Key takeaways

- Brookfield Reinsurance has agreed to buy the remainder of American Equity Life Holding Company that it does not already own for $4.3 billion.

- The deal gives AEL investors $55 per share, a 6.3% premium from Monday. closing price.

- Brookfield said the addition of AEL's annuity business will drive growth by expanding its existing offerings.

Brookfield Reinsurance Ltd. (BNRE) has agreed to buy the approximately 80% of annuity provider American Equity Life Holding Company (AEL) that it does not own for $4.3 billion. The deal came after AEL rejected several offers from private equity firms over the past few years.

The companies said the deal would pay AEL investors $55 per share, a 6.3% premium to Monday's closing price. Shareholders will receive $38.85 in cash and 0.49707 Class A shares of Brookfield Asset Management Ltd. (BAM) worth $16.15. The Canadian company Brookfield Asset Management Ltd. is the parent company of Brookfield Reinsurance.

The Managing Partner of Brookfield Reinsurance, Jon Bayer, said that by adding “AEL's leading fixed annuity business to our existing platform, we expect to accelerate growth in collaboration with our partners in distribution and our employees”.

Companies noted that the deal is expected to close at during the first semester of next year. Brookfield said it plans to maintain AEL's headquarters in Des Moines, Iowa, and that expanding AEL's business should create jobs for the company. #39;State.

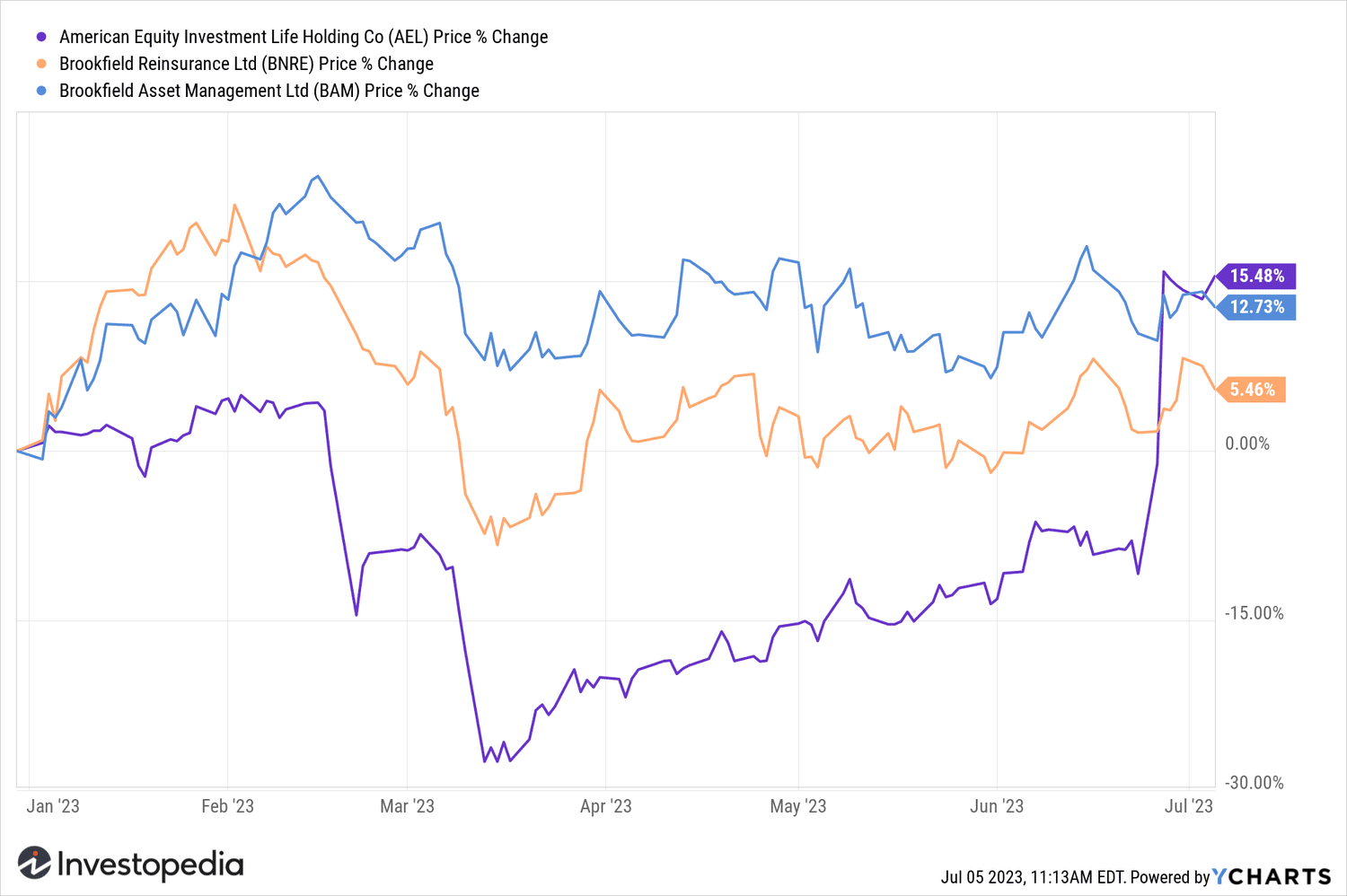

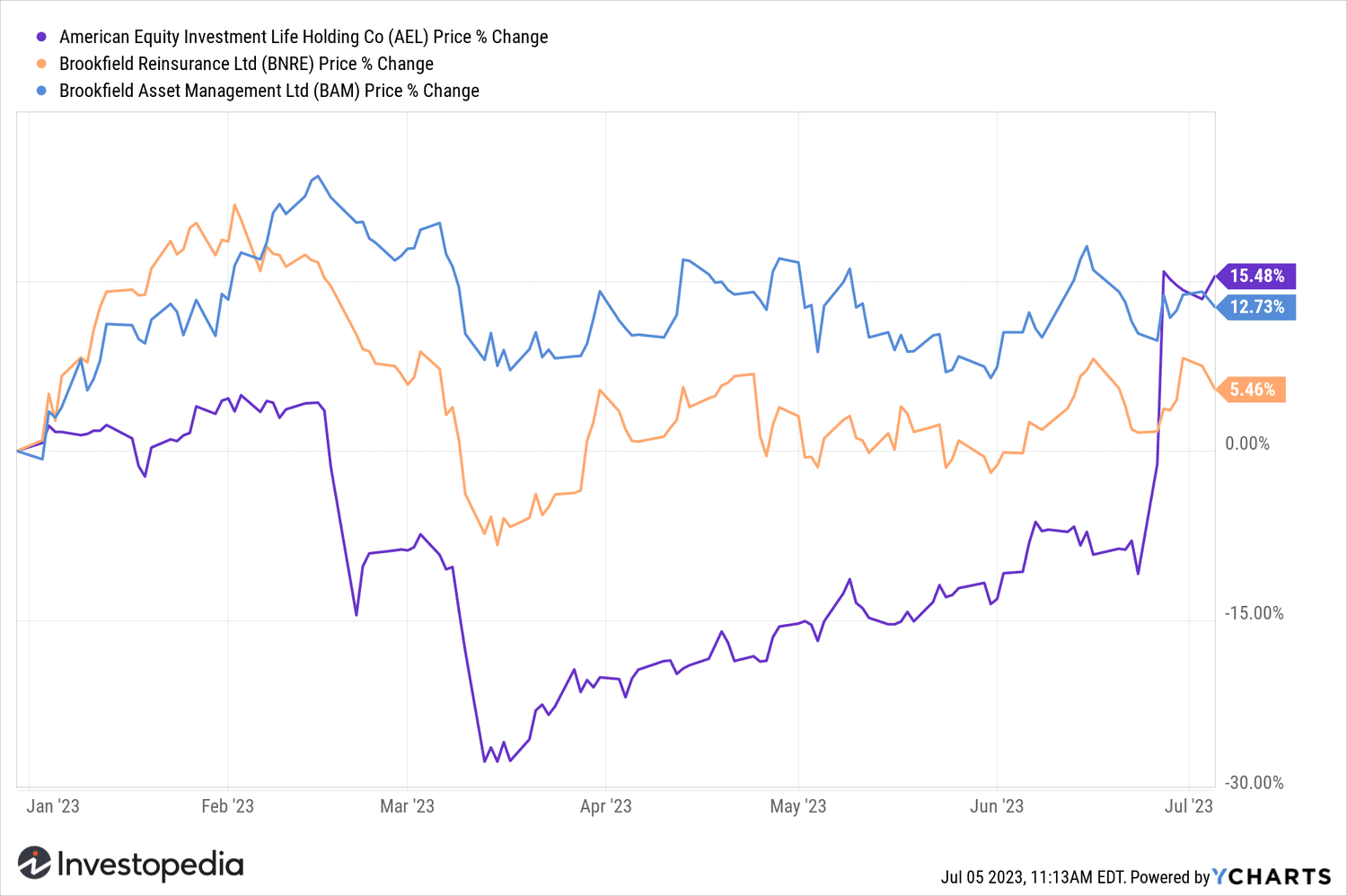

American Equity Life Holding Company Stocks rose more than 1% at 11:15 a.m. EST after the news broke, while shares of Brookfield Reinsurance and Brookfield Asset Management were down.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com