Key takeaways

- Cano Health has warned that it does not have enough cash to continue operations in a year.

- Business loss exploded due to declining revenues and rising costs.

- Cano said it is seeking a buyer for all or substantially all of its assets.

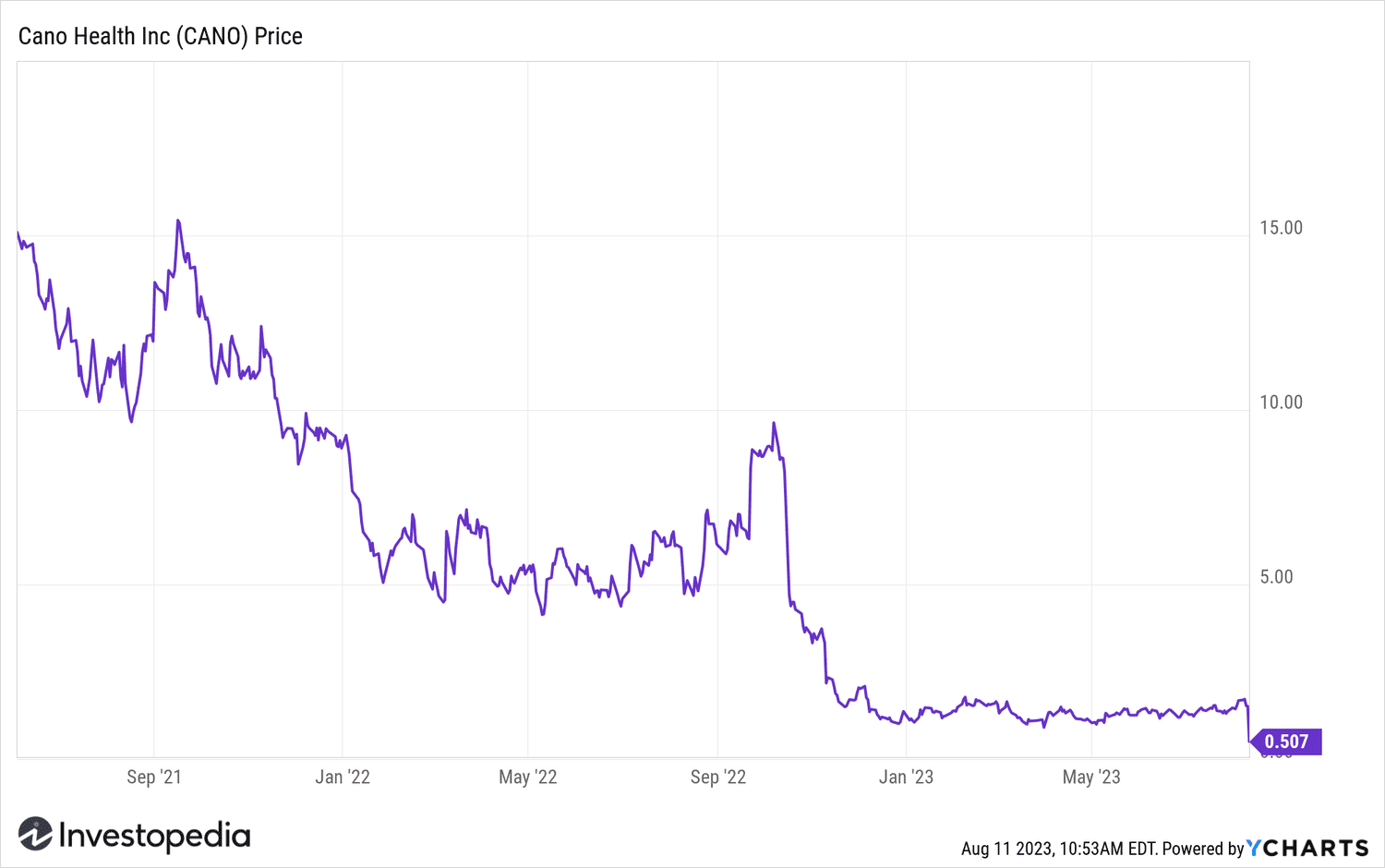

Cano Health (CANO) shares fell further from 67% in early trading Friday to an all-time low after the senior healthcare provider warned it may not be able to continue operations and is looking for a buyer as revenues have fallen and expenses have risen.

The company has indicated that it does not had only $101 million in cash and cash equivalents as of Wednesday, and believes the amount of cash “is not sufficient to cover operating, investing and financing of the company for the next 12 months”.

Cano added that management has concluded that 39; “there is substantial doubt about the company's ability to continue operations within one year”.

Cano posted a net loss of $270.7 million, more than 18 times its loss a year earlier. The company blamed a higher operating loss, mainly due to lower-than-expected Medicare risk adjustment (MRA) earnings, higher medical costs, reserve change of certain assets, a change in fair value of warrant liabilities and an increase in interest expense.

Cano added that it has accelerated actions to exit operations in California, New Mexico, Illinois and Puerto Rico, and is consolidating operations in Texas and Nevada. The company also plans to lay off 700 workers in the current quarter.

Cano announced that it was to “pursue a comprehensive process to identify and assess interest in a sale of the Company, or all or substantially all of its assets.”

Cano Health shares further lost more than two-thirds of their value after the #39;news.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com