Takeaways

- Boeing lowered its estimate for 737 Max deliveries this year due to inspections for a potential fuselage problem.

- The problem reduced deliveries in the third quarter, leading to a larger-than-expected loss .

- CEO Dave Calhoun told employees that Boeing had identified problems from the past that would now be resolved “once and for all.”

Boeing (BA) announced it would deliver fewer of its popular planes of 737 Max passengers this year because of a problem caused by one of its suppliers.

The company now expects 375 to 400 of its 737 Max will be delivered in 2023, down from its previous estimate of 400 to 450, due to delays caused by inspections and necessary repairs to their fuselages. In August, Boeing and Spirit AeroSystems (SPR) indicated that there was a potential problem with holes drilled in some of the aft pressure bulkheads built by Spirit AeroSystems, leading to the inspections.

Boeing said reduced deliveries caused by the 737 problem as well as “unfavorable performance” in its Defense, Space and Security division led to a loss of $3.26 per share in the third quarter of the fiscal year. 2023, more important than expected. Revenue rose 13% from last year to $18.1 billion, beating forecasts.

CEO Dave Calhoun said the aircraft maker continues to make progress in its recovery and that “despite near-term challenges” it remains on track to meet its financial goals. He added that Boeing was focused on stabilizing its supply chain and improving operational performance as it ramped up production to meet strong demand for aircraft following the COVID-19 pandemic crisis.

In a letter to employees, Calhoun noted that the company has “identified past non-compliances that we now have the rigor to find and correct once and for all.”

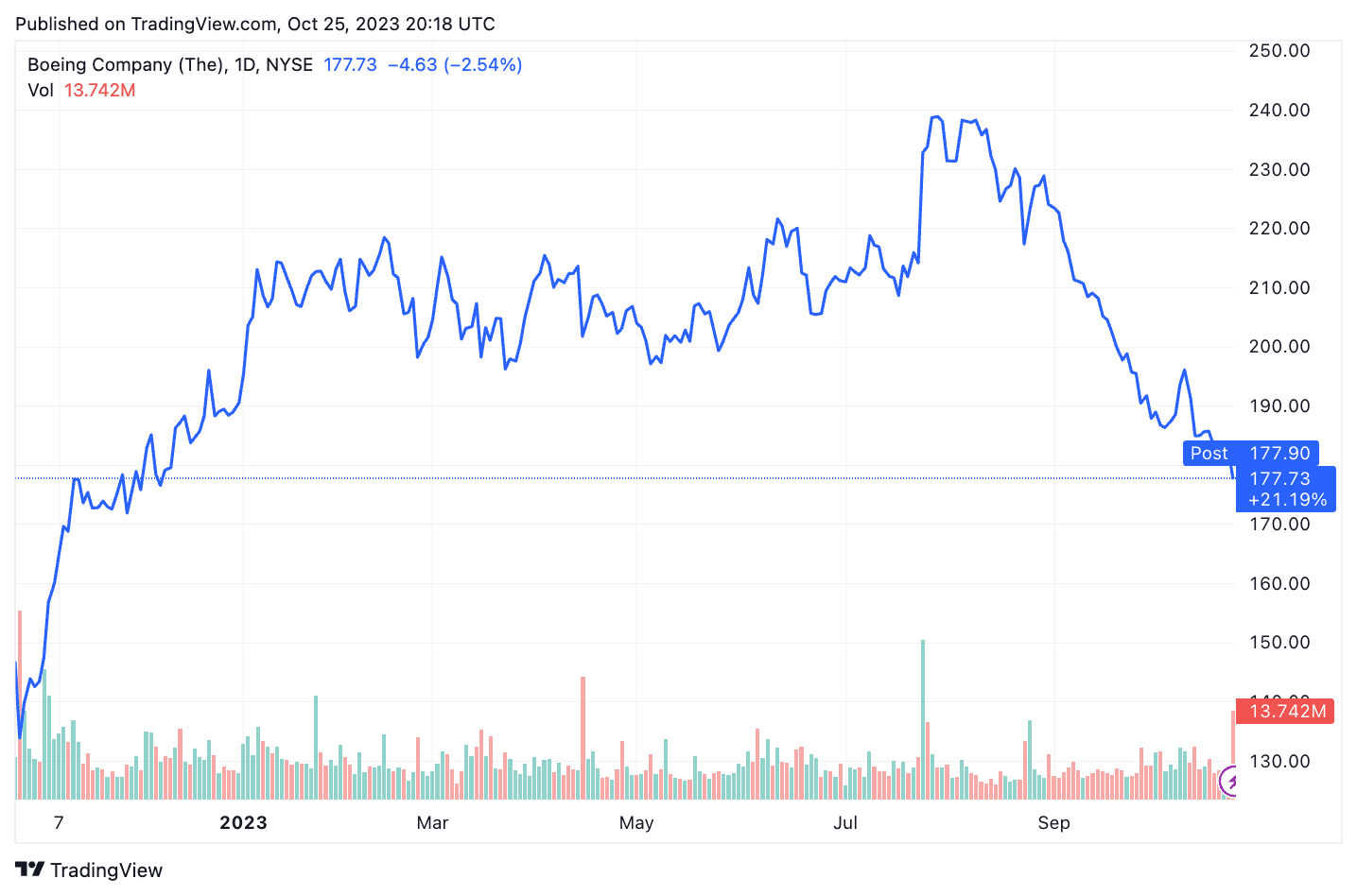

Boeing shares lost more than 2% on Wednesday to trade at their lowest level since last December. Shares of Spirit AeroSystems also fell.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com