Takeaways

- CVS Health on Tuesday issued 2024 sales guidance that beat estimates and raised its dividend as it signaled that demand for its health care services has increased.

- CVS also outlined plans to to change how prescription drug reimbursement works.

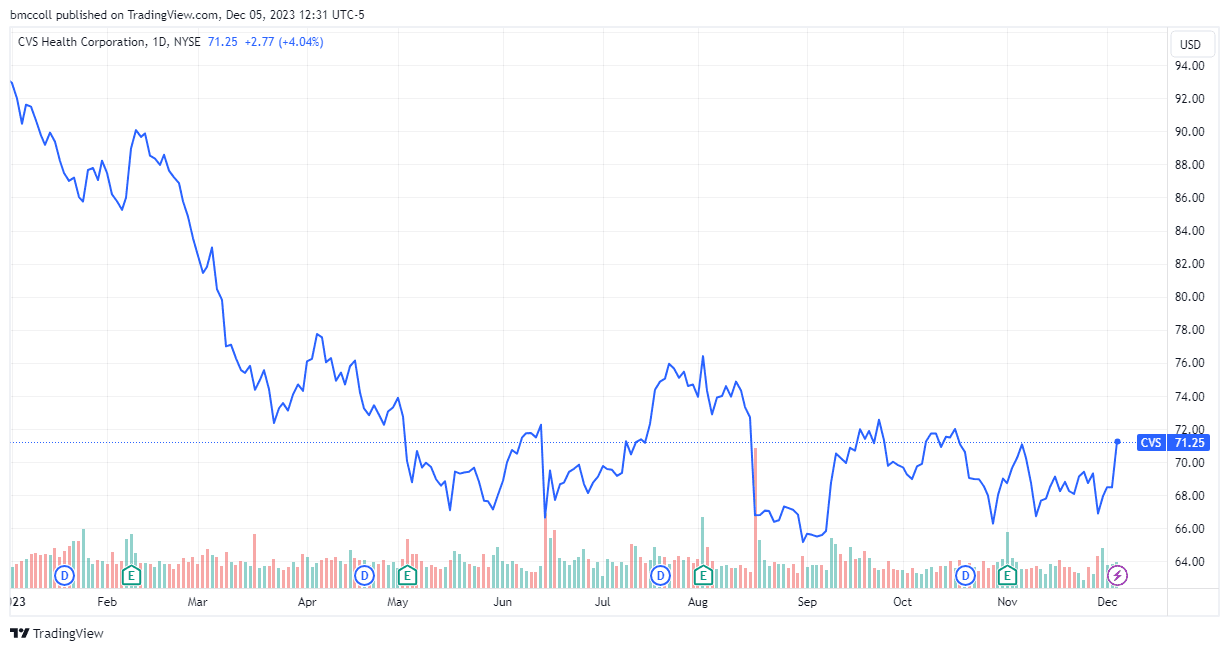

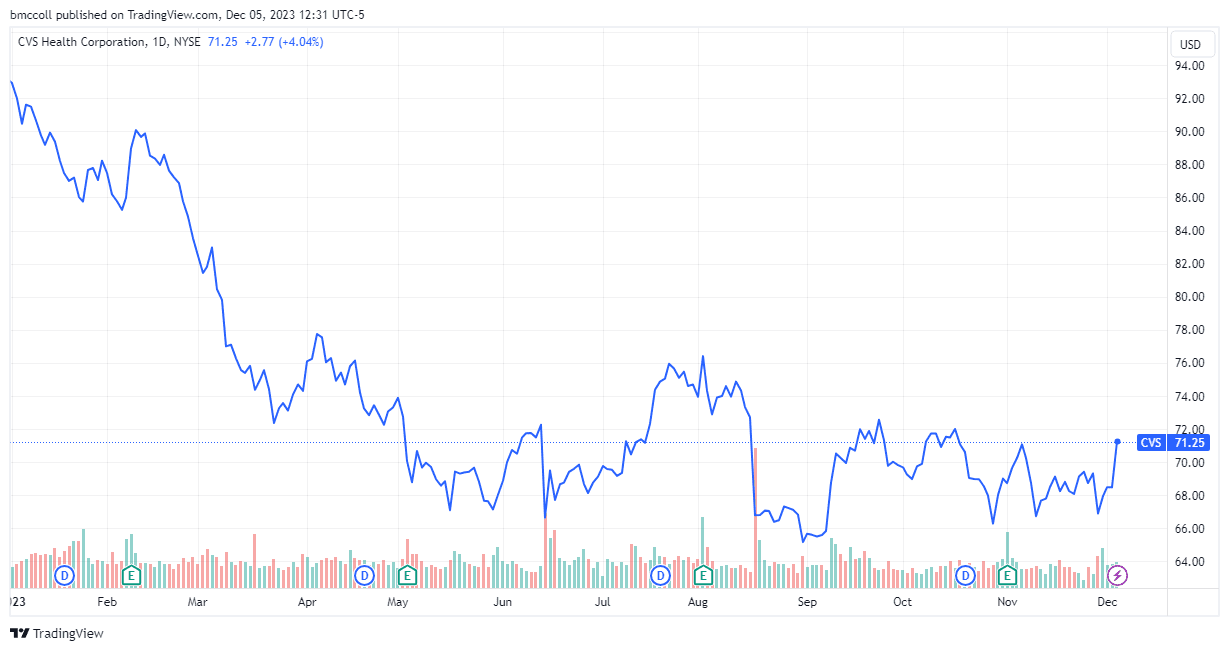

- CVS shares rose on Tuesday's news, but remain down for 2023.

Shares of CVS Health (CVS) jumped about 4% on Tuesday, as the drugstore chain and health care company issued strong guidance and increased its dividends amid strong demand higher for their health care services.

CVS expects 2024 revenue to be at least $366.0 billion, well above analyst estimates of $344.5 billion. The company also announced that it would increase its quarterly dividend from 60.5 cents per share to 66.5 cents per share, payable on February 1, 2024 to shareholders of record on January 22 of that year.

Additionally, CVS announced several initiatives. He said his CVS CostVantage plan will be a new approach to the traditional pharmacy reimbursement model that will bring “greater transparency and simplicity to the system.”

At the same time, the company introduced TrueCost, which it said “offers customers prices that reflect the true net cost of prescription drugs, with visibility into administrative costs.”

CVS is also launching CVS Healthspire, the new brand for its healthcare segment, which includes Caremark, Cordavis, Oak Street Health, Signify Health and MinuteClinic.

Despite Tuesday's gains, Shares of CVS Health are down about 23% for the year to date.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com