Key Points

- En online Auto retailer Carvana (CVNA) reported a smaller-than-expected loss and said it would post a positive adjusted profit for the current quarter.

- Carvana decided to cut costs in 2022 to weather headwinds in the industry and economy, and the CEO believes the strategy is working.

- Carvana shares soared 24% on May 5, 2023, following positive financial results.

Shares of Carvana (CVNA) soared after the online used-car retailer posted a smaller-than-expected loss and, to everyone's surprise, indicated it would make an adjusted profit positive during the current quarter.

Carvana reported a first-quarter loss of $1.51 per share, $0.49 less than analysts " forecasts. Revenue fell 11% to $2.61 billion, in line with expectations.

The company has sold 79,240 vehicles, more than expected. Gross profit per unit (GPU) jumped 52% to $4,303. On a non-GAAP basis, it was $4,796, a gain of 61% and the best Q1 GPU in company history.

Strategy works

CEO Ernie Garcia said the results show the company has made “a big step in the right direction and there are more steps to come.” He added that it was “clear that our strategy and execution are working”. Last year, Carvana decided to cut costs and maximize volume flexibility as it faced “additional industry and economic headwinds.” which put additional pressure on sales volume and which are likely to put additional pressure on the GPU”. It also rolled back its estimate of achieving positive earnings before interest, tax, depreciation and amortization (EBITDA) in 2023. However, it has now explained that the target will be achieved before the second half.

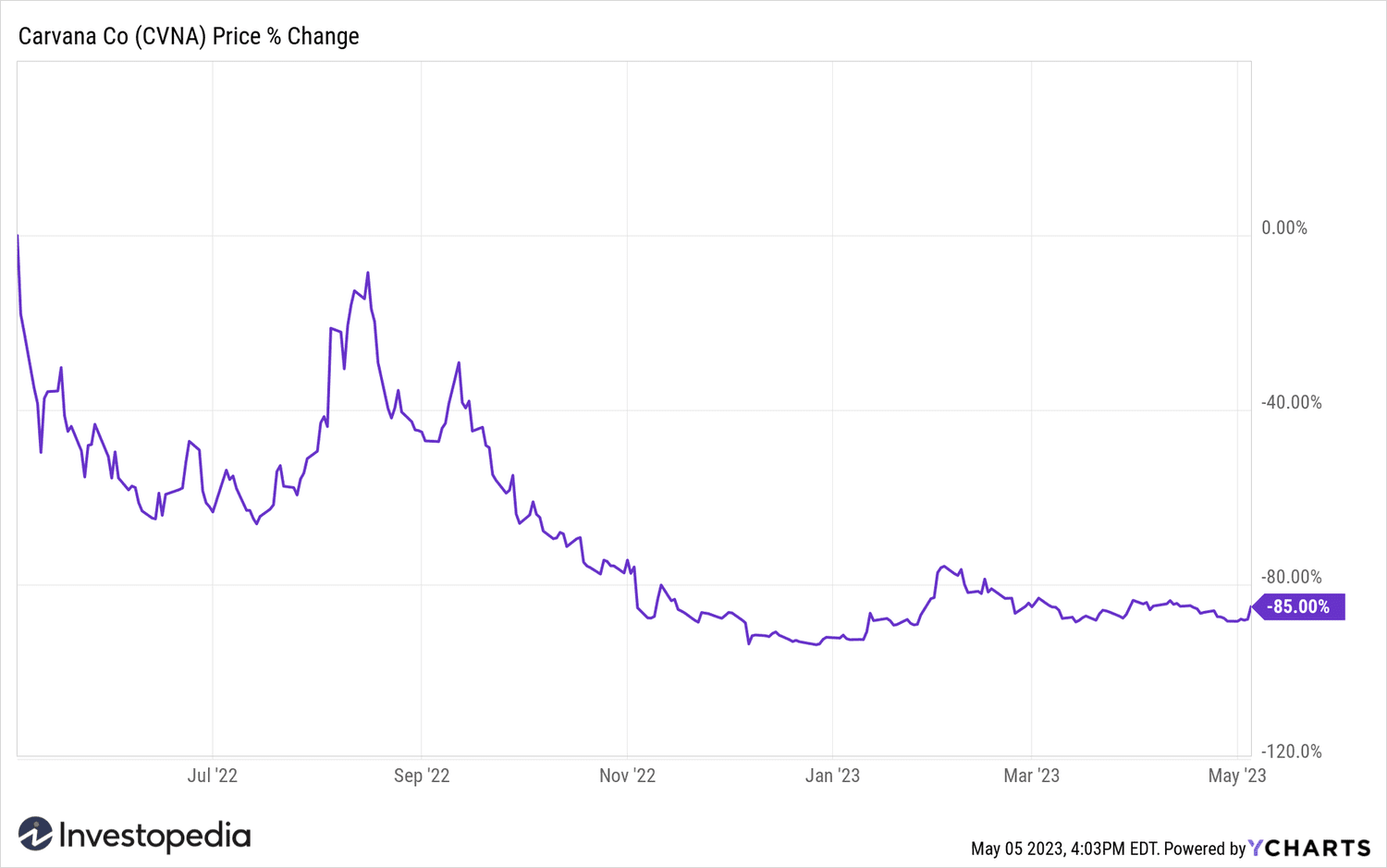

Carvana shares surged by 24% on May 5, 2023. They are up 88% since the start of the year, although they are down 85% from a year ago.

Y-Graphs

Source: investopedia.com