Points to remember

- Danaher has agreed to buy British biotech company Abcam for $5.7 billion.

- The deal values Abcam at $24 per share, a premium of 2.7% relative to Friday's closing price.

- Abcam will be a stand-alone company within Danaher's Life Sciences business.

Medical Tools Supplier Danaher (DHR) Expands Its Offering of products by acquiring British biotechnology company Abcam Plc (ABCM) for $5.7 billion including debt.

Danaher said he would pay 24 dollars per share for Abcam, a 2.7% premium to Abcam's closing price on Friday. The company said it plans to finance the transaction with its cash and proceeds from the issuance of commercial paper.

Abcam's life science tools help advance drug discovery and its technologies are used by approximately 750,000 researchers, Danaher CEO Rainer Blair, noting that Abcam's track record in of innovation, product quality and “breadth of antibody portfolio positions” made it an attractive acquisition target.

Danaher explained that Abcam should operate as a stand-alone company within its Life Sciences division.

Abcam has been under pressure of activist investors to explore strategic alternatives and said it had 20 potential buyers before settling on Danaher. The transaction is expected to be finalized in the middle of next year.

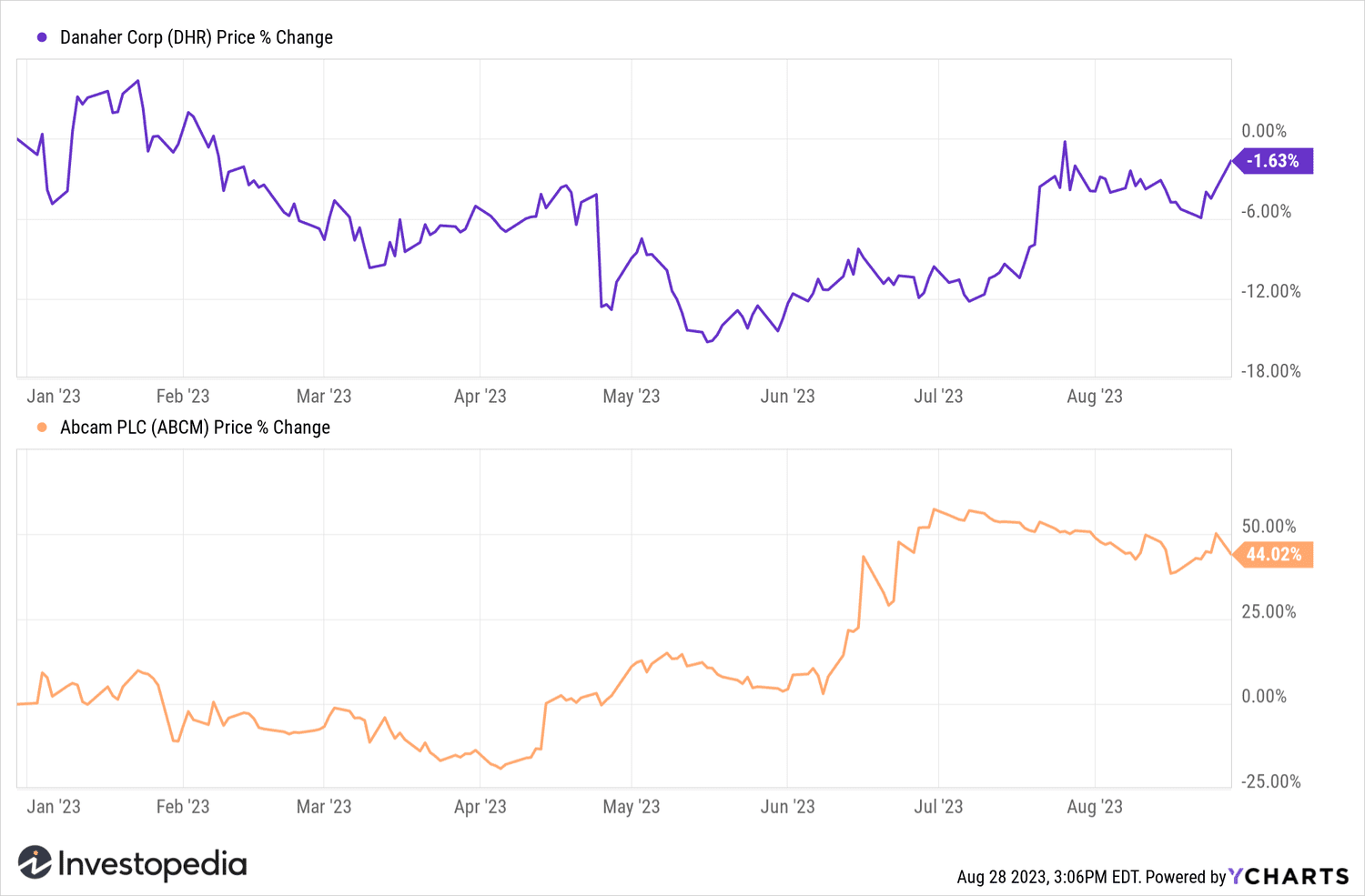

Danaher shares progressed down 2.3% on Monday following the news, while Abcam Plc's American Depositary Receipts (ADRs) fell 4.3%.

YCharts

Do you have a advice news for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com