Trending Videos

Takeaways

- Centene raised its outlook for 2024 and reaffirmed its guidance for 2023 by cutting costs.

- CEO Sarah London said the expected profit increase was based on stronger operational momentum. performance and strong execution of the company's strategic plan.

- The healthcare provider also increased its stock buyback program by $4 billion.

Shares of Centene (CNC) gained nearly 3% on Tuesday after the healthcare provider raised its guidance by cutting costs and strengthening its share buyback program. .

The company now expects earnings per share (EPS) above $6.70 for fiscal 2024, up from above $6.60. It projects revenue between $142.5 billion and $145.5 billion, which is above analyst estimates. Centene reaffirmed its 2023 forecast of EPS of at least $6.60, with premium and services revenue between $137.5 billion and $139.5 billion.

CEO Sarah London said the company continues to “execute our strategic plan, positioning Centene to deliver strong long-term earnings growth and create significant shareholder value.” She explained that the higher earnings outlook was “indicative of positive operational momentum and strong execution of our plan.”

The company also said that The board authorized a $4 billion increase in its existing stock repurchase plan, which will add to the remaining $1.2 billion.

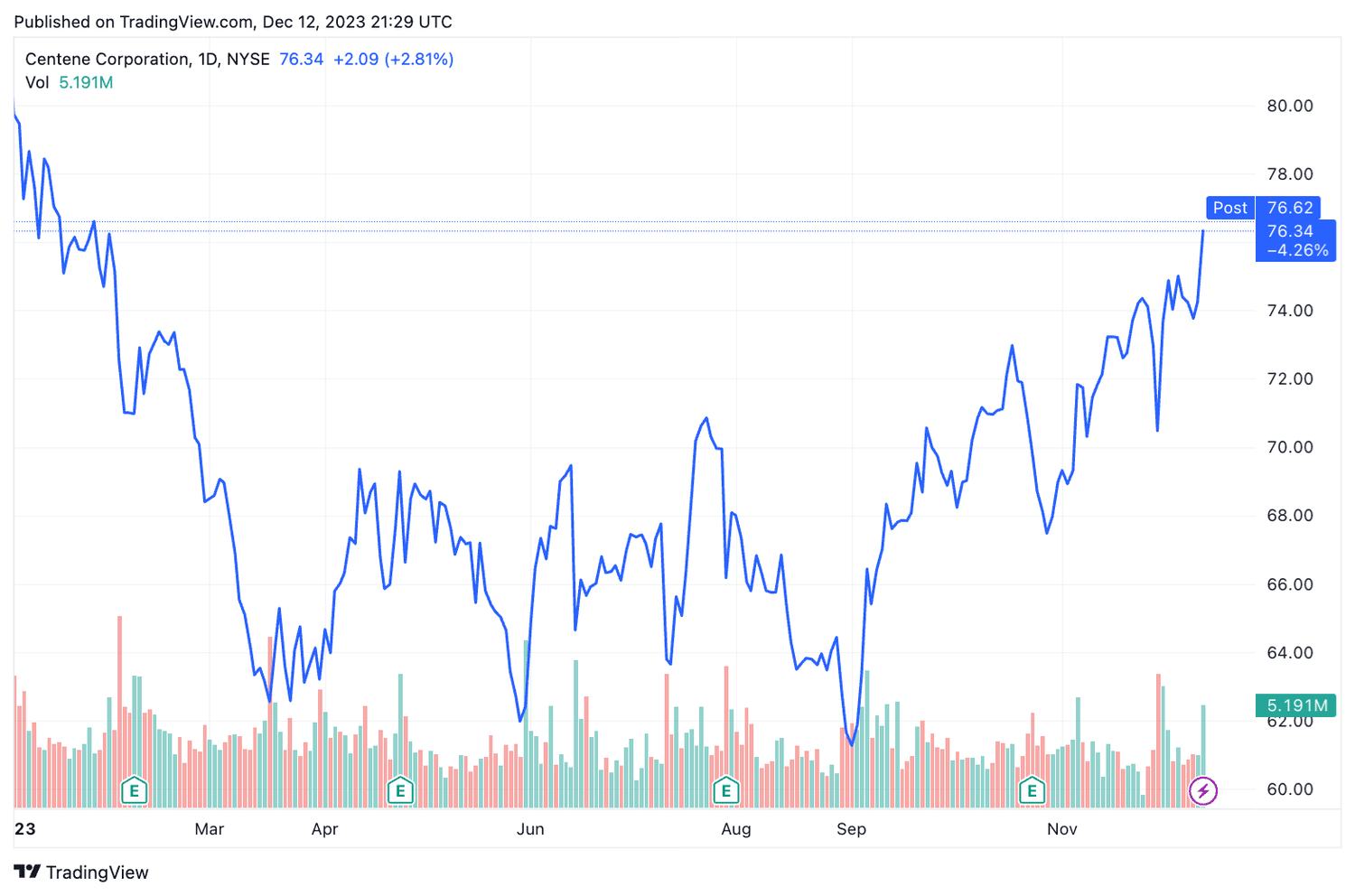

Centene shares priced at ended up 2.8% Tuesday at $76.34 following the news. However, Centene shares remained lower for 2023, down 4.3% year to date.

TradingView

Do you have a tip for trading journalists? 39;Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com