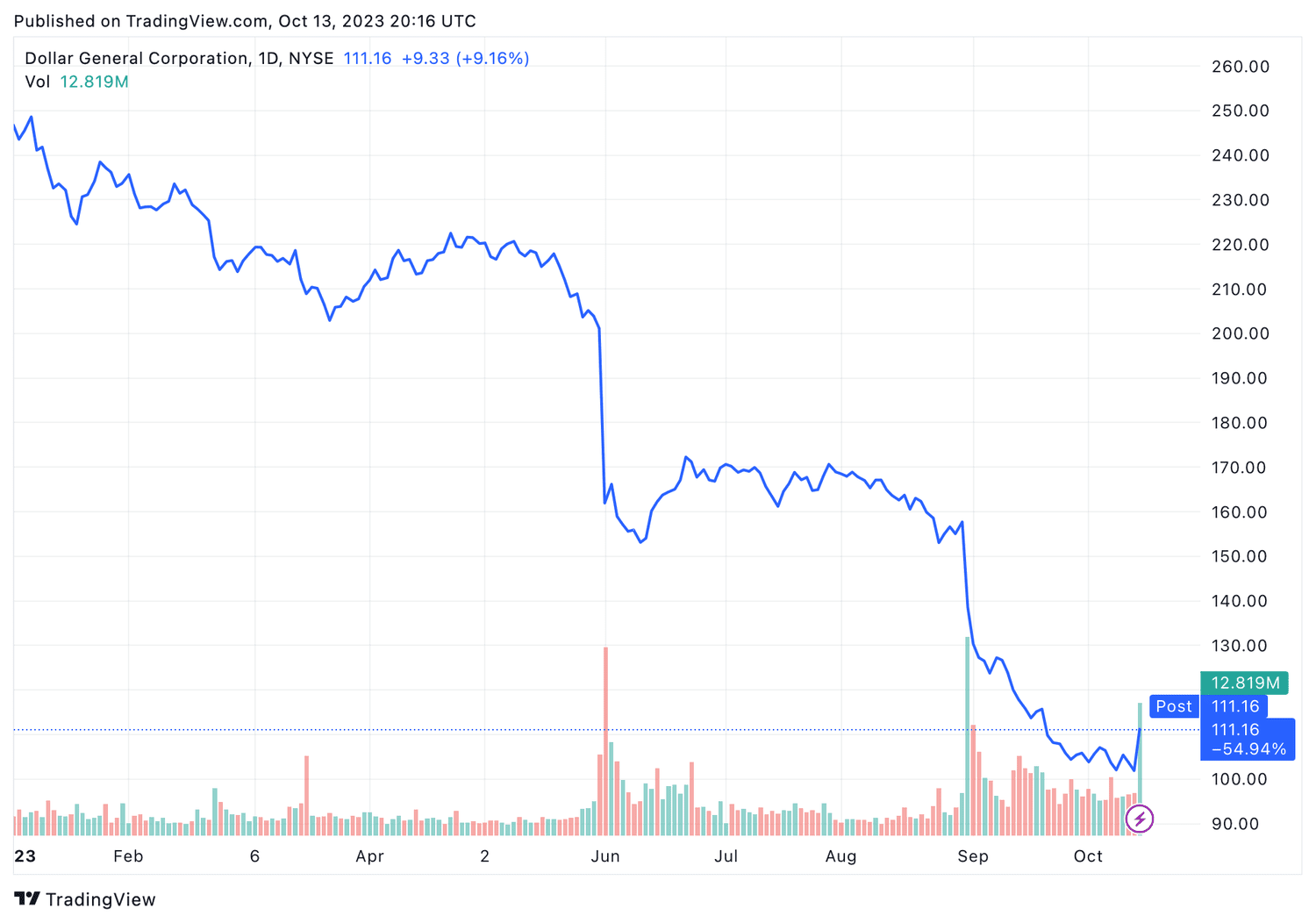

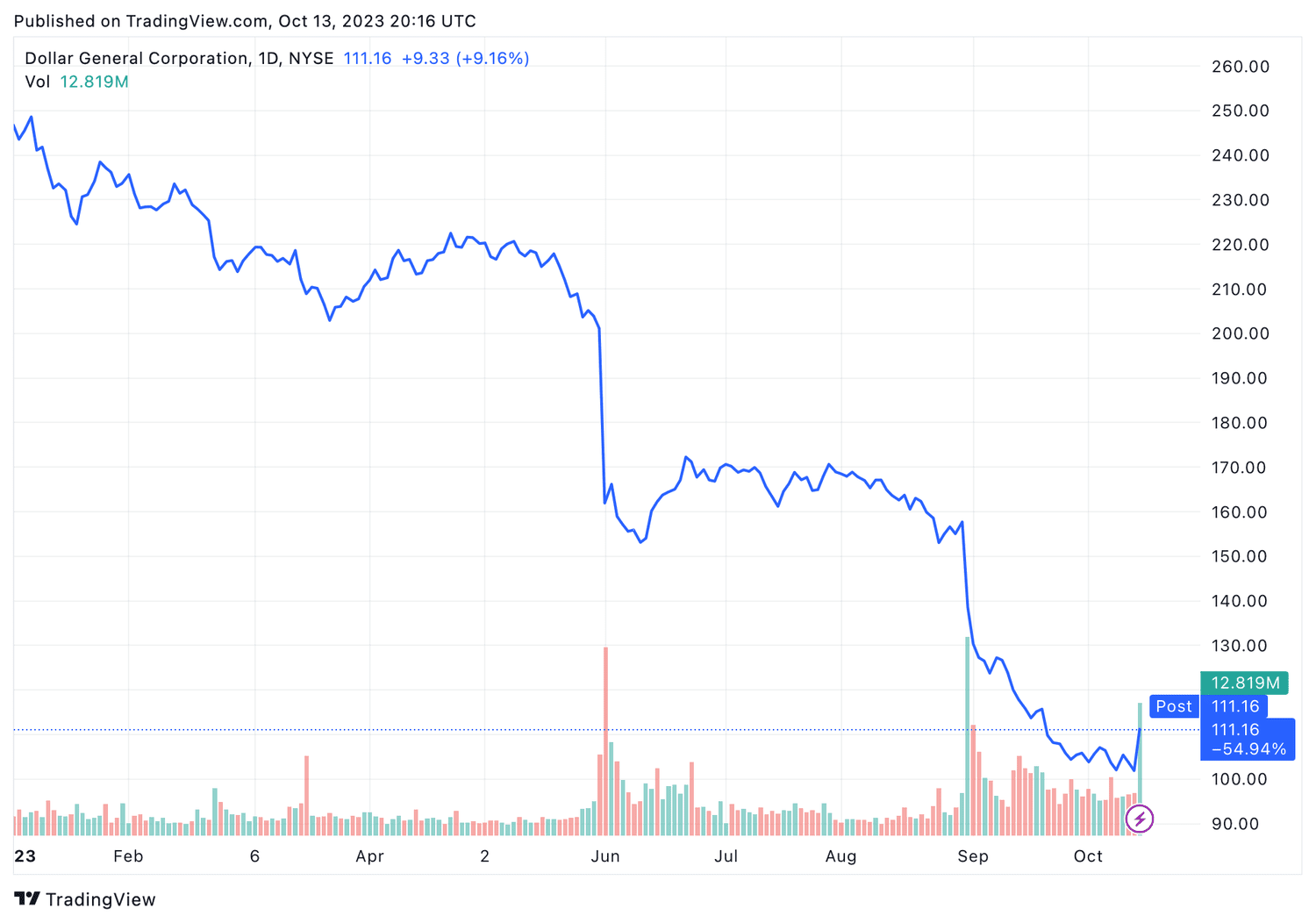

Dollar General shares have fell on a Thursday, their lowest level in five years, and even with Friday's gains, they have lost more than half their value this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com