Denny’s Corporation (DENN) shares have dropped more than 7% during Wednesday session after the company priced an offering of 8 million common shares at $9.15 per share, with an underwriter over-allotment option of an additional 1.2 million shares. The transaction is scheduled for July 6, 2020, to raise between $69.6 million and $ 80.1 million for general corporate purposes.

In mid-June, the company announced a sequential improvement in same store sales during the second quarter, restaurants have started to reopen. The stock has lost ground, a week later, in the middle of the strong increase of the COVID-19 infections and hospital admissions in Texas, Florida, North Carolina, Tennessee, and Arizona. Some states have reintroduced the eating restrictions in the wake of these increases.

The Restaurant chains where the customers prefer to eat like Denny’s, Dave & Buster’s Entertainment, Inc. (PLAY), and The Cheesecake Factory Incorporated (CAKE), have struggled with the COVID-19 pandemic. Traders should watch for the continuation of the uncertainty in these stocks in the coming sessions, as COVID-19 developments continue to rock the market.

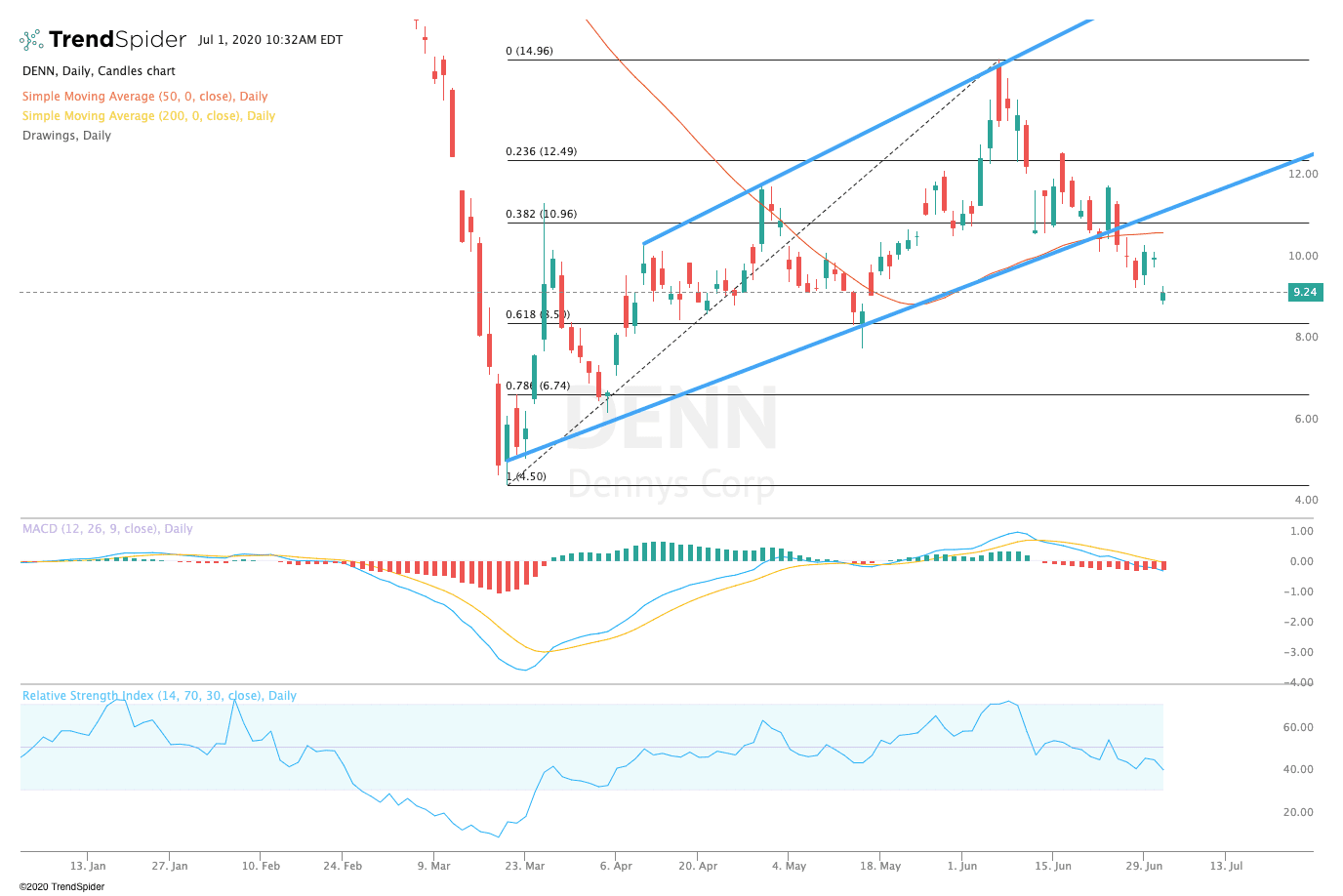

From a technical point of view, the Denny’s stock broke down from a curve fit of the levels of support in a potential move to the reaction lows of near $8.00. The relative strength index (RSI) has been moved slightly lower to 39.22, but the moving average convergence divergence (MACD), has extended its downward trend. These indicators suggest the possibility of a new cut of the front.

Traders should watch for an analysis of the reaction lows of near $8.00 in the coming sessions. If the stock breaks down from these levels, prices could retest reaction lows of around $6.50 or 52-week low of around $5.00. If the stock rebounds more, traders should expect to see a break of the 50-day moving average of $10.70 to the front of the peaks of near $15.00.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com