Key takeaways

- Delta shares jumped more than 6% in intraday trading on Tuesday after the airline raised its profit and revenue guidance for the current quarter and for the full year.

- The airline cited pent-up demand following the COVID-19 travel crisis.

- CEO Ed Bastian said demand tailwinds were “substantial”.

Shares of Delta Air Lines (DAL) jumped more than 6% in intraday trading on Tuesday after the carrier raised its outlook for the current quarter and year and reiterated its outlook for 2024, citing a pent-up demand following the COVID-19 travel crisis.

Delta said in an Investor Day presentation that it now expects its second-quarter earnings per share (EPS) to be $2.25 to $2.50, higher than the previous quarter. #39;s previous estimate of $2, with revenue up 17%-18%, beating its previous forecast of a 15%-17% gain.

For the full year, it anticipates EPS of $6, rising from a range of $5 to $6, with revenue 17% to 20% higher than the prior guidance of a increase of 15% to 20%. He sees the operating margin at the high end of his forecast of 10% to 12%. It forecasts free cash flow of $3 billion instead of $2 billion and a return on invested capital (ROIC) of more than 13%, an increase from the previous double-digit forecast.

CEO Ed Bastian noted that while the supply constraints plagued by the industry are real, “the demand tailwinds are also real, and they're also substantial.”

Delta indicated that it benefited passengers spending more for upgraded seats as well. He said premium revenue would be around $19 billion this year, or 35% of total revenue.

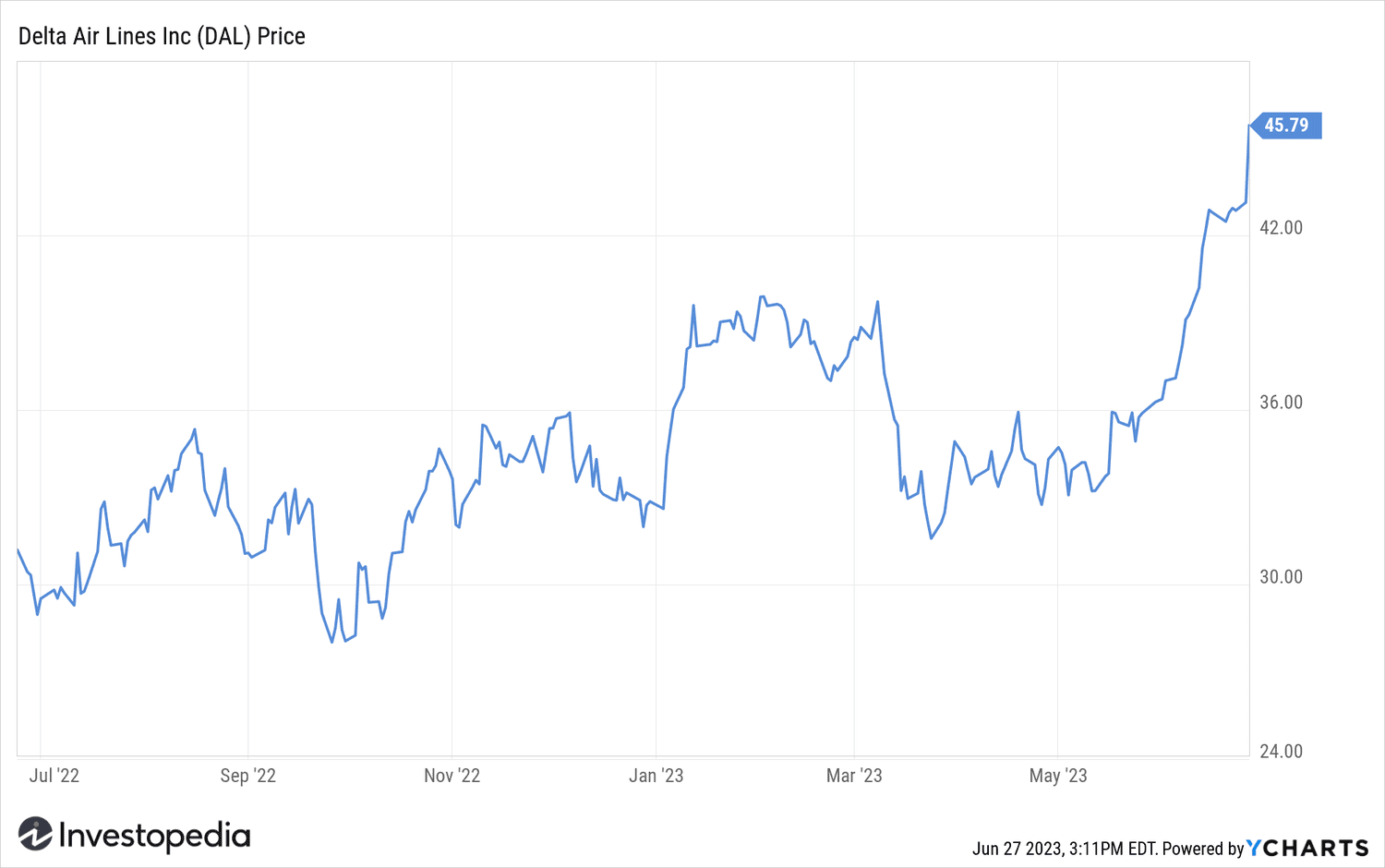

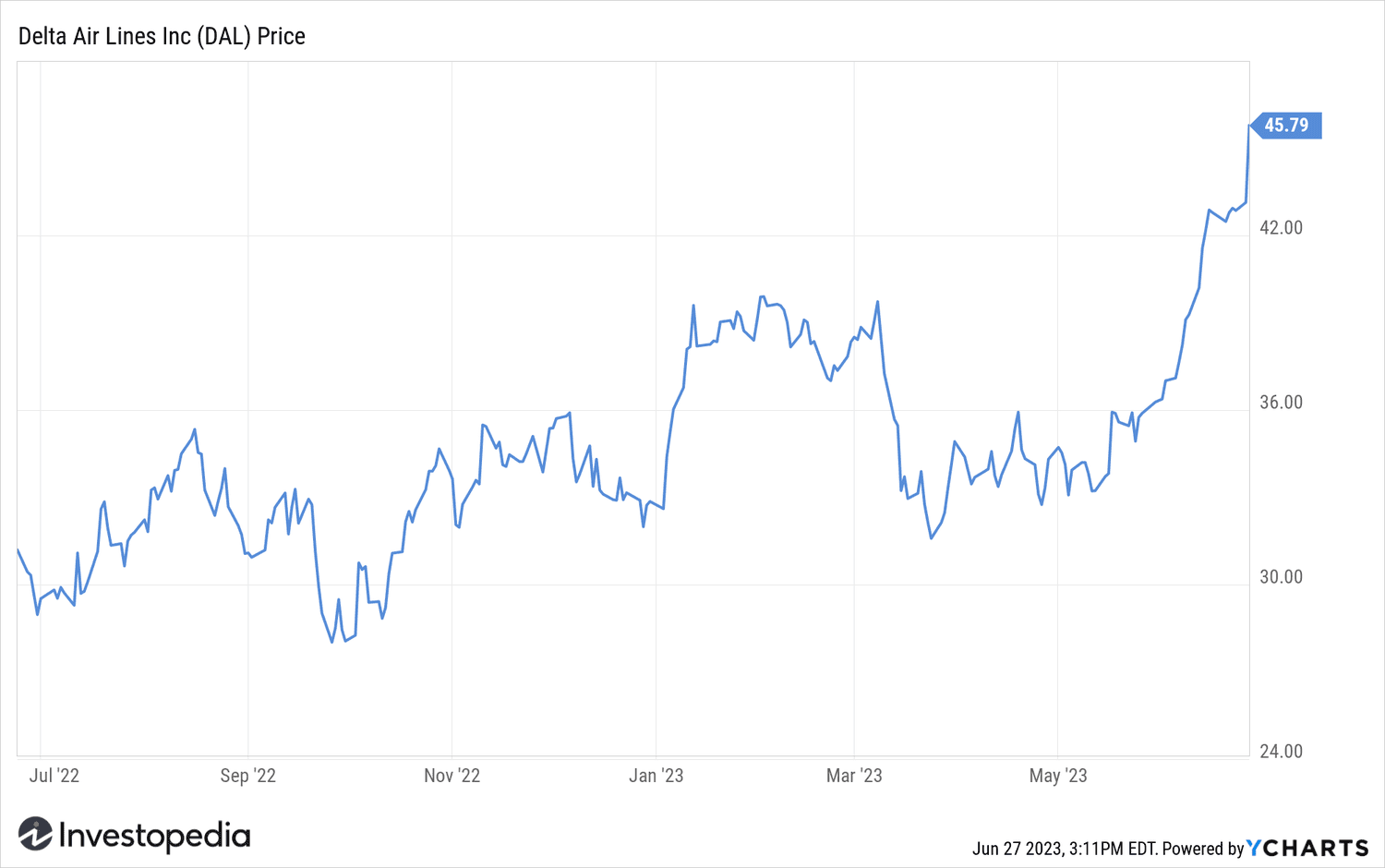

Delta shares traded at their highest level in over a year. The news also helped boost the market shares of competing airlines.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com