Takeaways

- Bristol -Myers Squibb has agreed to pay up to $5.8 billion to Mirati Therapeutics to strengthen its cancer treatment portfolio.

- Upfront payment to Mirati shareholders is $58 per share, with the potential for an additional $12 per share. awaiting regulatory approval of one of its lung cancer drugs.

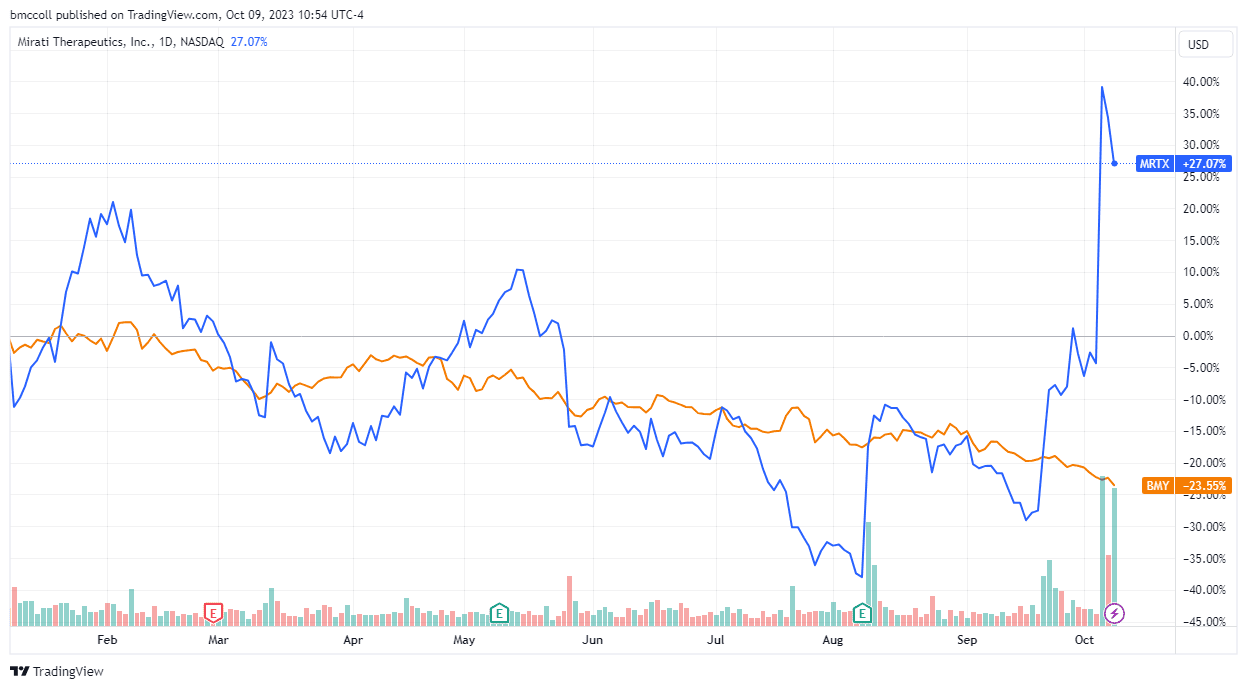

- Mirati Therapeutics shares fell on the news, the price dropping to $58 per share being lower than Friday's closing price of $60.20.

Bristol-Myers Squibb (BMY) has decided to expand its reach into cancer drugs by purchasing Mirati Therapeutics (MRTX) in an all-cash transaction for an amount that could total 5.8 billions of dollars.

The initial phase of the Bristol-Myers deal pays $58 per share for Mirati, representing a 3.7% discount to Mirati's closing price on Friday. However, Mirati investors will also receive a non-tradable Contingent Value Right (CVR) for each Mirati share they own, potentially worth $12 per share.

Bristol-Myers is already adding Mirati's Food and Drug Administration FDA-approved Krazati treatment for certain non-small cell lung cancers using a KRAS inhibitor, which blocks cancer cells' reproduction signals. It also has several other potential cancer drugs in its pipeline. Payment for CVRs would occur if the FDA accepted the application of one of them, MRTX1719, to treat lung cancer.

Chris Boerner, COO and CEO-elect of Bristol-Myers called the move “another important step in our efforts to grow our diverse oncology portfolio” and further strengthen the company's pipeline for the future .

The transaction should be finalized at first half of next year.

Shares of Mirati fell more than 5% in early trading Monday after the news, although they remained higher for the year. Bristol-Myers Squibb shares were also down.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com