Key Takeaways

- The adjusted EPS was $0.60 vs $0.89 analysts expected.

- Overall revenue was higher than expected.

- Parks, Experiences, and Products revenue fell, but less than expected.

What Happened

Disney have had mixed results for its Q2 of FISCAL 2020 earnings report, published on 5 May. Its results have been well below the analysts ‘ estimates, but its revenue has been higher than expected. Its Parks, Experiences, Products and income of the segment decreased by 10%, a significant drop, but less than analysts expected. Total revenues for Direct-to-Consumer and International segment increased significantly, contributing to the fall. The company’s Direct-to-Consumer segment is not yet generating an operating profit, so that the increase of income from this money-losing segment weighed on earnings.

(Below, Investopedia’s original earnings preview, published 5/4/20.)

What to Look for

The COVID-19 pandemic has had a major impact on the way consumers interact with entertainment conglomerates such as Walt Disney Co. (DIS). Disney companies relying on the person, the activities were seen plunging demand, including theme park attendance, the cruise line reservations, and the audience at the live sport network ESPN. On the other hand, the company’s new streaming entertainment service, Disney+, is well-placed to see the outbreak of the audience as more customers stay home. Investors will watch closely how these contradictory trends affect Disney results when it publishes its results on May 5, 2020 for the 2nd quarter of fiscal 2020. Analysts expect to dive the adjusted earnings per share, even as revenue rises due in large part to the company’s giant acquisition of 21st Century Fox in the same period a year earlier. This is the first 2nd quarter of the fiscal year in order to fully reflect the numbers of business 21st Century Fox. Disney’s fiscal year ends in September.

A key measure of investors will focus on the relation T2 is income at Disney’s Parks, the Experiences and the Products of the segment, which the COVID-19 pandemic is about to do the most damage to the. This segment consists of its theme parks, resorts, cruise line, and its merchandising. Analysts expect this segment to suffer its first year-on-year decline in revenue in three years.

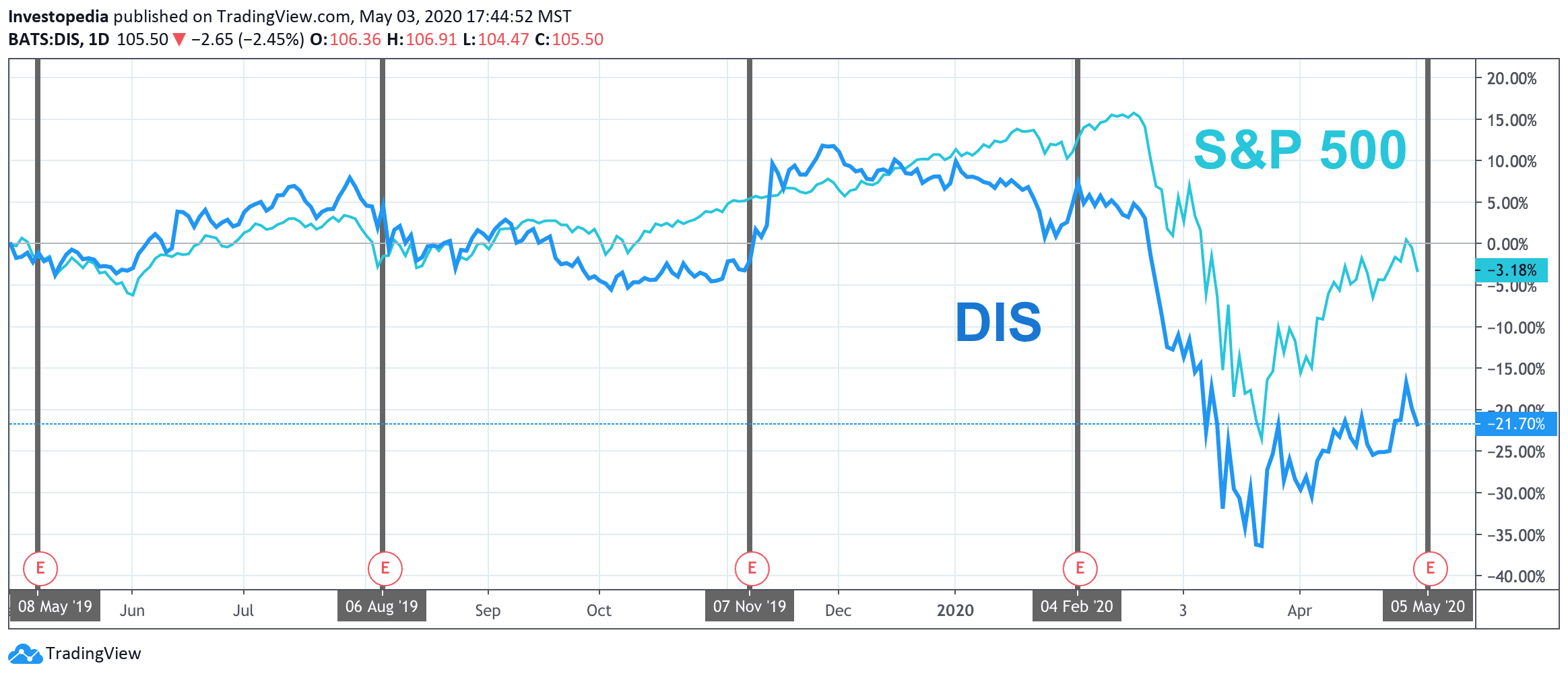

In the last 12 months, Disney stock has significantly underperformed the market, with a total return of -21.7% compared to -3.2% for the S&P 500.

Source: TradingView.

In before the 2nd quarter of fiscal periods, Disney’s quarterly revenue growth has varied considerably in recent years. It has increased by 2.8% year-on-year (yoy) in the 2nd quarter of FISCAL 2017, FROM 9.1% yoy in the 2nd quarter of FISCAL year 2018, and 2.6% yoy in the 2nd quarter of the FISCAL year 2019. Analysts estimate that revenue for the 2nd quarter of the FISCAL year 2020 is going to grow much more quickly, by 18.6% year-on-year to $ 17.7 billion for the quarter. Revenue will be enhanced because of its $71.3 billion purchase of the entertainment giant 21st Century Fox, which took place a year by March 2019, near the end of the 2nd quarter of FISCAL year 2019.

On the other hand, the performance of Disney’s adjusted earnings per share (EPS) is sharply deteriorated. Disney has posted gains quarter adjusted EPS of 10.3% in the 2nd quarter of FISCAL year 2017 and 23.2% in Q2 of FISCAL year 2018. But the adjusted EPS declined 12.9% in Q2 of FISCAL year 2019. The most recent quarter could be even worse: the consensus estimates are for a massive decline of 44.9% yoy to $0.89 for the Q2 of FISCAL year 2020. That would be Disney’s sixth year-on-year decline in quarterly revenue in a row.

Disney Key Measures

The estimate for the 2nd quarter of the year 2020

2nd Quarter Of Fiscal 2019

2nd Quarter Of Fiscal year 2018

The adjusted earnings per share (in dollars)

0.89

1.61

1.85

Turnover (in billions of dollars)

17.7

14.9

14.5

Parks, Experiences, and Products sales (in billions of dollars)

5.4

6.2

5.9

Source: Visible Alpha

As mentioned previously, a key measure to watch is the Disney Parks, the Experiences and the Products of the segment. It is the most vulnerable part of any Disney segment of the disruption of COVID-19. More than a third of Disney’s total revenue by 2019, this segment has been the largest in terms of revenue for the last 3 years. This segment is based on travel, crowded public spaces, and non-essential retail purchases, and it is at the intersection of the industries most disrupted by COVID-19.

This segment has posted steady, if unspectacular, revenue growth in each quarter since the 2nd quarter of FISCAL year 2017. If the analysts are to be believed, this trail is about to be broken by a 12.2% drop in Q2 of FISCAL year 2020. This is to be compared to the 8.4% year-on-year growth registered in the 1st quarter of FISCAL year 2020, the third-fastest quarterly growth rate since this streak started in the 2nd quarter of FISCAL year 2017. Considering that a large part of the world only opposite lock towards the end of the most recent quarter, it is probably just a taste of the pain to come later in the year.

Source: investopedia.com