Takeaways

- Cal -Maine stocks fell after reporting profits fell 99% as egg prices collapsed. Its EPS and sales missed analysts' expectations. estimates.

- The company reported that the average price of eggs fell about 30% per dozen and sold fewer eggs than a year ago.

- Cal-Maine has a variable dividend and the company reduced it following its quarterly results.

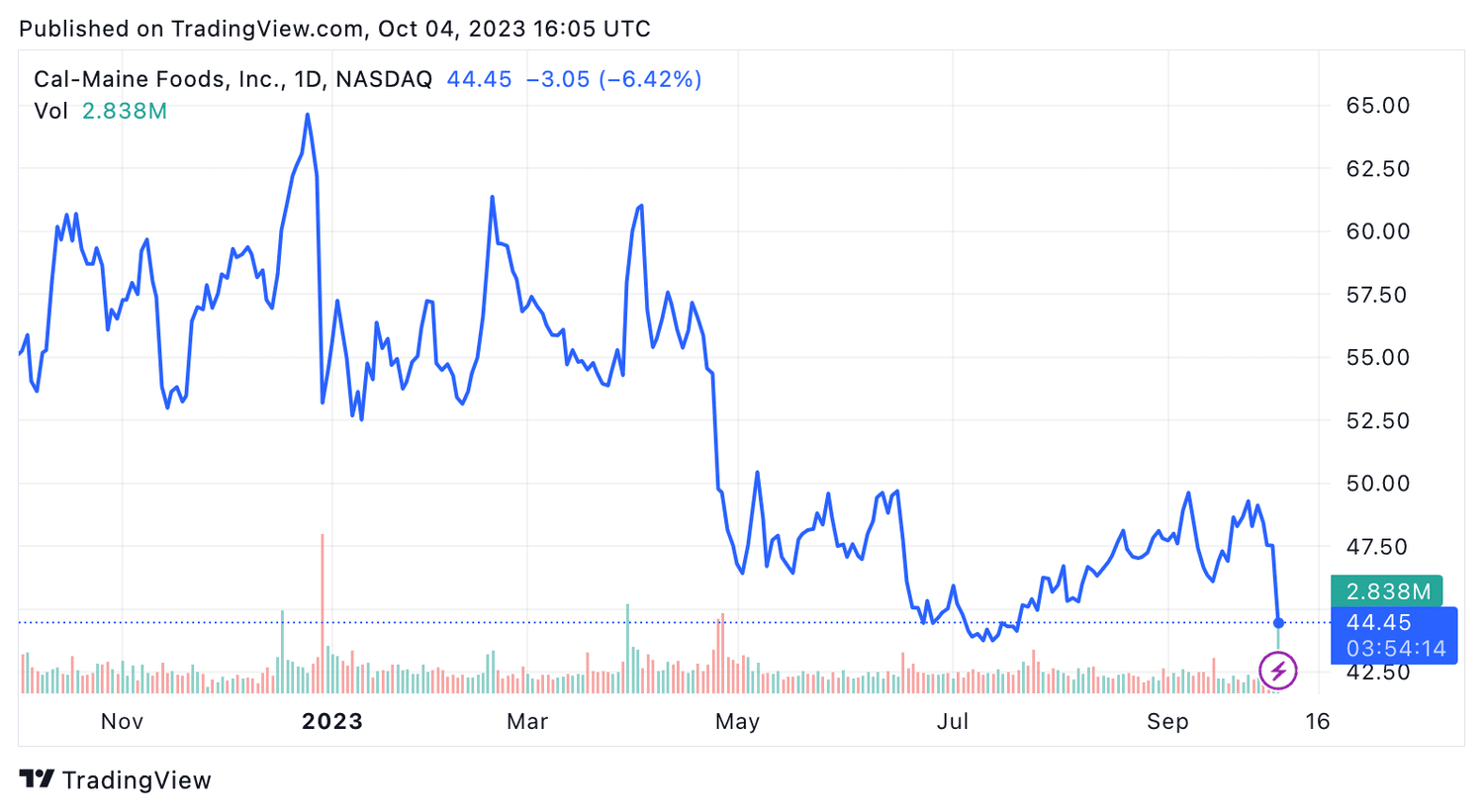

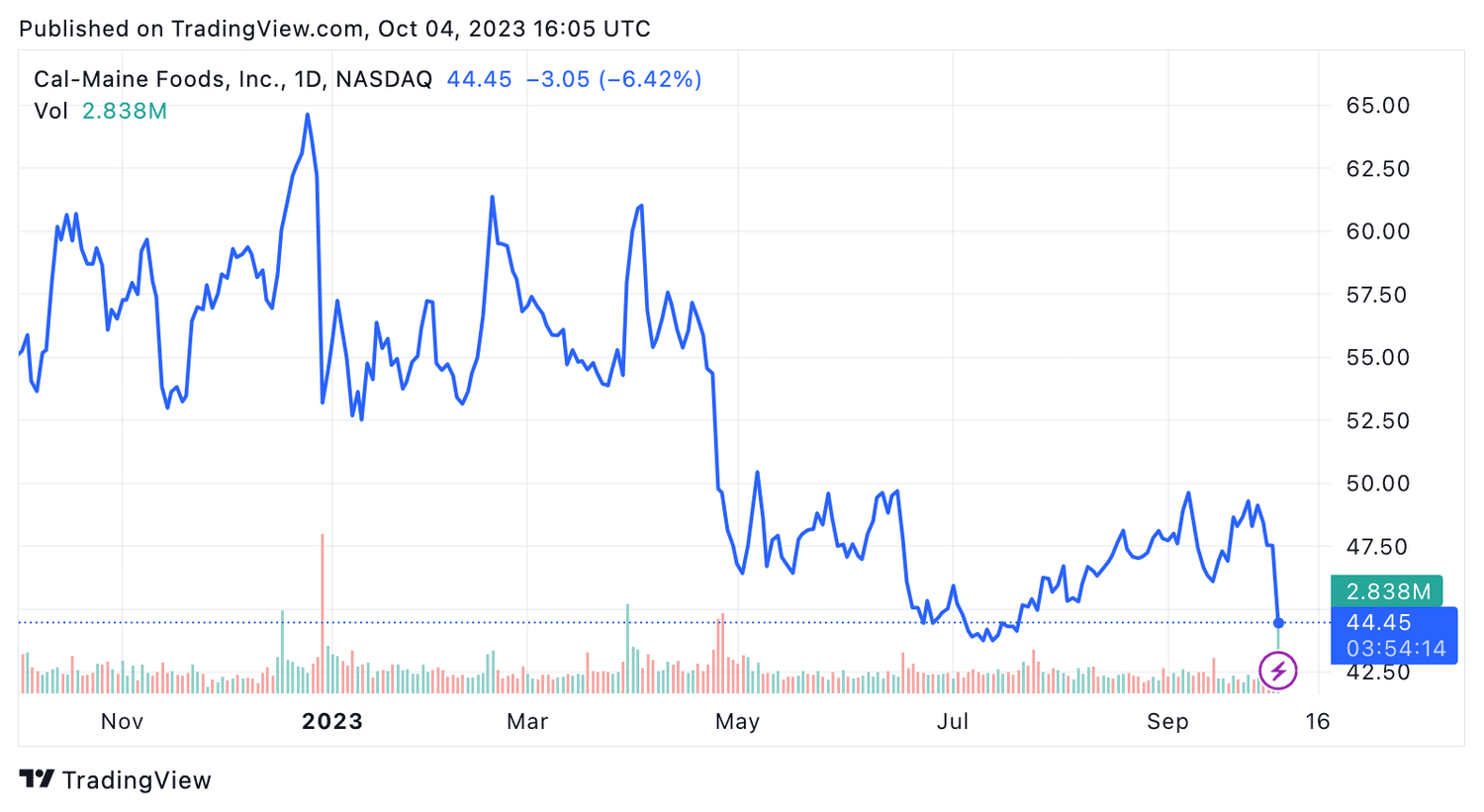

Cal-Maine Foods (CALM) shares fell more by 6% at the start of the session on Wednesday as the egg producer's profits fell with the price of eggs.

Cal-Maine announced a profit for the first fiscal 2024 quarter plummeting 99% to $926,000, or $0.02 per share. Analysts were forecasting earnings per share (EPS) of $0.33. Revenue fell 30.2% to $459.3 million, also missing estimates.

The company said the network's average selling price for a dozen eggs fell to $1.59 from $2.28 a year ago. Its egg sales fell to 273,126 dozen from 275,317 dozen in 2022.

CEO Sherman Miller noted that after reaching record levels in fiscal 2023, average selling prices for shell eggs “have since returned to more normalized levels” as the ;supply is recovering after the latest avian flu epidemic which significantly reduced the number of laying hens.

Cal-Maine has a variable dividend policy, and due to lower revenues, it will only pay $0.006 per share in the first quarter of fiscal 2024. This is down from $0.755 in the previous quarter and $0.853 in the first quarter of last year.

Cal-Maine Foods Stock traded at 20-month low after announcement.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com