Chevron (CVX) announced on Monday that it would buy energy exploration and production company PDC Energy (PDCE) for $6.3 billion.

Chevron says the PDC Energy Stocks buy values at $72, a 10.8% premium to their Friday closing price. He added that PDC investors would receive 0.46 Chevron shares for each PDC share held. Including debt, the total enterprise value of the buyout would be $7.6 billion.

"PDC's Attractive and Complementary Advantages Strengthen Chevron's Position in Major U.S. Production Basins," said Chevron CEO Mike Wirth. PDC operates in the Wattenberg field in Colorado, adjacent to Chevron's Denver-Julesburg Basin site, and the Delaware Basin in West Texas.

Quick Impact

Chevron expects the transaction to benefit all key financial metrics within the first year following closing. He said PDC will add about $1 billion in annual free cash flow for oil (assuming the price of Brent crude is $70 a barrel) and $3.50 per thousand cubic feet of Henry Hub gas. (based on May 2024 futures prices). The companies expect the deal to be finalized by the end of this year.

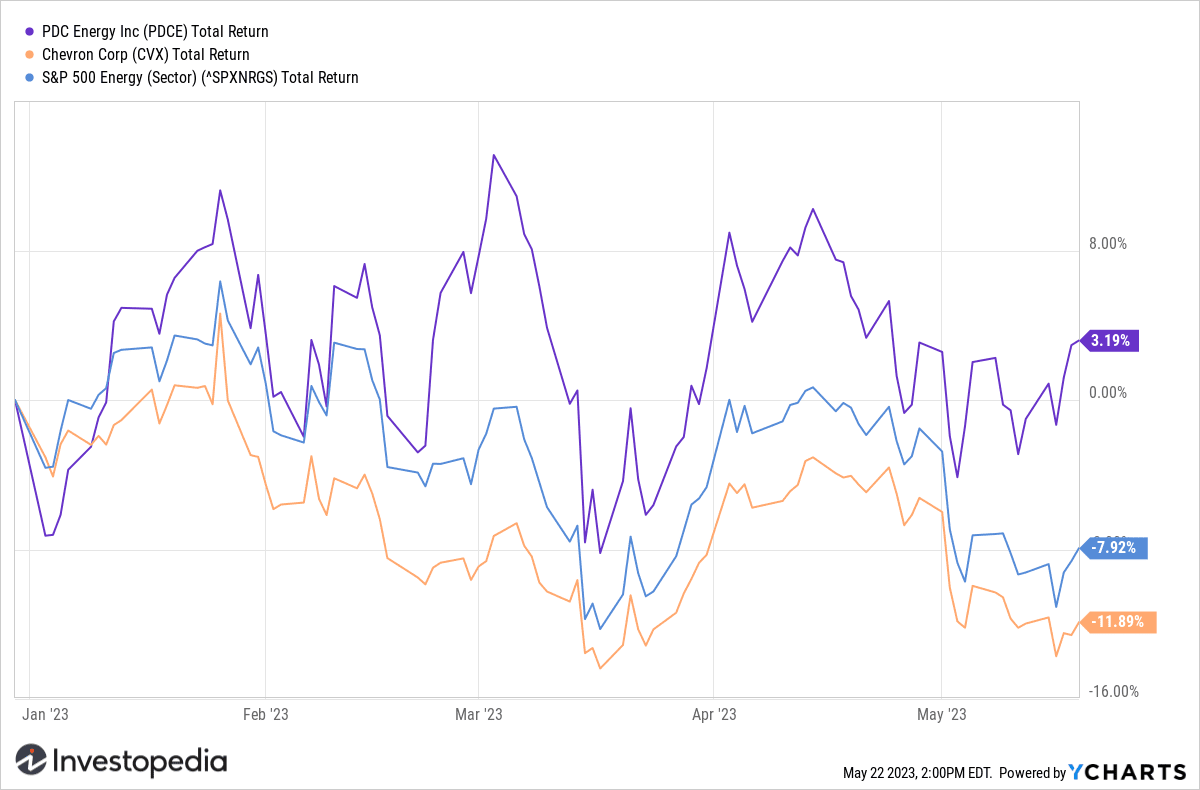

PDC Energy shares have rose 9%, while shares of Chevron fell 0.5%. Year-to-date, stocks of the former are up just over 3%, outpacing an 8% loss for the energy sector as a whole over the past year. the same period. Shares of Chevron are down 12% year-to-date, underperforming the broader sector.

Y-Graphs

Source: investopedia.com