Key Takeaways

- Analysts estimate adjusted EPS of$0.18 vs. $3.99 in Q2 2019.

- Same store sales are expected to fall significantly year-over-year.

- Revenues expected to decline in Q2 mid-COVID-19 spin-offs.

Chipotle Mexican Grill Inc. (CMG) has seen its stock rebound more than 130% from its low in mid-March, in spite of the COVID-19 of the health crisis that has closed much of the U.S. economy. The reason: investors are optimistic about the surge in online orders for Chipotle items to offset plunging sales of the chain of eat-in restaurants, which remain closed. Despite the economic outlook in certain regions of the UNITED states, Chipotle, and the restaurant industry are continuing to reel from government ordered social distancing measures and other measures to slow the spread of the virus.

Investors will look at how well Chipotle manages these forces, when it publishes its results on July 22 for the 2nd quarter of the FISCAL year 2020. Based on the estimates of the analysts, the new will not be good. Analysts expect the company to report a loss for the first time in at least 14 quarters in revenue and same-store sales sharp drop.

The investor has a particular focus intensely on the key metric of same-store sales, which is a critical measure of the string’s underlying growth. Chipotle just stopped their dinner service in March, the last month of Q1. In order that the full effects of the COVID-19 prohibitions, and other measures are more likely to be seen in T2, where the analysts expect that the first same store sales decline in at least 14 quarters.

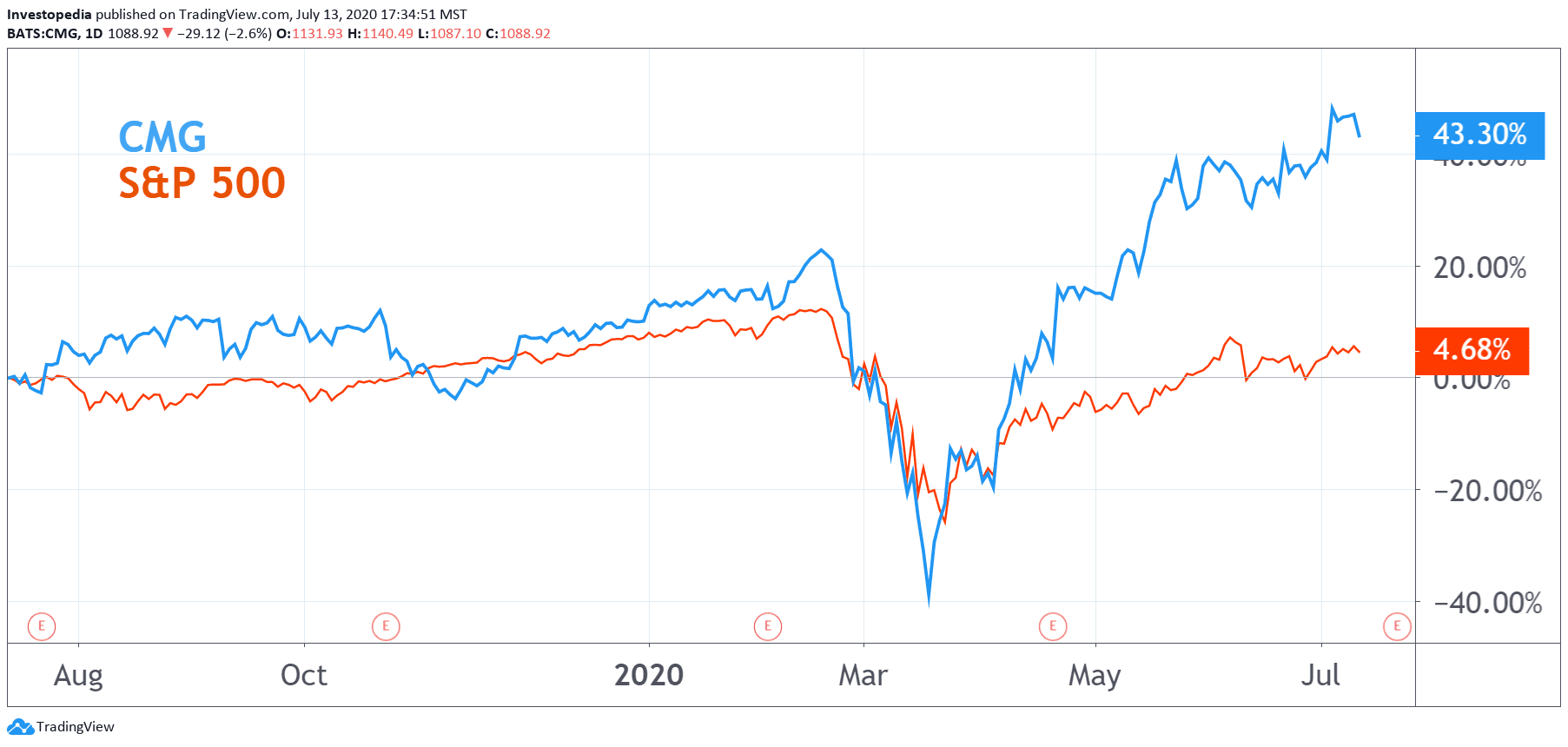

In the last 12 months, Chipotle has significantly outperformed the broader market, posting a total return of 43.3% compared to 4.7% for the S&P 500. Since its March lows, Chipotle stock has increased at more than twice the pace of the market as a whole.

Source: TradingView.

On the 21st of April, the company reported better than expected Q1 of FISCAL 2020 earnings, thanks, in part, of its expansion in line deliveries business, pushing the stock sharply. To be sure, Q1 adjusted earnings per share (EPS) of $3.08 was down 9.4% year on year, the first adjusted EPS decline of at least 13 quarters. But investors were optimistic, because the adjusted EPS number beat the consensus estimate of 5.8%. Another positive sign was that revenues rose 7.8% year-on-year, even if it was a big deceleration compared with the previous quarters.

Analysts do not expect the same positive signs in Q2 of FISCAL year 2020. In the next publication of the results, analysts expect adjusted EPS of swing from $3.99 Q2 the YEAR 2019 to a loss of $0.18 in Q2 2020. Revenue is expected to plunge by 8.9%. Given the higher than usual due to economic uncertainty and the lack of visibility, these estimates could potentially have a greater margin of error.

Chipotle Key Measures

Estimate of the Q2 2020 (AF)

Real for the 2nd quarter of 2019 (FY)

Real for the 2nd quarter of 2018 (AF)

Adjusted Earnings Per Share ($)

-0.18

3.99

3.05

Revenue ($B)

1.31

1.43

1.27

Same Store Sales Growth yoy (%)

-13.6

10.0

3.3

Source: Visible Alpha

As noted, the key metric for investors to watch is Chipotle’s same-store sales growth. Same-store sales, or comparable-store sales, is a key financial metric for restaurants and retail companies. It provides a measure of total sales attributable to stores that have been in operation for a year or more, or in Chipotle case, for at least 13 full calendar months.

Chipotle same store sales have shown a robust growth over the past two years, following the overhaul of its activities as a result of food poisoning outbreaks connected to restaurants in four states starting in 2015. This spring, the chain of agreement with the U.S. Justice Department to pay a fine of $25 million fine to resolve criminal charges.

Helped by measures to improve the cleanliness of its stores, Chipotle same store sales have rebounded from 1% growth in the 3rd quarter of FISCAL year 2017, and has peaked at 13.4% growth in the 4th quarter of FISCAL year 2019. That progress has reversed this year. Same-store sales rose 3.3% in Q1 2020, and analysts estimate a 13.6% decline in Q2.

Source: investopedia.com