Key takeaways

- Campbell Soup shares fell on Wednesday after its full-year earnings outlook fell short of estimates.

- As the company raised prices, volumes declined, a sign that price-sensitive buyers may have backed off.

- Fiscal third quarter results topped analysts" forecast.

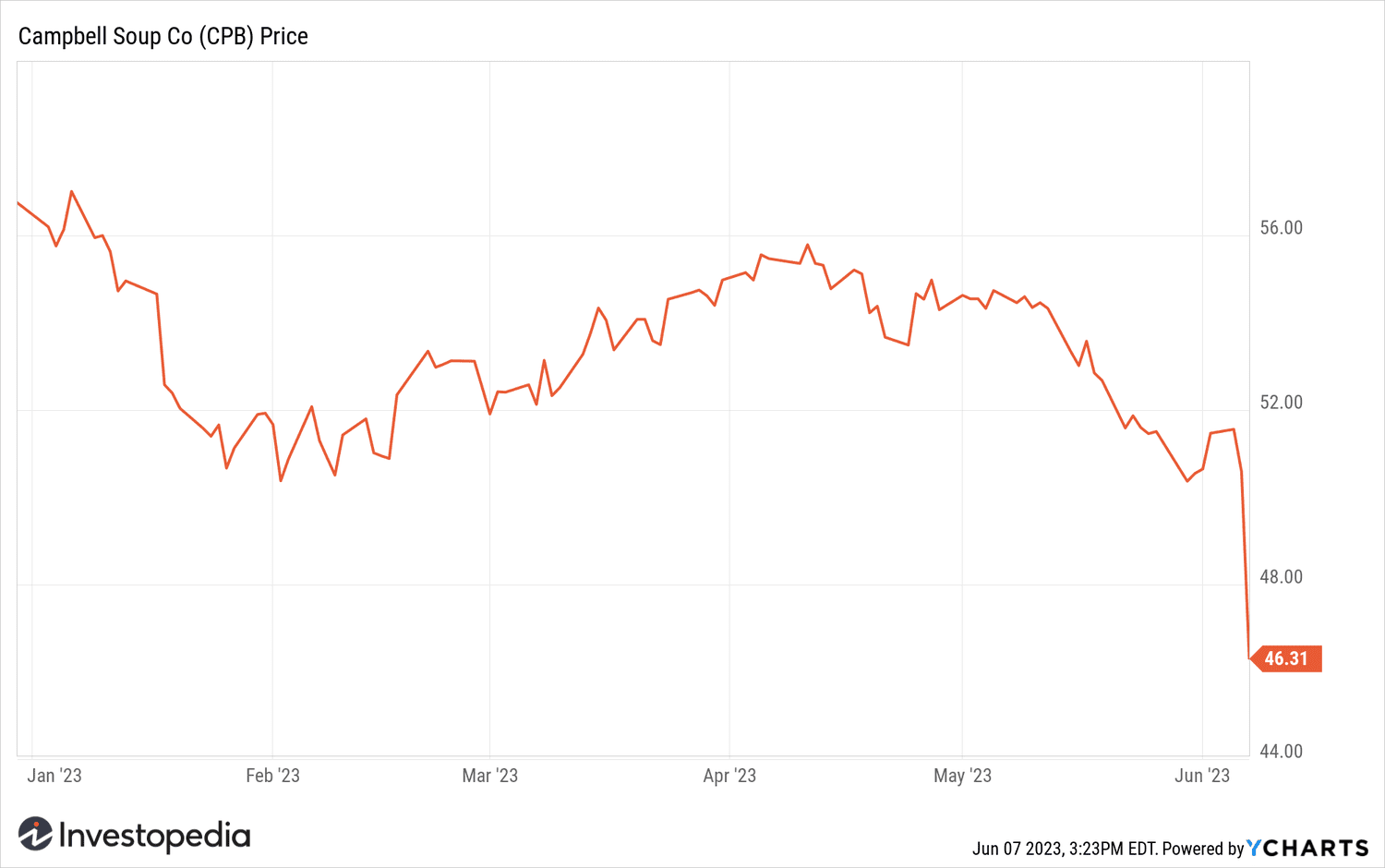

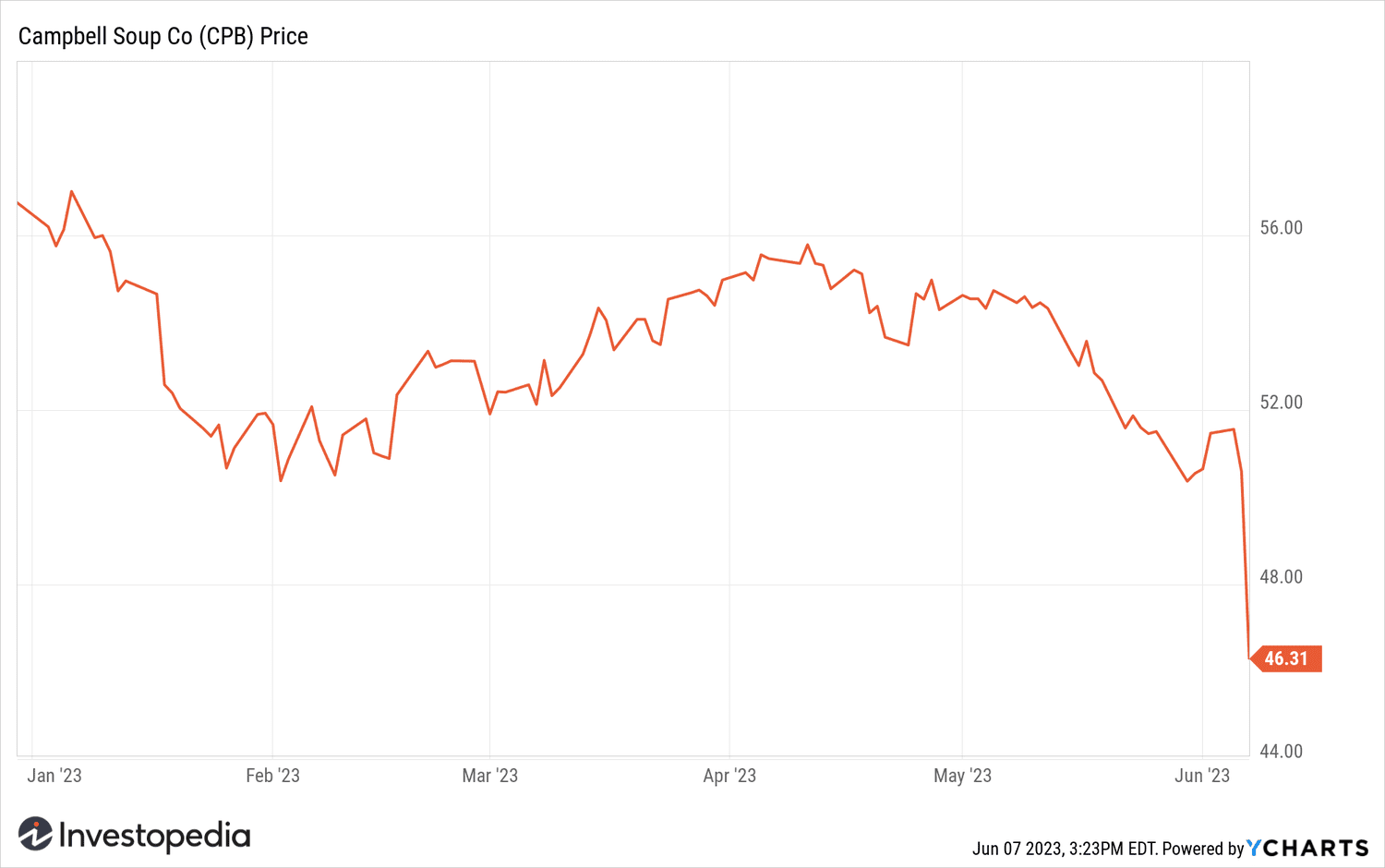

Campbell Soup (CPB) was the worst-performing stock in the S&P 500 after the food company predicted lower-than-expected full-year earnings.

Campbell reaffirmed its earlier guidance for the fiscal 2023 earnings per share (EPS) in the $2.95 to $3 range, and noted that it was “heading toward the upper end of the outlook range.” However, analysts were expecting $3.01. Campbell still expects revenue growth of between 8.5% and 10%, roughly in line with forecasts.

For Q3 EPS came to 0 $.68, better than estimates. Revenue rose 4.6% to $2.23 billion, in line with forecasts.

CEO Mark Clouse said the company benefited from “inflation-inflated” price increases, as well as momentum in the market and strong supply chain execution. He added that this year's results created “a difficult comparison” with last year, when retailers restocked in the wake of the COVID-19 pandemic.

However, the report noted that the gains generated by higher prices were partially offset by lower volume “due to elasticities”," suggesting that price-sensitive consumers may have pulled back.

Campbell Soup shares have fell 8.9% on Wednesday to their lowest level this year.

YCharts

Source: investopedia.com