Takeaways

- Cybersecurity company CrowdStrike Holdings Inc. beat its earnings and revenue estimates and raised its full-year forecast as subscription revenue jumped.

- The company reported setting a record for net new annual recurring revenue (ARR) and becoming the only pure-play company to surpass $3 billion ARR.

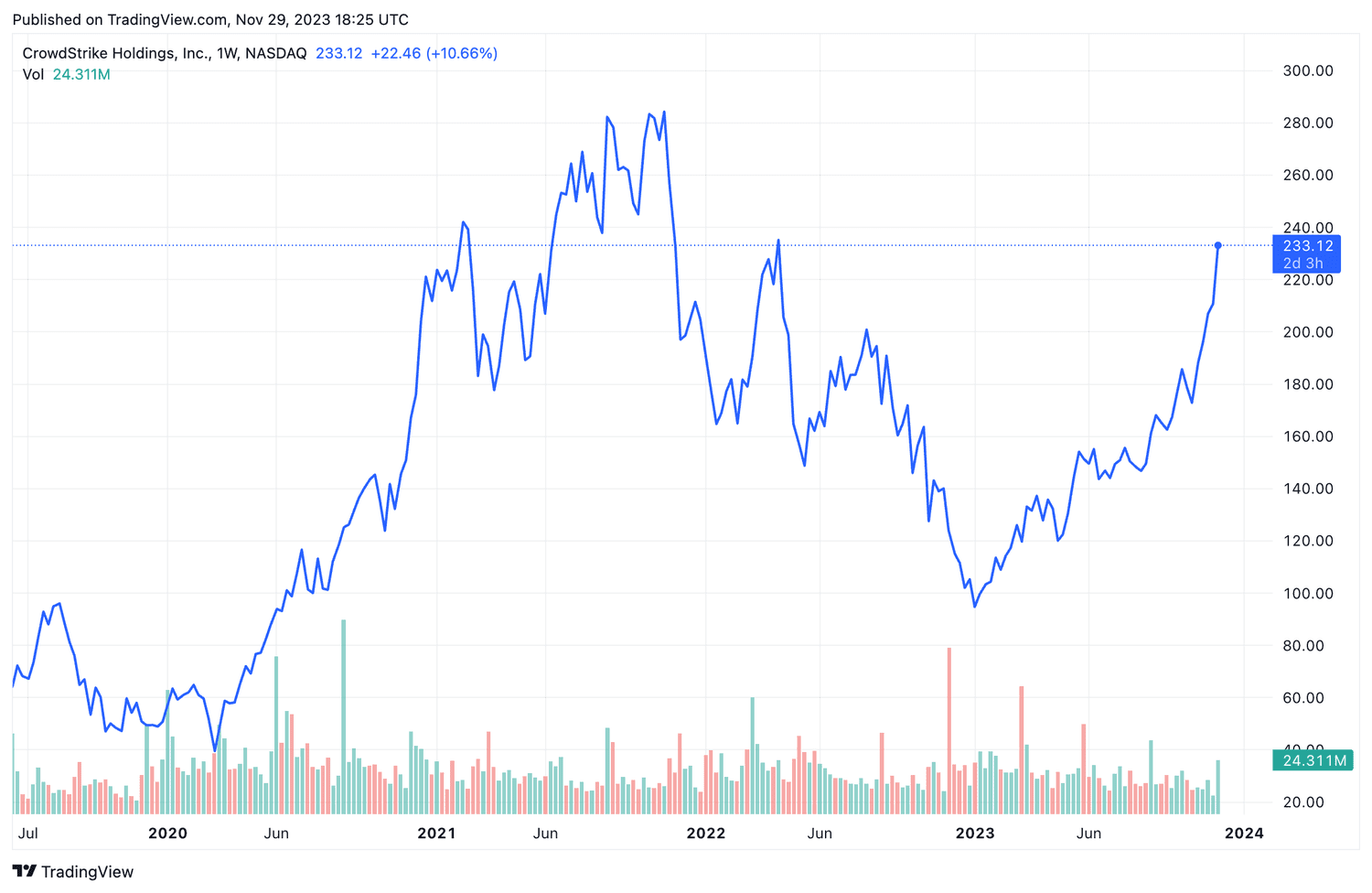

- CrowdStrike shares rose more than 10% early Wednesday afternoon to reach their highest level since April 2022.

Shares of CrowdStrike Holdings Inc. (CRWD) rose sharply on Wednesday after the cybersecurity company reported strong quarterly results and improved its outlook for increased subscription revenue.

CrowdStrike reported third-quarter 2024 earnings of 82 cents per share, double the 40 cents it earned in the year-ago quarter, with revenue up 35% to $786 million. dollars. Both results were higher than estimates. Subscription sales jumped 34% to $733.5 million in the period ended October 31.

The company reported that net new annual recurring revenue (ARR) from subscriptions, or year-over-year annualized revenue, reached an all-time high of $223 million, and final ARR exceeded $3 billion , which CEO George Kurtz said. has made CrowdStrike the only purely specialized cybersecurity provider to reach this level.

Chief Financial Officer (CFO) Burt Podbere added: The company is targeting an ARR of $10 billion over the next five to seven years.

CrowdStrike now sees the Its full-year earnings per share (EPS) of $2.95 to $2.96 and revenue of about $3.05 billion, compared with its prior forecast of a EPS of $2.80 to $2.84 and revenue between $3.03 and $3.04 billion.

Shares of CrowdStrike Holdings have rose further more than 10% by early afternoon, to their highest since April 2022.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com