Dow component Cisco Systems, Inc. (CSCO) reports earnings Wednesday after the closing bell, with analysts expecting an earnings per share (EPS) of $0.71 in the third quarter of fiscal 2020 sales of $11.85 billion. The stock reversed at resistance and sold at more than 5% after the meeting of the second quarter of the guidance in February, before a more gentle slope slide taken by the coronavirus pandemic. This decline ended at 18-month low in the $ 30s in March, before a rebound that stalled at the 50-day exponential moving average (EMA) in April.

Chief executive officer Charles Robbins noted during the month of February, conference call that “longer-term decision-making cycles” were in development in most product lines due to “global uncertainty.” Given the judgment that followed, it is likely that the buying habits slowed to a crawl by the end of the first quarter. However, a second quarter, the pick-up makes sense due to the improvement in sentiment and the high technology base of customers who need to replace and modernize the equipment, regardless of the pandemic.

Cisco stock has been an underperformer for two decades, but the share price has improved over the past five years, has more than doubled in the second quarter of 2019, when the increase of the standoff in the middle of$50. Similarly, the level of resistance is still more than 20 points below March 2000 all-time high at $82.00. Almost all of the big tech stocks, with the exception of Cisco, have ridden the bull market highs posted this year.

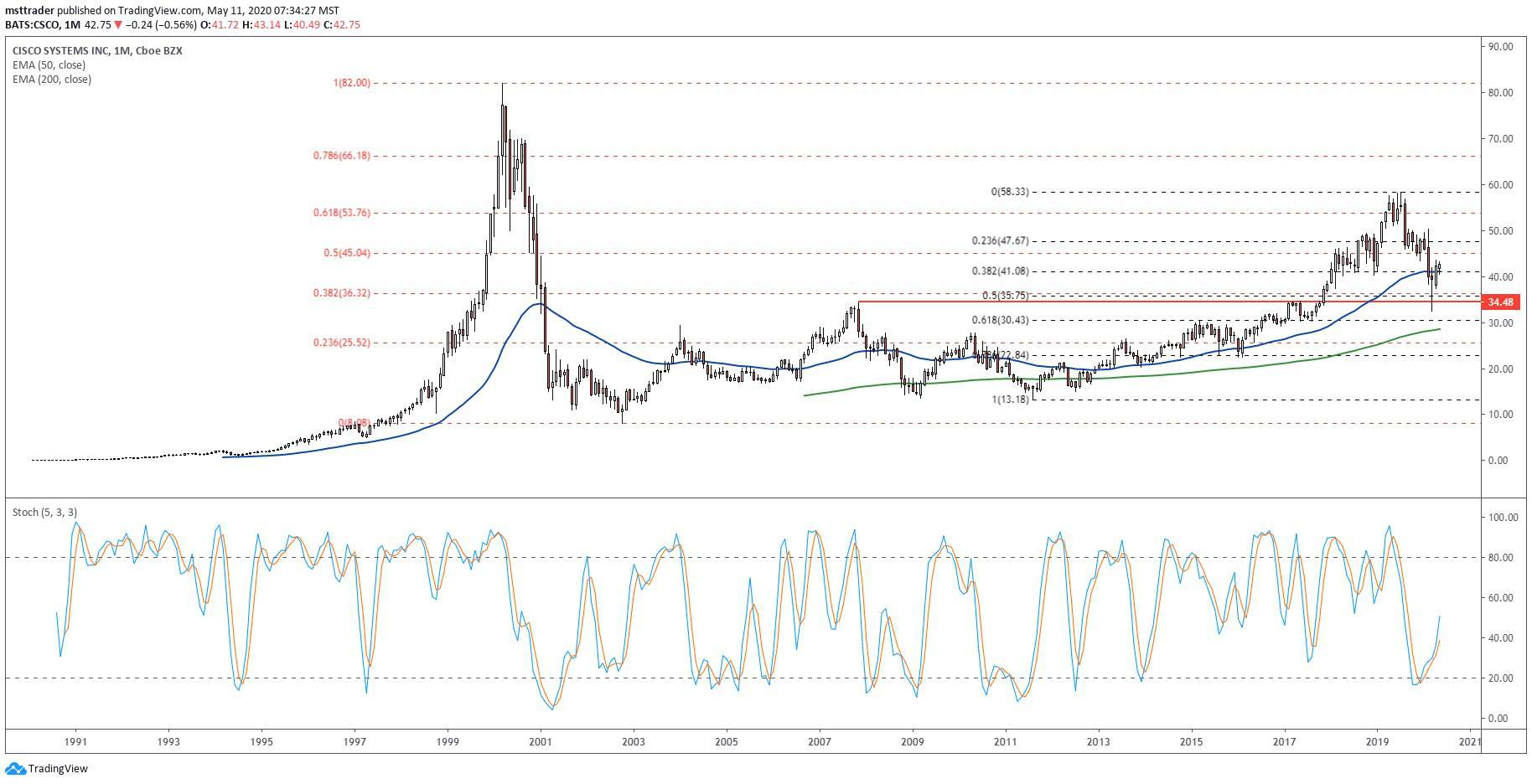

CSCO Long Term Chart (1992 – 2020)

TradingView.com

The stock split seven times in the 1990s, with an extraordinary buying interest driven by the fall of communism and the rise of the internet. The upward trend ended at $82.00 in March 2000, just two sessions after the final split, leaving the place to a steady downtick which has found the support of at least $50 in May. This level was busted in November, triggering a steep slide that finally ended in the single digits in the fourth quarter of 2002.

A slight increase during the mid-decade bull market topped below the .382 Fibonacci sell-off of the retracement level in 2007, the yield on renewed selling pressure, which has held above the 2002 low during the economic collapse of 2008. However, the weakness of purchasing power in the new decade has not build a bullish trend is sustained, the generation of successful tests to the lows of 2009, in 2011 and 2012. A positive feedback loop then set in motion, the sculpture of a slow-motion advance, which reached the record of 2007 in March 2017.

A November 2017 breakout has caught fire, the lifting of the stock in the two major rally of the wave of a 19-year high at $58.26 in July 2019. A small double top with resistance at this level has broken to the downside in August, signaling a new decline that broke through 2018 support near $40 during the month of March 2020 fall vertical. The stock is passed just above new resistance at the beginning of April, and has spent the last five weeks of grinding of the side in a holding pattern.

CSCO Short-Term Outlook

Fortunately for the bulls, the monthly amount of the stochastic oscillator has entered in a purchase cycle from the oversold zone in February and is now accelerating in the middle panel, indicating that the bulls remain in charge long-term price action, in spite of the recent setbacks. In turn, this raises the rating for a buy-the-news reaction after the Wednesday report, potentially back broken support at the 2018 low-and 50-month EMA.

The perfect placement of Mars low in the mid – $30s suggests long-term low, reversing the right to November 2017 breakout level. The floor of the exchange, marks the 50% retracement for the eight years of the upward trend, with the alignment suggesting that the downward trend has come to an end, and the action could possibly continue its long journey back to the resistance posted more than 20 years.

The Bottom Line

Cisco Systems stock may have put an end to eight months of downward trend in March low, setting the stage for a full recovery to return to the bull market top in $50.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com