UK regulators have given the go-ahead for Broadcom (AVGO ) $69 billion in purchases of VMware (VMW) on Monday, sending shares of both companies soaring in early trading.

Key Points to Remember

- The UK's Competition and Markets Authority (CMA) cleared Broadcom's $69 billion acquisition of VMware on Monday.

- The deal , first announced in May last year and initially worth $61 billion, cleared one of its major regulatory hurdles this week.

- The merger could help accelerate Broadcom's adoption of cloud computing technologies, while giving VMware the resources to fund R&D projects.

Britain's Competition and Markets Authority (CMA) on Monday cleared Broadcom's $69 billion acquisition of Palo Alto, California-based cloud computing company VMware, concluding a two-pronged investigation phases that began in March. An independent panel of regulators ruled the merger would not stifle competition in the supply of server hardware components in the UK

The deal, first announced in May last year and initially valued at $61 billion, cleared one of its biggest regulatory hurdles this week. Regulators in the European Union (EU), Australia, Canada, Brazil, Israel, South Africa and Taiwan have already approved the agreement, with the United States and China now the last remaining obstacles.

A merger with VMware would allow Broadcom, one of the world's largest semiconductor companies by revenue, to accelerate its adoption of cloud technologies, while giving the former the resources financial resources and capabilities to fund its research and development (R&D) ambitions. Broadcom's roughly $350 billion market capitalization is five times that of VMware's $70 billion capitalization.

Broadcom shares rose by more than 2% in early trading Monday, while those of VMware jumped more than 4%. Shares of the former are up nearly 50% year-to-date, while those of the latter have gained 26% over the same period.

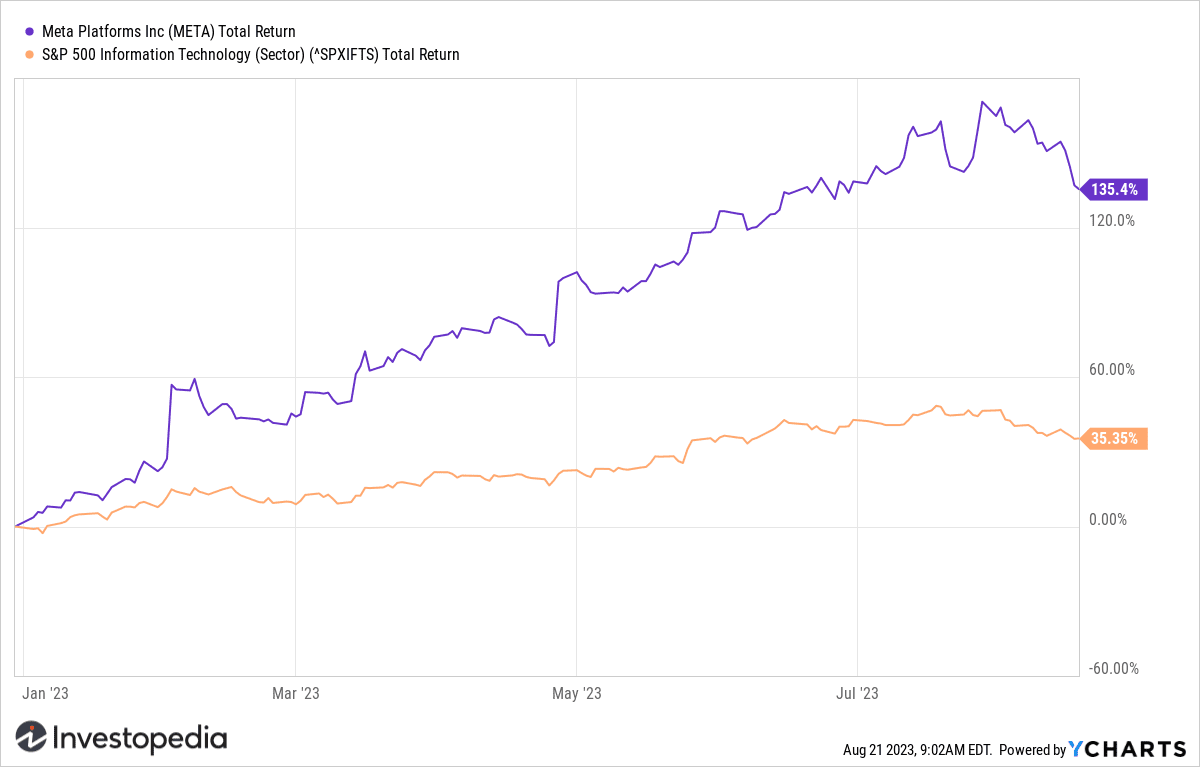

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com