Takeaways

- Demand for pizza helped boost sales at Casey's General Stores, and the convenience store operator's stock price hit a record.

- Casey's General Stores' ;s helped increase pizza sales. Net income for the first quarter of fiscal 2024 increased 11% from the 2022 quarter and was a third higher than analysts' estimates. estimates.

- Casey's said it plans to add 150 stores in its current fiscal year.

Shares of Casey's General Stores Inc. (CASY) hit a record high after the convenience store operator reported a better-than-expected profit on pizza demand.

Casey's reported first-quarter fiscal 2024 earnings per share (EPS) of $4.52, up 11% from a year and over a year ago. third higher than analysts' forecasts. Revenue fell 13.1% to $3.87 billion, slightly below estimates.

The company said same-store sales rose 5.4%. % as it sold more whole pizzas and successfully launched its Casey's thin crust pizza. Same-store sales of groceries and general merchandise increased 5.2%, while those of prepared foods and dispensed beverages increased 5.9%. Same-store fuel sales rose 0.4%, although profits from that line item ultimately declined due to lower gasoline prices. Casey's said it reduced same-store working hours by 3%.

CEO Darren Rebelez said the company benefited from a “more normalized macro operating environment”, which he said allowed Casey's unique business model to be “on full display.” “.

Casey's explained that due to pending transactions, it plans to add at least 150 stores this fiscal year. It currently has 2,536 locations.

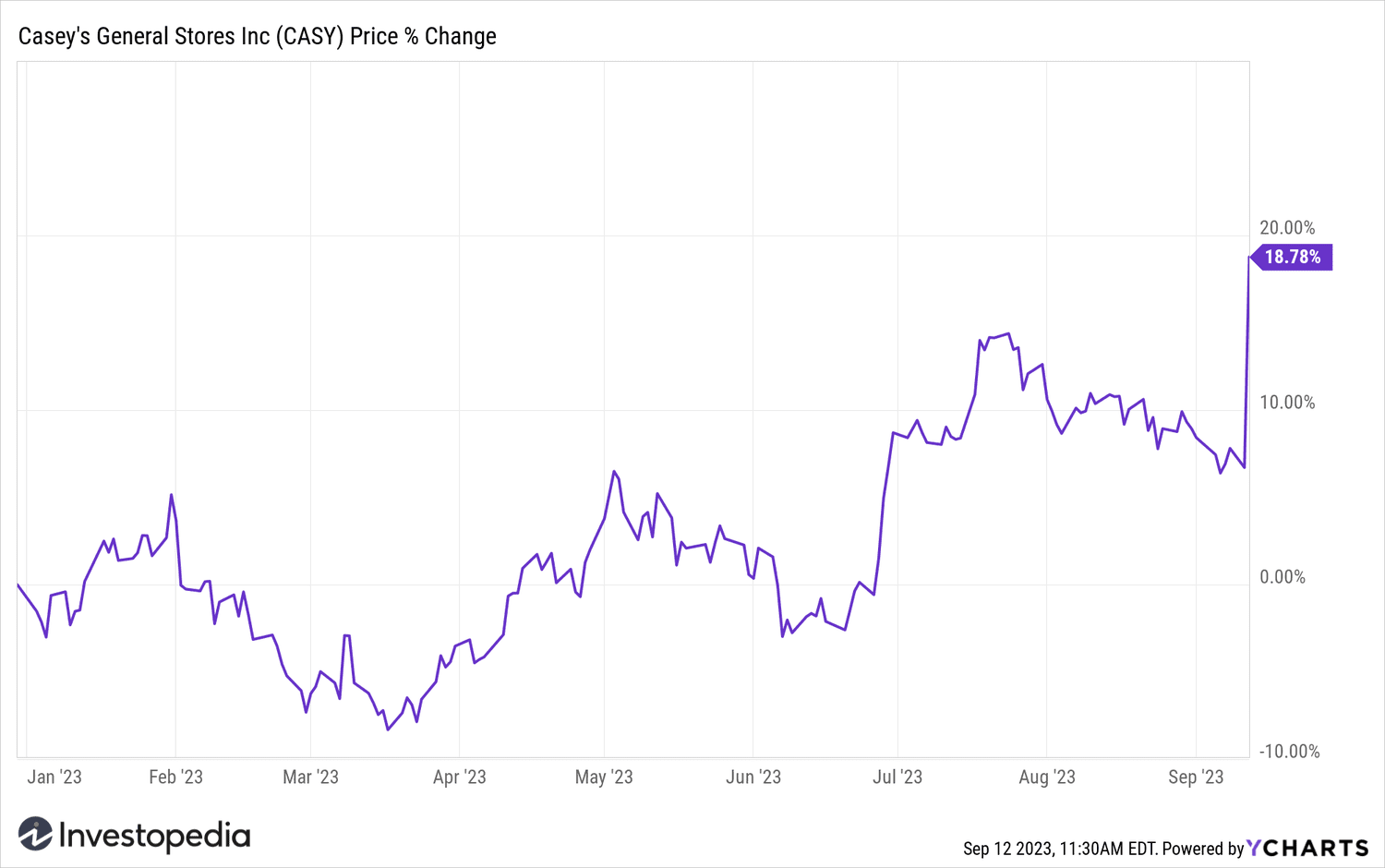

With a 10% gain as of midday Tuesday, shares of Casey's General Stores are up about 18% so far in 2023.

YCharts

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com