Takeaways

- Delta Air Lines reported better-than-expected profit as summer travel demand boomed, but warned fuel costs will impact full-year results.

- Airline profits soared 59% in the third quarter from a year ago, boosted by an increase in international travel.

- Delta lowered the upper end of its outlook profit for the full year due to higher fuel prices.

Delta Air Lines (DAL) said its quarterly profit soared after a strong summer travel season, but the carrier warned that rising fuel costs would impact its overall results. #39;year.

Delta reported net income up 59% for the third quarter of 2023. from $1.11 billion a year ago, or $2.03 per share, beating estimates. Revenue rose 13.3% to a record $14.55 billion, in line with forecasts.

International travel revenues have climbed 35%, with transatlantic sales up 34% and Latin American sales up 20%. Domestic travel revenue increased 6%. The company also noted that sales of its premium seats climbed 17%. Master cabin revenue increased 12%.

President Glen Hauenstein indicated that “a request robust travel” continues into the December quarter. However, Delta expects full-year earnings of between $6 and $6.25 per share, after previously projecting a range of $6 to $7 as rising fuel prices cut into earnings.

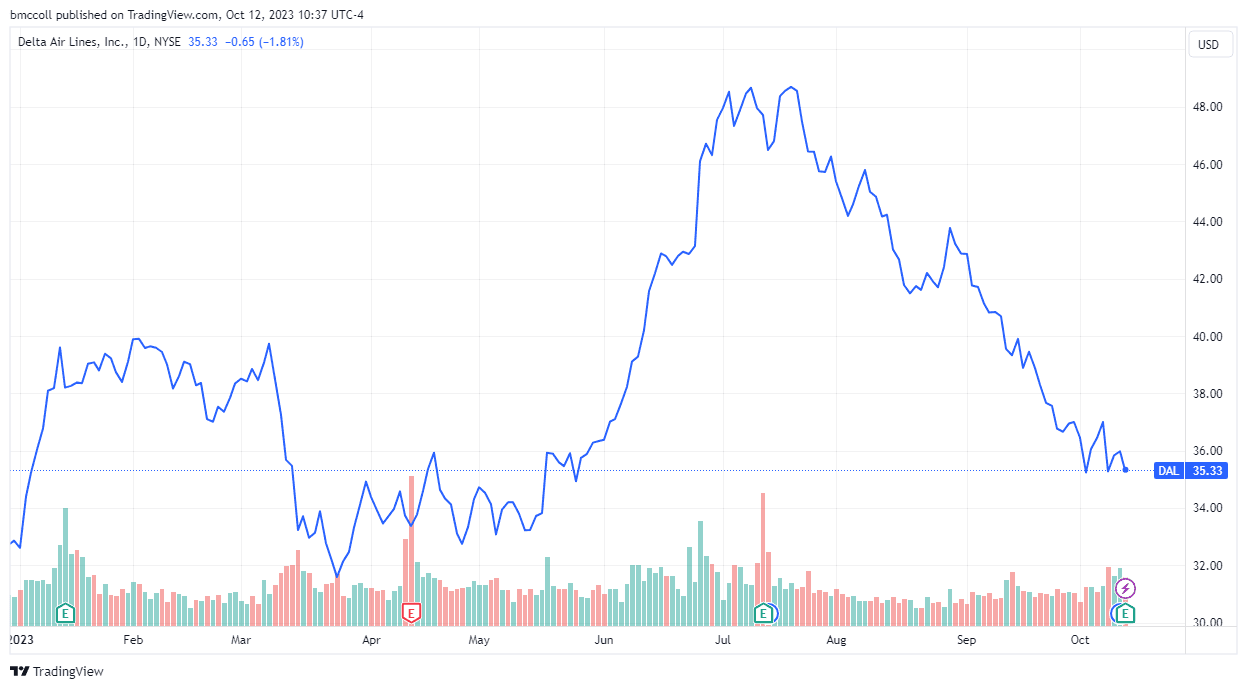

Delta Air Lines shares were down 2% in early trading at 10:45 a.m. ET Thursday, but remained in positive territory for 2023.

TradingView

Do you have a current tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com