Takeaways

- Citigroup has agreed to sell its Chinese unit to HSBC Bank China as it sheds assets to simplify its operations.

- The deal includes all clients, assets under management and deposits

- The move is part of Citi’s “broader global strategy refresh.” announced in 2021.

Citigroup (C) announced that it would sell its consumer goods portfolio in China to HSBC Bank China (HSBC), as the financial firm continues to shed its overseas assets in a bid to reduce the size of its operations .

Citi said the deal includes its clients, assets under management (AUM) and deposits. He added that assets under management and deposits were valued at approximately $3.6 billion.

Terms of the deal were not disclosed. Citi noted that the transaction is expected to be completed in the first half of next year. The company emphasized that it will continue its institutional activities in China.

Citi announced in April 2021 its intention to exit consumer banking in China as part of its “broader refresh of its global strategy.” It then indicated that it would abandon 14 of its consumer franchises around the world, and has already withdrawn eight.

Titi Cole, head of Citi historic franchises, explained that the bank continues “to make progress on our divestments as part of our strategy to simplify Citi”.

Divestitures are part of the CEO Jane Fraser's strategy to increase Citi's profits and drive up its stock price.

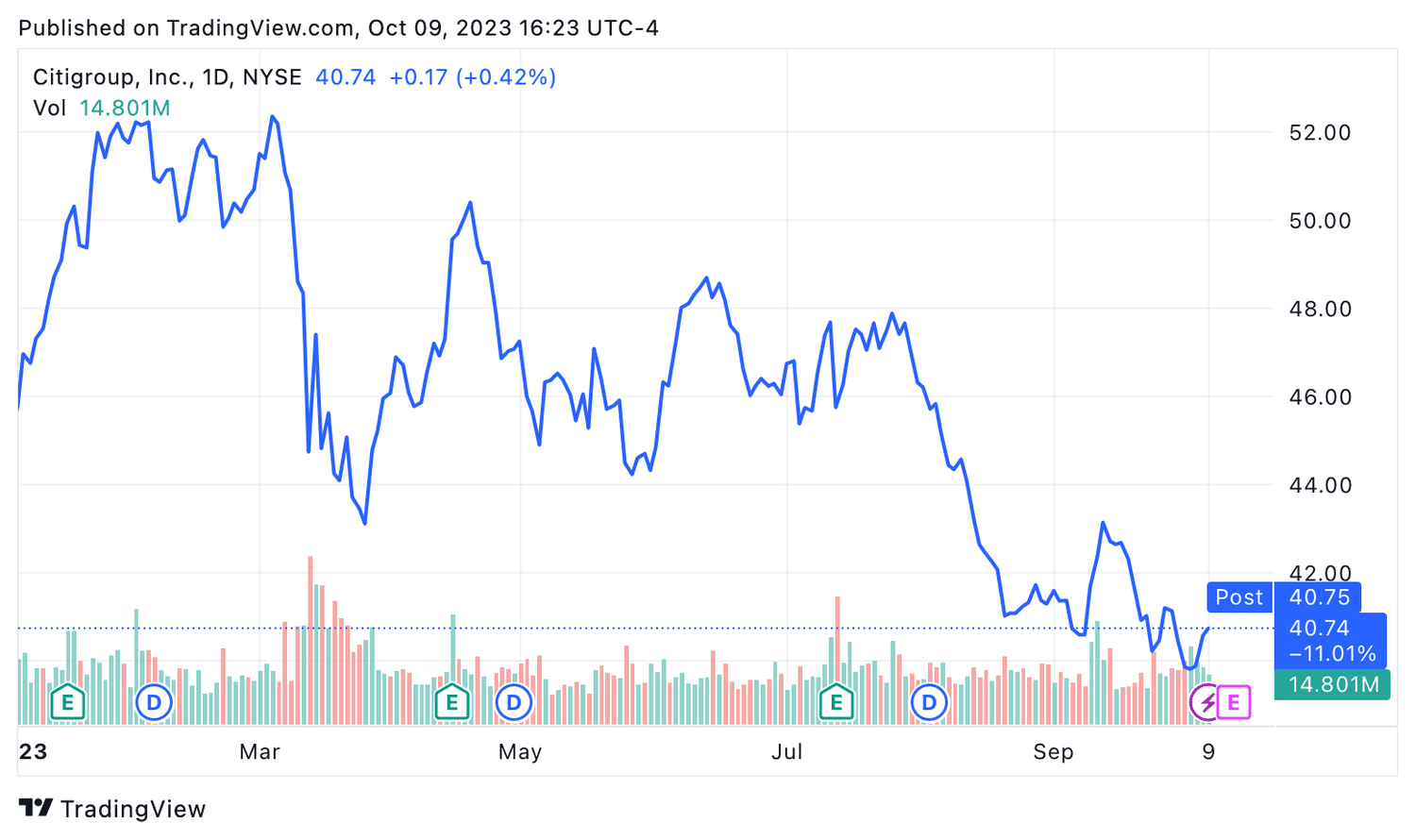

Citigroup shares rose by 0.4% on Monday following the news, but they have lost 11% of their value this year.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com