Key Points

- Bunge and Viterra will merge in an $18 billion agribusiness deal.

- Viterra shareholders will receive shares and cash worth approximately $8 $.2 billion.

- Bunge CEO Greg Heckman said the deal will be “significantly” #34; boost Bunge strategy.

Bunge (BG) has announced that it will merge with private company Viterra in an $18 billion deal that will create an agribusiness powerhouse valued at around $34 billion.

Bunge, the world's largest oilseed processor, said Viterra shareholders will receive approximately 65.6 million shares of Bunge stock, worth a total of approximately $6.2 million. billion dollars, and 2 billion dollars in cash. Additionally, Bunge will assume $9.8 billion of Viterra's debt. Viterra investors would hold a 30% stake in the combined company following the completion of the transaction, expected in mid-2024. However, Bunge is also planning a $2 billion share buyback, and once that is completed, Viterra shareholders would control 33% of the company.

Viterra operates a network of grain elevators, special crops facilities and port terminals across Canada and parts of the United States. Bunge CEO Greg Heckman explained that the merger “significantly accelerates Bunge's strategy, building on our core purpose of connecting farmers to consumers.”

The new cabinet will be led by Heckman, Viterra CEO David Mattiske and Bunge CFO John Neppl becoming co-chief operating officers.

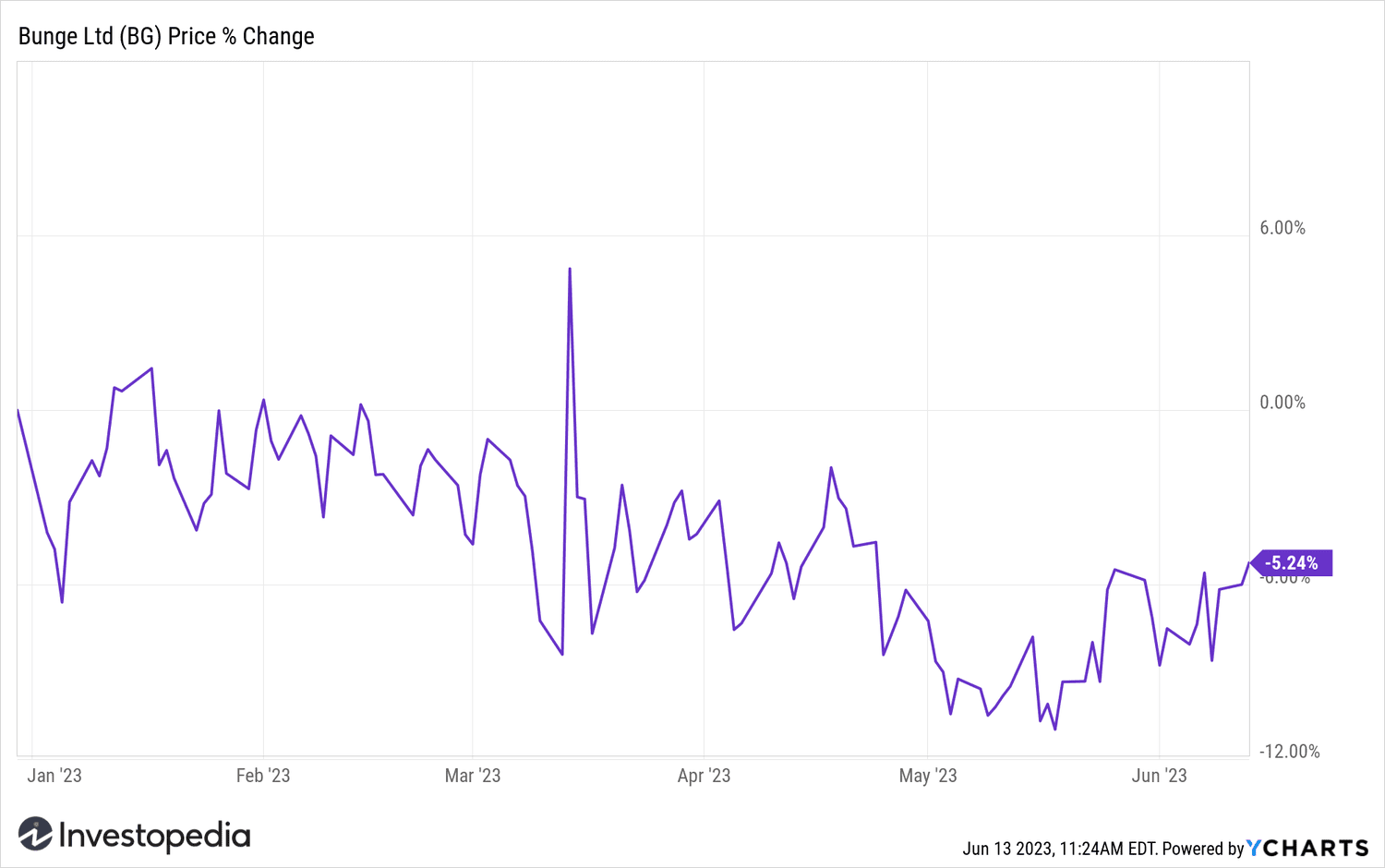

Bunge shares rose by 2% on the Tuesday morning following the news.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com