Avantax (AVTA), a leader in the financial sector focused on tax planning and wealth management, has agreed to be acquired by financial advisor Cetera, in a transaction valued at approximately $1.2 billion.

Takeaways

- Cetera will acquire Avantax in a transaction valued at $1.2 billion, the two companies announced Monday.

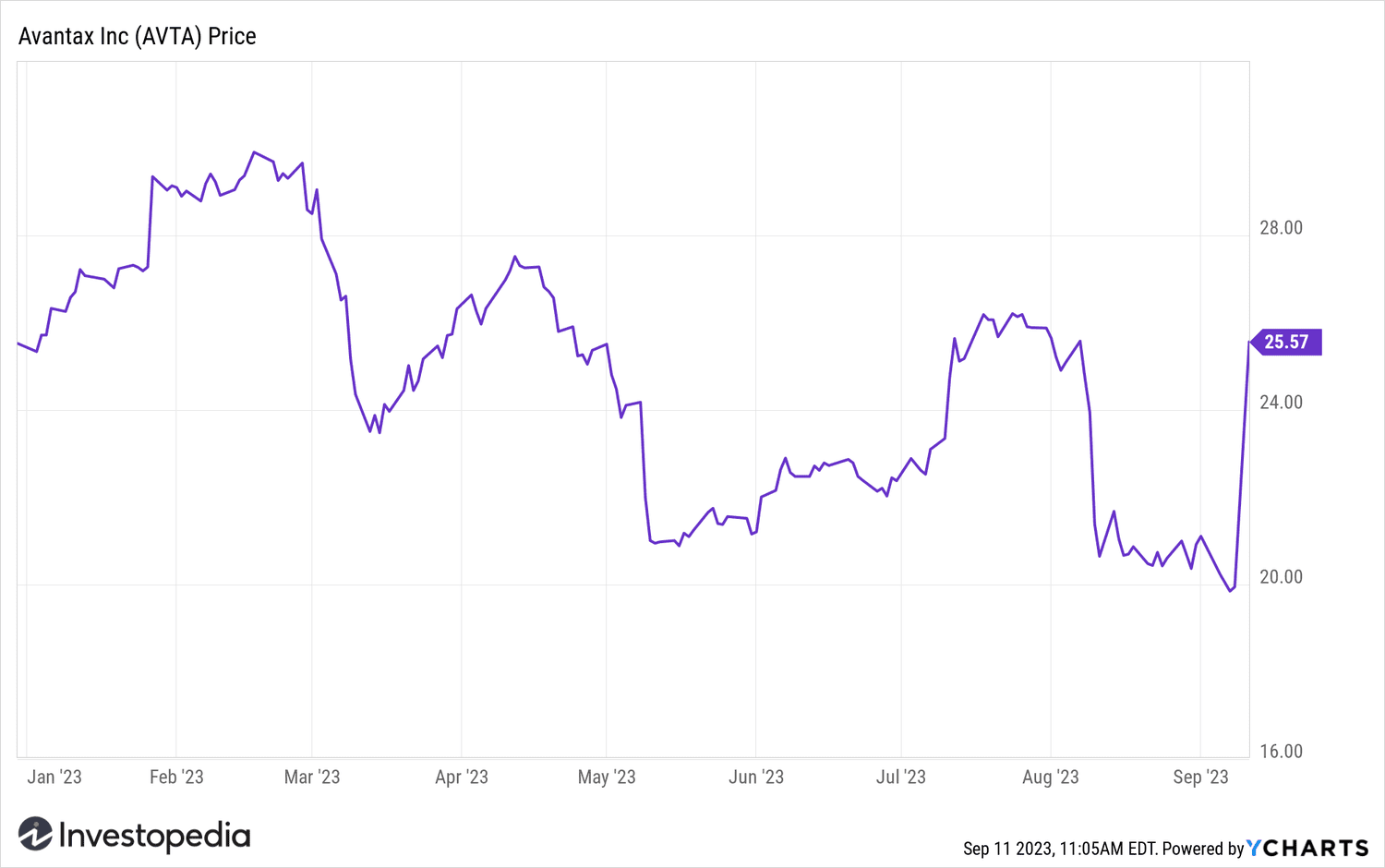

- Company shareholders will receive $26 per share in cash, a 30% premium to the stock. closing price on September 8.

- Avantax shares rose more than 28% following the announcement.

- The transaction is part of an increasing trend of mergers and acquisitions of registered investment advisors (RIAs) in recent years.

Upon closing, Avantax will become a private company and a standalone business unit within Cetera. The company will include 3,078 Avantax financial professionals, with $83.8 billion in assets under administration and $42.6 billion in assets under management, the company said. announcement.

Company shareholders will receive $26 per share in cash, a 30% premium to the stock's closing price on Friday.

“This transaction, once finalized, will deliver immediate monetary value to Avantax shareholders” and is “the result of Avantax's strategic transformation and value creation efforts, which… have unlocked significant value for our shareholders”, Avantax CEO Chris Walters said in a statement. Prepared statement.

Mike Durbin, CEO of Cetera Holdings, said that “Avantax was an ideal target” to “expand Cetera’s capabilities in wealth management and tax expertise as a critical part of our growth strategy.”

Avantax shares rose more than 28% on Monday. Before the deal was announced, the stock price had fallen more than 27% year to date.

Investment advisor mergers and acquisitions (M&A) registered (RIA) are rising after a record high in 2022, according to a report from Echelon Partners. The agreement between Cetera and Avantax is part of a surge in large transactions. Nearly half of all RIA acquisitions in the first half of 2023 were for targets with more than $1 billion in assets under management, according to Echelon Partners. Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com