Deutsche Bank (DB) and Citigroup (C) admitted Wednesday to trade sensitive information on UK government bonds between 2009 and 2013, and were among five banks, including HSBC (HSBC), Morgan Stanley (MS) and Royal Bank of Canada (RY), found guilty of breaching UK competition law.

A small number of traders from each of the banks illegally exchanged information about the pricing and trading strategies of UK gilts and gilt asset trading via private Bloomberg chat rooms, the UK competition regulator said. Competition and Markets Authority (CMA).

These actions likely had negative effects on bank customers, including the UK's Debt Management Office (which issues government funds by auction), pension funds and, at the end of the account, the Treasury and the UK taxpayers, depriving them of all the benefits of market competition, including lower borrowing costs.

'A competitive and properly functioning bond market benefits tens of millions of taxpayers and savers, as well as being central to the UK's reputation as a global financial hub. These alleged activities are therefore very serious and warrant the detailed investigation we have undertaken, " said Michael Grenfell, executive director of law enforcement at CMA.

Due to their cooperation with regulators, Deutsche Bank could be spared a fine, while any fines received by Citigroup will be deducted. The other three banks have issued no statements admitting wrongdoing and could face fines once the regulator issues a notice of violation.

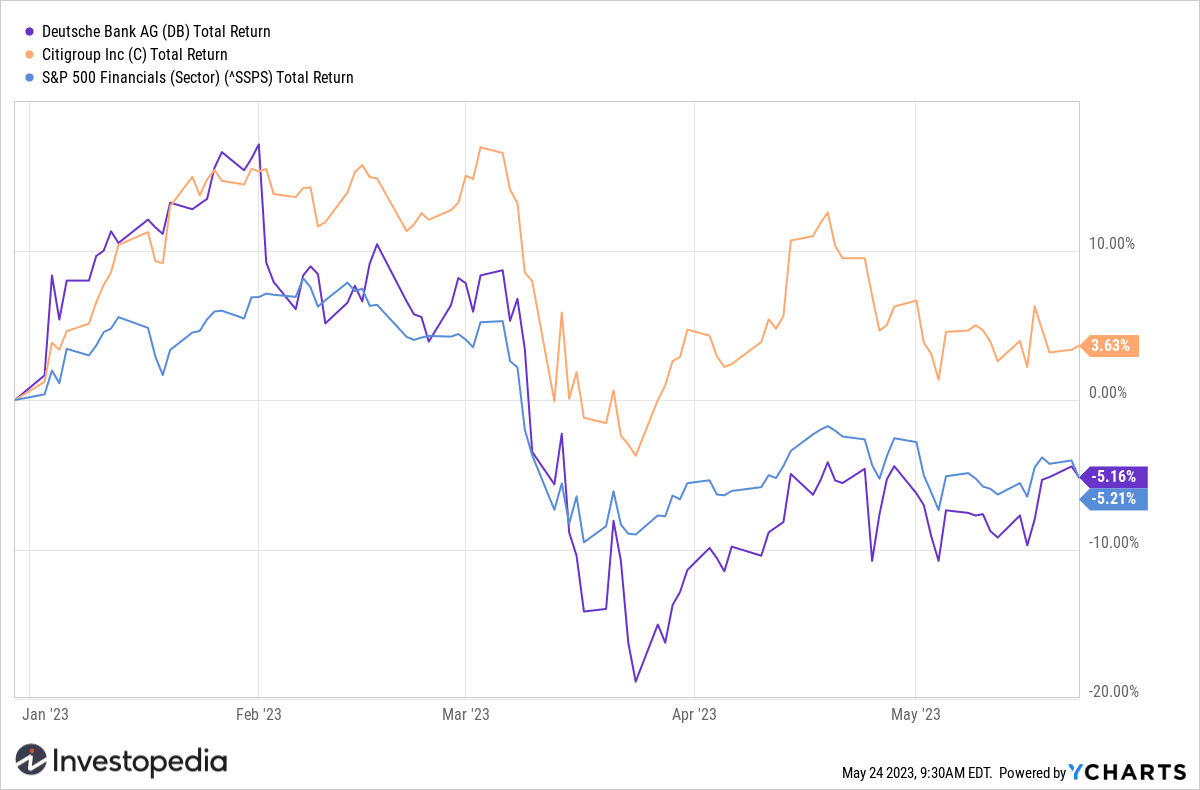

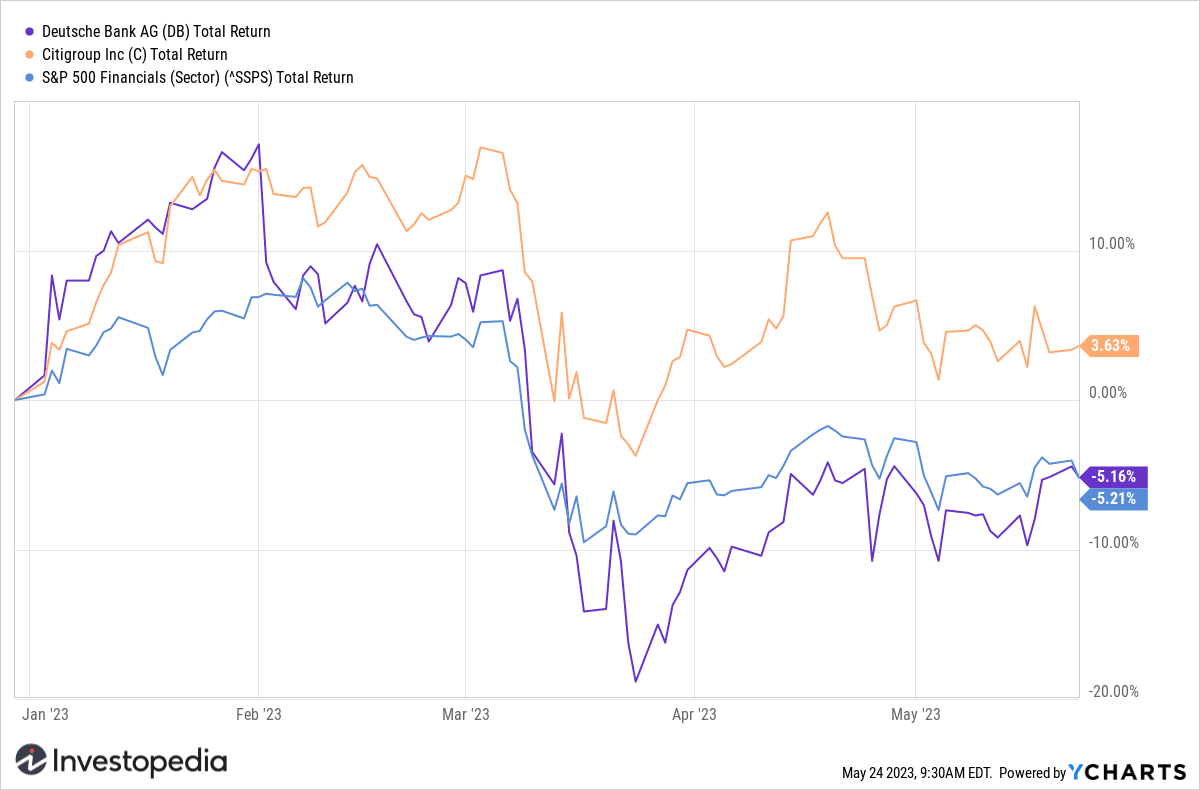

Citigroup shares fell down around 3%, while Deutsche Bank shares traded around 1% lower in early trading on Wednesday. Shares of Deutsche Bank have fallen 5% so far this year, while those of Citigroup have risen just under 4%, outperforming the broader financial sector, which has also decreased by 5% over the same period.

YCharts

Source: investopedia.com