Key takeaways

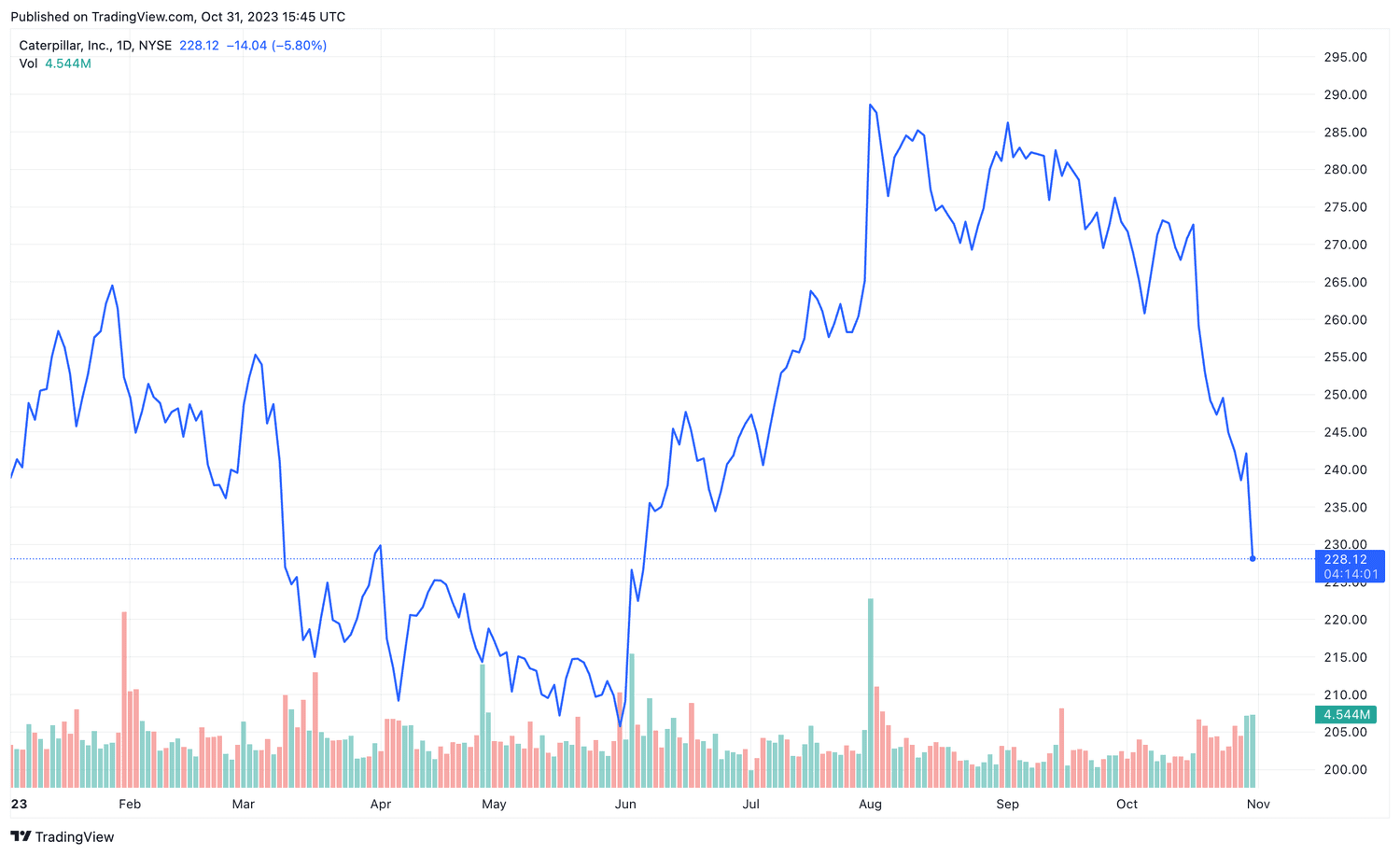

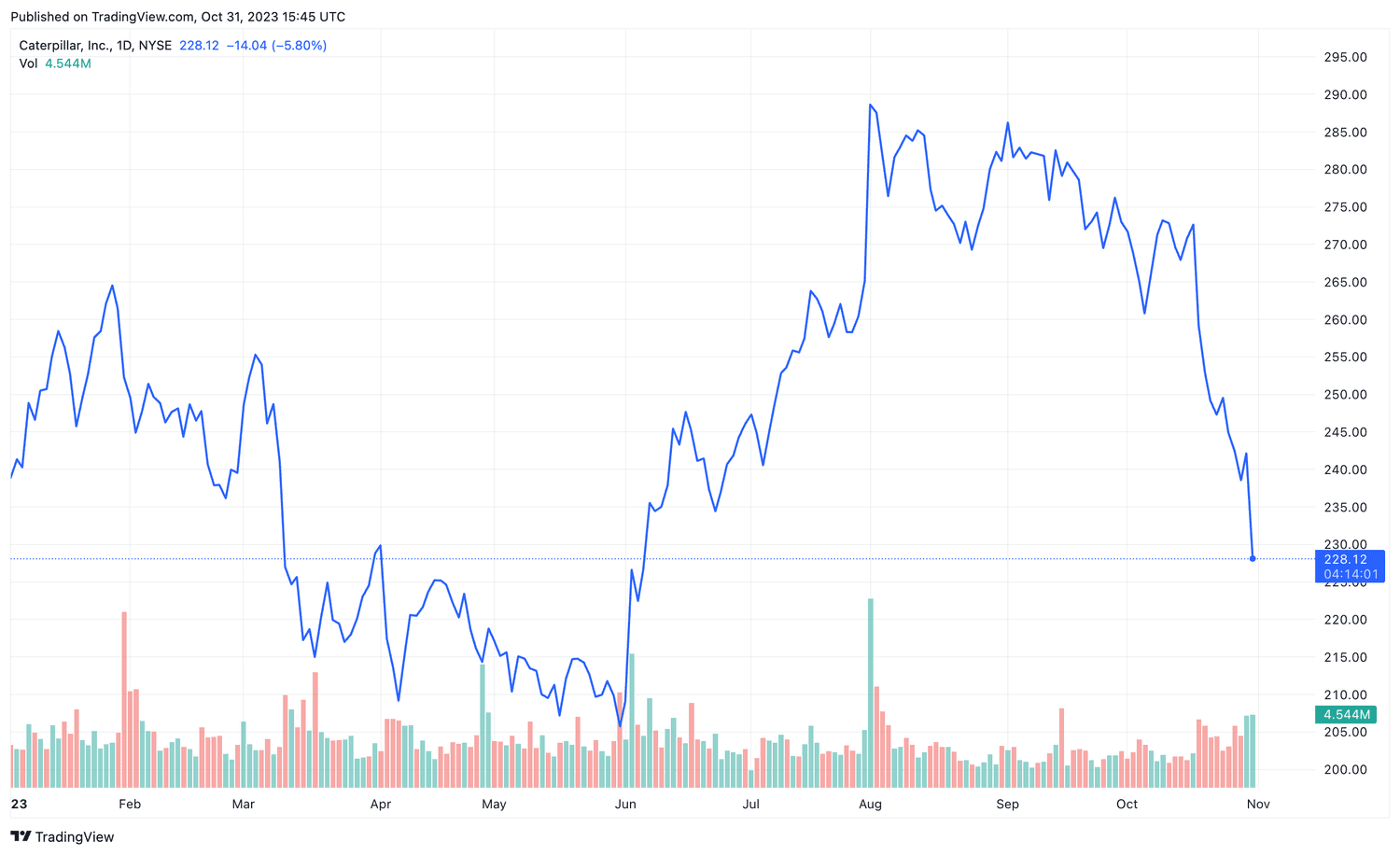

- Caterpillar (CAT) fell more than 5% Tuesday morning despite falling profits, as the construction equipment maker issued a cautious outlook for the fourth quarter and said order backlogs declined , fueling concerns about an economic slowdown.

- Executives said on the quarterly earnings call that they were comfortable with market conditions and that Dealer inventories were within a typical sales range.

- The company expects “slightly higher” sales and revenue in the fourth quarter compared to the same period last year, but a lower operating profit margin compared to the recent quarter completed.

- Caterpillar, which has a fleet of construction equipment located around the world, is considered a bellwether for the global economy because its sales are fueled by demand for construction spending, a key economic driver.

Caterpillar (CAT) shares fell by more than 5% Tuesday morning despite a earnings beat, as the construction equipment maker issued a cautious outlook for the fourth quarter and said order books had declined, fueling concerns about a slowdown economic.

Third-quarter revenue was $16.81 billion, an increase of 12% from the year-ago quarter, driven by higher sales volumes . Profit was $2.79 billion, or an adjusted $5.52 per share, up more than 40% from $3.87 per share in the 2015 quarter. ;last year, and well above consensus estimates of $4.75. Caterpillar's adjusted operating profit margin, at 20.8%, improved by more than four percentage points from the same quarter last year.

Growth was particularly strong in North America, the company's home region, reflecting strong infrastructure spending driven by government investment, as well as gains in non-residential construction. On the other hand, the company expects continued weakness in China, where the share of corporate sales in the total will likely remain below the usual 5-10% range.

The reduction in delay gives rise to economic concerns

Caterpillar's order backlog fell by 1 .9 billion in the latest quarter compared to the same period last year, a sign that global demand for construction equipment may be stagnating. The backlog decreased by $2.6 billion from the previous quarter, while dealer inventories increased by $600 million.

Despite this, the leaders of the business' The earnings call said they were comfortable with market conditions.

Although the company expects dealer inventories to be higher at the end of 2023 than they were at the end of last year, CFO ( CFO) Andrew Bonfield said during the quarterly earnings call that the company “still expects it to be in the typical range of three to four months of sales.”

'We are very comfortable with the level of inventory held by dealers overall,' Bonfield said, noting that dealers would like to have more inventory in certain circumstances.

The company expects sales and “slightly higher” revenues in the fourth quarter compared to the same quarter last year. However, Caterpillar's operating profit margin is expected to be lower than in the third quarter.

Caterpillar, the world's largest manufacturer of industrial and construction equipment with a fleet located around the world, is often considered a bellwether for the global economy. Indeed, construction spending tends to increase when economic growth accelerates and decrease when growth slows or a recession is imminent. When company orders or revenue decline, it is often seen as a sign of lower construction spending and future economic growth.

As a cyclical benchmark, CAT stocks have have always been particularly vulnerable to economic downturns.

Caterpillar shares fell by 5.8% to $228.12 late Tuesday morning. The stock is now in negative territory for the year, and down from an all-time high of nearly $290 per share in early August.

Do you have a news tip for news journalists 9 ;Investopedia? Please email us at tips@investopedia.com

Do you have a news tip for news journalists 9 ;Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com