Takeaways

- Charles Schwab reported profit above estimates and announced plans to cut $1 billion in additional annual expenses.

- The company noted that bank deposits rose last month, the first time in a year and a half. .

- Schwab absorbed $1.3 trillion in client assets from TD Ameritrade over Labor Day weekend.

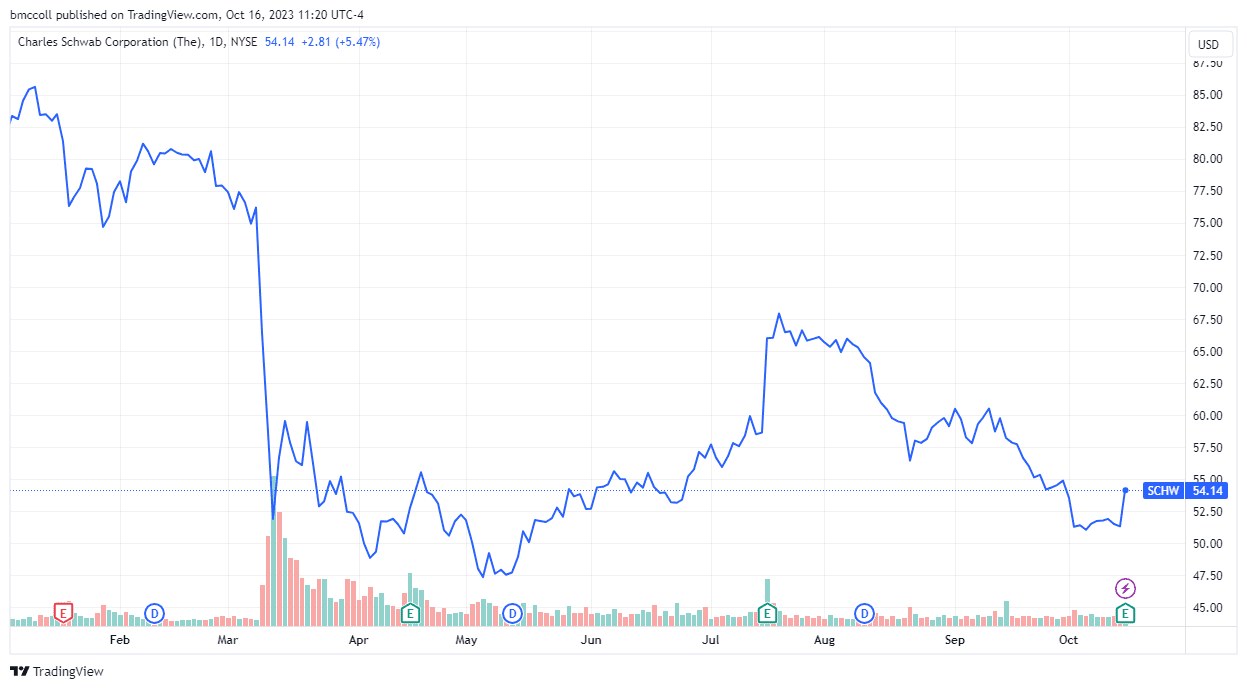

Shares of Charles Schwab (SCHW) jumped in early trading Monday after the discount brokerage and investment firm reported better-than-expected earnings and announced it was embarking on a major plan cost reduction.

Schwab reported its third-quarter fiscal 2023 earnings per share of $0.77, beating estimates. Revenue fell 16% from last year to $4.61 billion, just below forecasts. Net interest income of $2.24 billion was better than expected.

The company also indicated that bank deposits increased in September for the first time since March 2022.

The results came during a period when Schwab absorbed and converted $1.3 trillion in customer assets from TD Ameritrade, noting that the switchover over Labor Day weekend was the largest in industry history.

CEO Walt Bettinger explained that alongside the Ameritrade integration, Schwab would focus on “advancing our key strategic initiatives.” He highlighted that the company “has identified a number of opportunities to increase efficiencies” which, when fully implemented, are expected to generate at least $1 billion in savings. additional annual expenses.

Charles Schwab's shares were close to 5% higher at noon ET. Monday following the news. However, even with Monday's gains, Charles Schwab shares have lost more than a third of their value since the start of the year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com