Costco Wholesale Corporation (COST) is trading lower by almost 2% on Friday in pre-market despite beating third quarter of 2020 the top and bottom line estimates. A profit of $1.89 per share exceeded expectations by$ 0.03, while revenues increased 6.7% year on year to $ 37.3 billion, marking an impressive growth. UNITED states the stores have remained open during the epidemic, but has been hampered by the social distance and the supply disruptions, making the quarterly metrics even more impressive. E-commerce sales were up 66.1% over the same period, taking over a part of the income lost through physical sales.

The sell-the-news reaction follows a similar action after Walmart Inc.’s (WMT) report of the 19 May, highlighting the distribution in the large group area in the course of the past six weeks. It is likely that the smart money is the output of these questions at a rapid pace, expects sales to contract at the same time as the recession, the forces to reduce the purchasing power of consumers. This makes sense because the retail sector is very cyclical, often rise during periods of economic expansion and decline during periods of recession.

However, the company will report May sales on Wednesday of next week, and the continuation of the force could disentangle the short-term bearish response. At the national level, the re-opening of may have triggered an additional demand for goods and services that were deferred during the course of stay-at-home orders, give sales another boost that captures the attention of the market. Even so, it is best to remain skeptical through the release due to the weakness of the accumulation of readings.

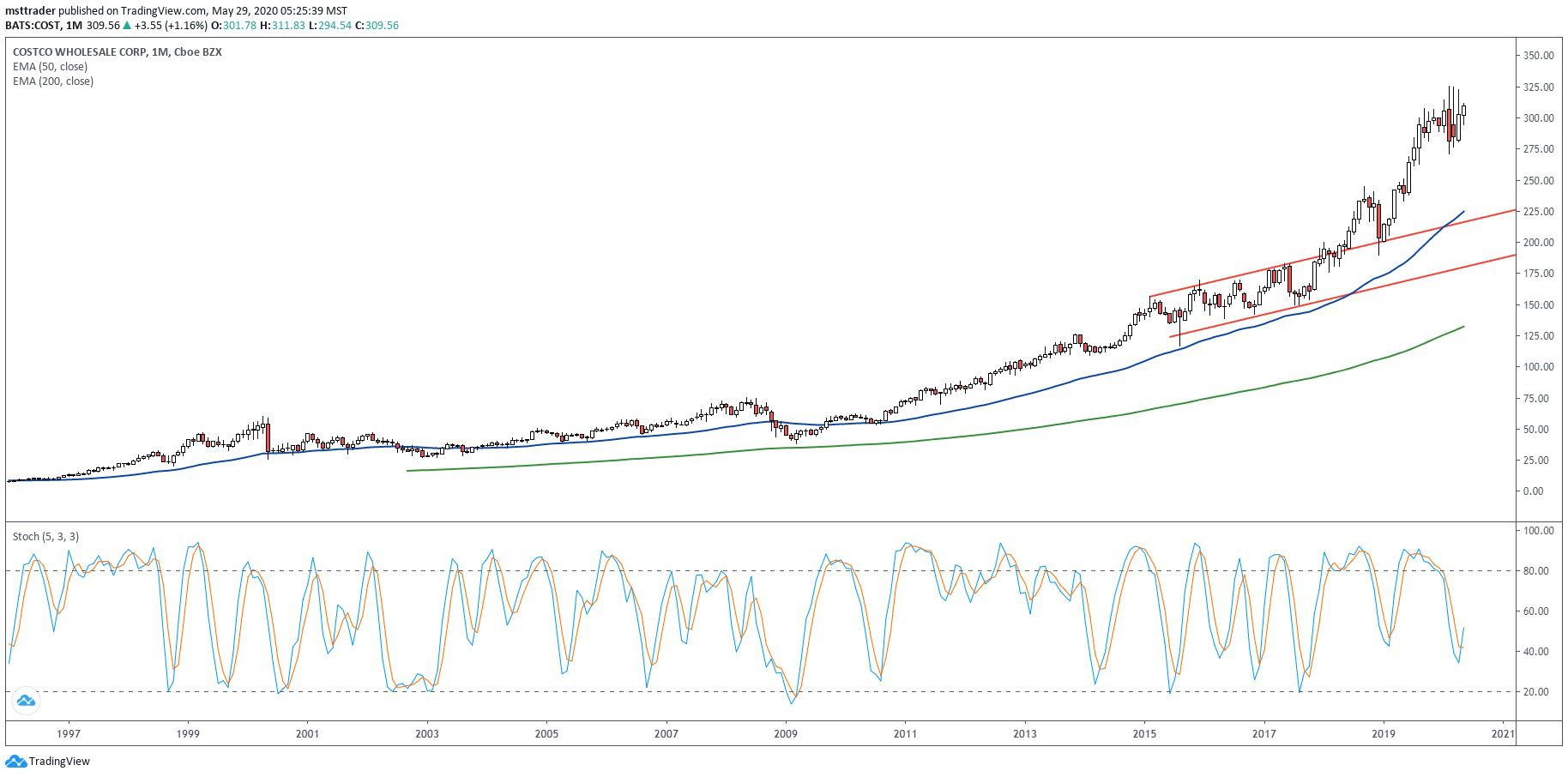

The COST in the Long-Term Chart (1997 – 2020)

TradingView.com

Costco stock has broke above 11 years of resistance in the middle of adolescence, in 1997, entering a strong uptrend that topped out at $60.50 in April 2000. Cut it in two, and in the following month, finding support at $25.95 before rebounding in 2001. Price action is held inside of these limits for the next seven years, carving a successful trial carried out in 2003 in the bass, followed by a slow upward movement that has reached the resistance of the range in 2007. The subsequent breakout made limited progress, the trim in the middle of$70s in the second quarter of 2008.

Price was cut in half once more, during the economic collapse, displaying a more down to $38.17 in March 2009 and turning in a two-legged recovery who has completed a round of travel in the 2008 high in 2011. An escape were quickly allayed by a rise in the channel and holding these borders in 2014 ventilation. It is entered in a second channel at the beginning of the year 2015 and has posted solid gains in June 2018, when he blew across the top of the chain in a dynamic advance that has won $245 in September.

The drop test again the support from the three months before you committed the interest generated purchase a new escape. Volatility increased in the fourth quarter, with prices of sculpture chaotic model that has generated even more volatility in the course of the pandemic-driven sell-off. The stock has traded between Feb. 21 all-time high at $325.26 and Feb. 28 six-month low at $271.28 for the last two months, the completion of a symmetrical triangle to predict the increase, the results, wait for a selling pressure under the surface.

COSTS in the Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator posted an all-time high, with prices in February, and has entered a phase of distribution, which has hit a 12 month low in mid-May. The stock is trading at more than 60 points higher now than at the time of the state of the OBV print (black line), signaling to a conflict that has heavily promotes the lower prices in the next few weeks. However, the model may be the final arbiter in this equation, with a triangle of derivation of new buy signals.

Given these inputs, most investors should stay on the sidelines for now, watching this discrepancy unfold. New shareholders can place stop losses under the triangle of support, which has increased by$ 300, and the step of the touch line on a failure, which would also require a break of the 50 and 200 days exponential moving averages (EMAs). That is the downside of the event could trigger big sell signals, hinting at the decline that could extend into the upper part of the red line and .786 Fibonacci rally retracement level near$220.

The Bottom Line

Costco sells, despite beating third-quarter to 2020, the estimates of gains, the addition of persistent selling pressure since the beginning of April.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com