Charles Schwab (SCHW) said on Wednesday that; it would raise $2.5 billion via bond sales to fund general corporate expenses, including “investments in our subsidiaries and support for business growth”, as the giant brokerage is dealing with the fallout from the recent turmoil in the banking sector.

Schwab said it will sell $1.2 billion in bonds maturing in 2029, as well as $1.3 billion in notes expiring in 2034. Both securities will have yields to maturity (YTM) by 5.64% and 5.85%, respectively, which will yield just over a 2% premium. to the 10-year US Treasury note, which is currently trading at 3.6%.

The company has been under financial pressure since March, when the collapse of Silicon Valley Bank and Signature Bank prompted the brokerage firm's clients to shift cash into money market funds, which offer higher yields. high due to Fed interest rate hikes. Bank deposits at Schwab fell 11%, or about $40 billion, in the first quarter.

The bond sale is the stockbroker's latest attempt to shore up its finances. In recent months, the company has raised funds by issuing certificates of deposit (CDs) and borrowing from the Federal Home Loan Bank, to offset the impact of deposit outflows. Schwab had about $20 billion in long-term debt at the end of the first quarter, of which about $3.7 billion matures by the end of next year.

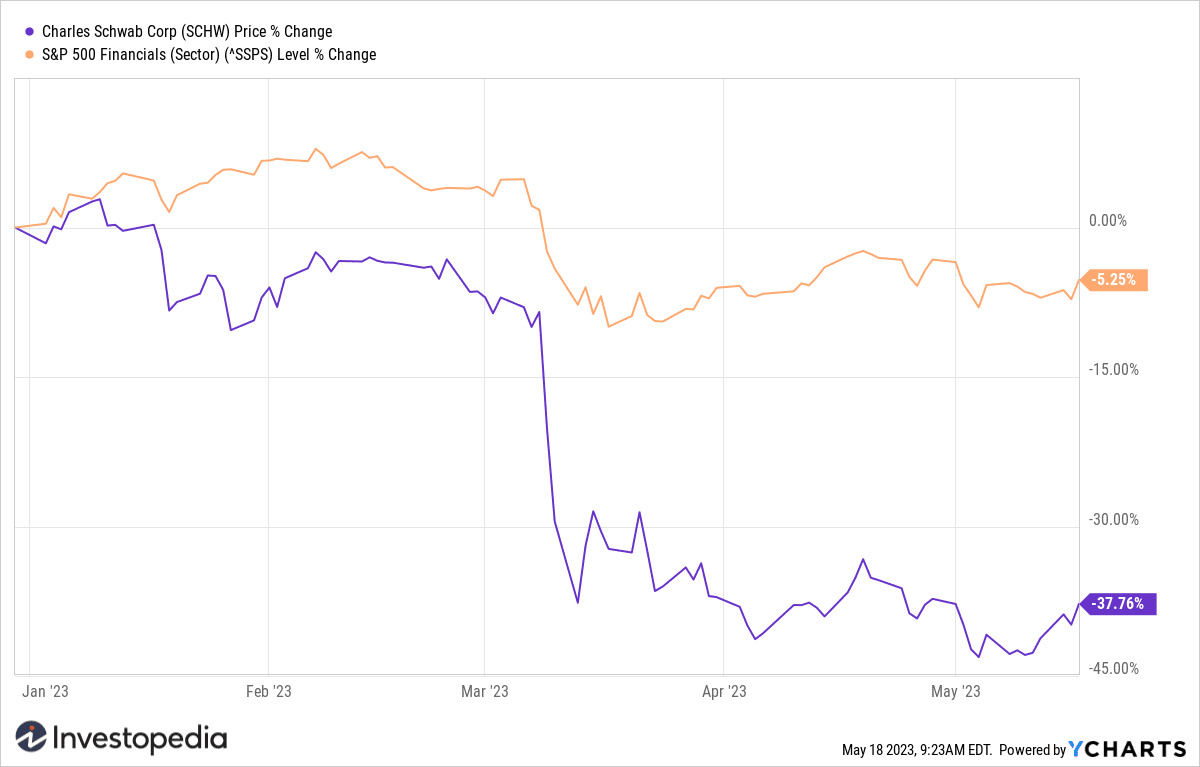

Charles Schwab's actions were roughly flat in premarket trading on Thursday. They are down more than 37% since the start of the year, compared to a decline of 5% in the financial sector as a whole during the same period.

Y Charts

Source: investopedia.com