Trending Videos

Takeaways

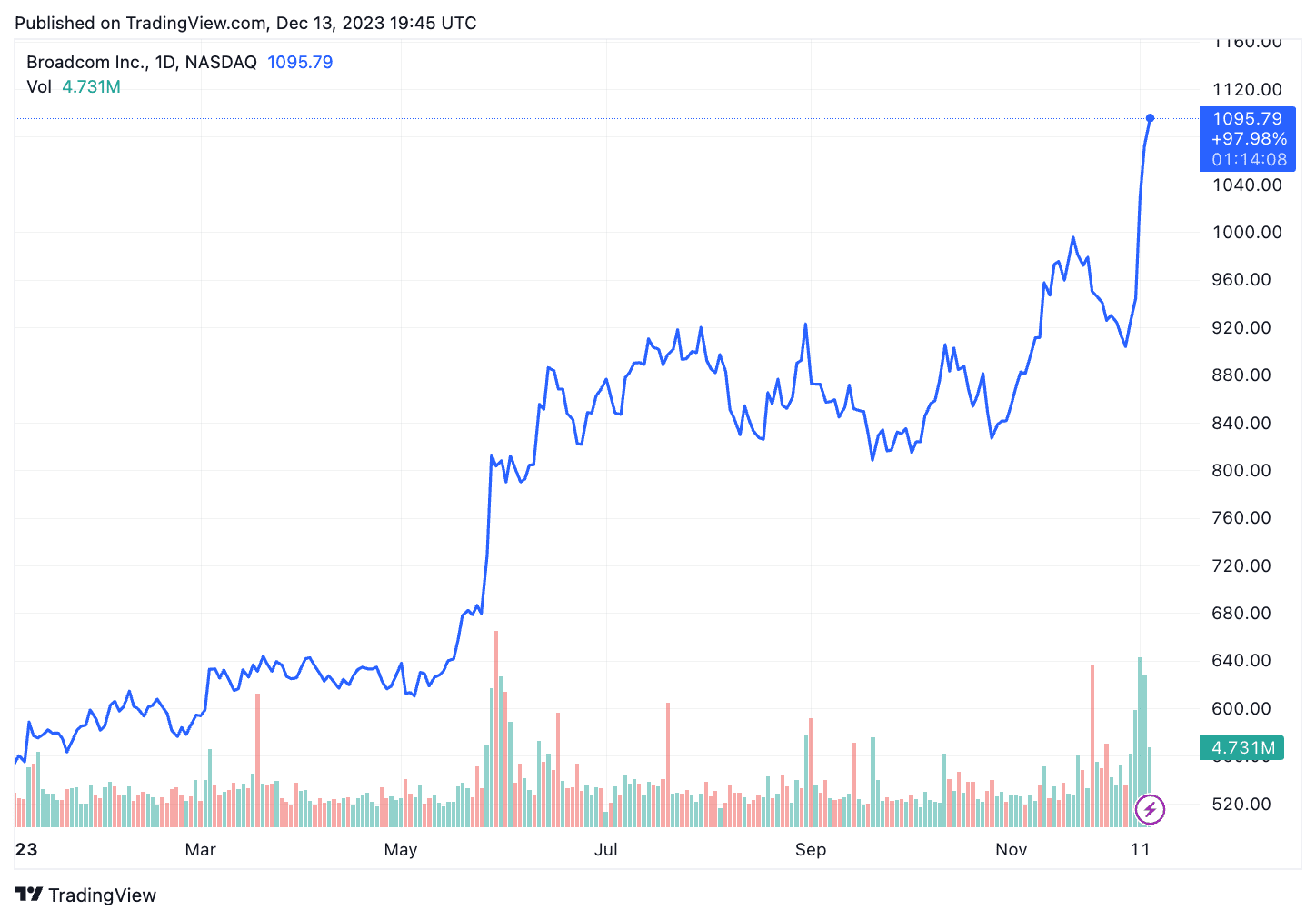

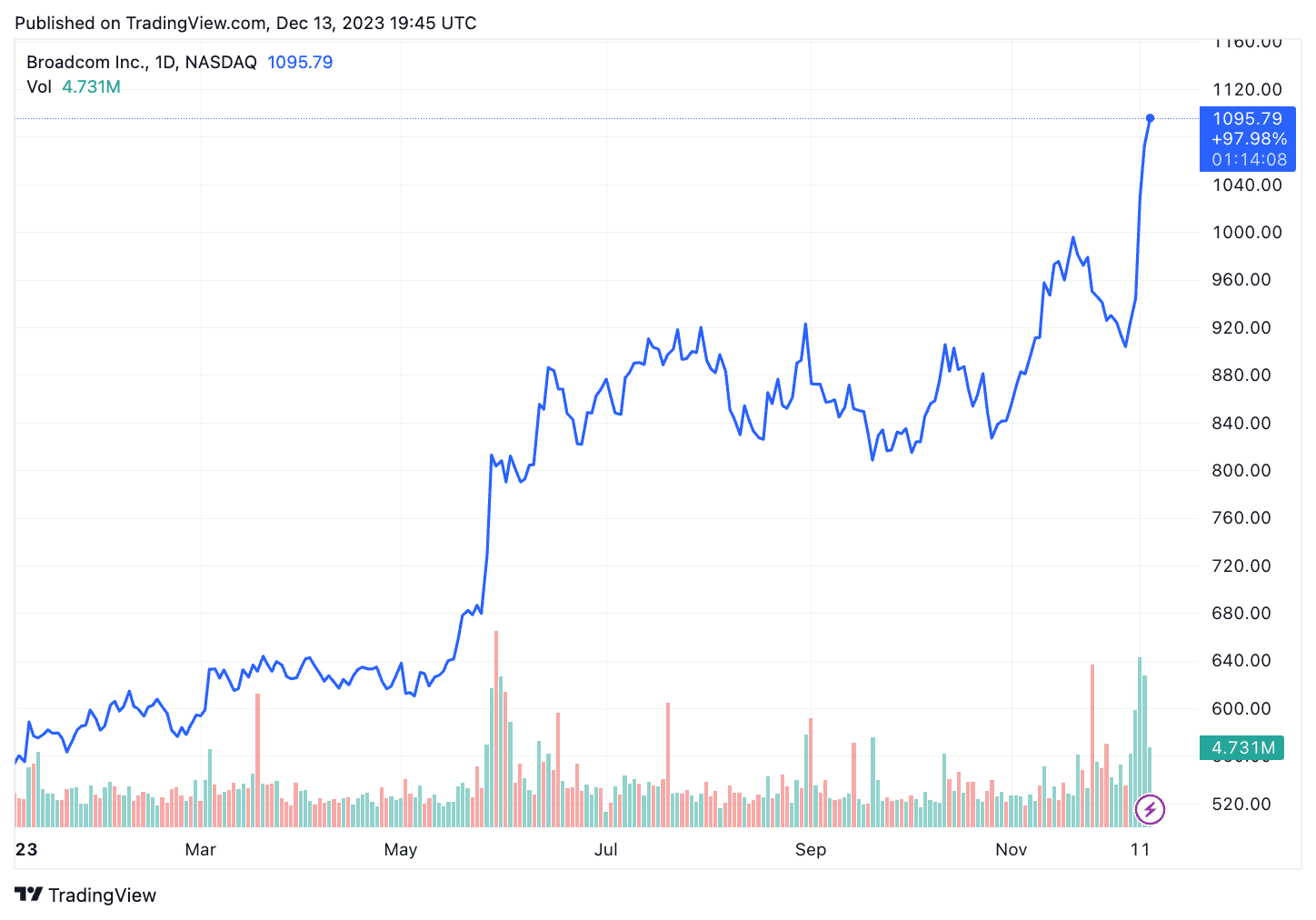

- Broadcom's stock price hit a new high on Wednesday, after hitting record highs on Monday and Tuesday as analysts raised their price targets on the stock.

- Bank of America analysts raised their price target Wednesday to $1,250 from $1,200, citing “strong VMWare synergies and growth potential.”

- Citigroup analysts made similar comments about the software maker's business on Monday and raised their price target.

Shares of Broadcom Inc. (AVGO) hit a record high Wednesday for the third straight day after analysts raised their price target on the stock.

Bank of America analysts raised their price target from $1,200 to $1,250 on Wednesday following a virtual meeting with company executives. BofA Securities noted that the session with CEO Hock Tan, CFO Kirsten Spears and head of investor relations Ji Yoo highlighted Broadcom's focus on “extracting” cost synergies of its $61 billion acquisition of a cloud computing company. VMWare, its evolution towards generative artificial intelligence (AI), its stable non-AI business and its strong profit margin.

Analysts said the company could offer a “combination” of attractive valuation and free cash flow generation/yield. BofA added that the higher price target “reflects continued growth momentum.”

On Monday, Citi had also recovered Broadcom's coverage with a “buy” and said Broadcom's core business and the VMWare purchase gave it advantages.

Broadcom shares rose up 2.2% to $1,095.84 per share around 2:45 p.m. ET Wednesday. Their value has almost doubled this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com