Dow component Boeing Company (BA) is trading sharply lower Wednesday, after missing the second quarter of 2020, earnings estimates, in a distant country. The giant of the aerospace recorded a loss of $4.79 per share, much worse than$2.63 expectations, while revenue of $11.81 billion missed the $12.95 billion consensus. The giant of the aerospace industry reported a healthy order backlog of more than 4,500 commercial aircraft, but has not commented on the likelihood of cancellations and massive in the second half of the year 2020.

Key Takeaways

- Boeing missed second quarter earnings and revenue forecasts by large margins.

- The stock has been engaged in a sharp decline since the month of March, 2019.

- The downward trend could eventually reach the first-quarter low.

Commercial airplane revenue fell a staggering 65% year on year. Abnormal production costs as a result of production slowdowns and freezing of new aircraft also affected the quarterly results, which were dismal all around. In particular, the company has offered little information about the 737-MAX for the application in the light of the massif of the first half of the cancellations and other delays in obtaining the struggling airline back in the sky.

Wall Street consensus has remained kept pointing toward the exit, with a “hold” rating based on seven “Buy” and seven “Hold” and three “Sell” recommendations. Price targets vary between a minimum of $110 for the Street high of$ 277 per month, while the stock opened the session of this morning more than $16 below median $186 target. The sell-the-news reason does not help this asymmetry of the equation, which suggests that analysts are overvaluing Boeing long-term prospects.

Production or product costs relate to the expenses incurred by a company manufacturing a product or delivering a service. Production costs may include a variety of expenses, such as labor, raw materials, consumables, manufacturing supplies and overhead costs. Product costs may also include those who are engaged in the framework of the provision of a service to a client.

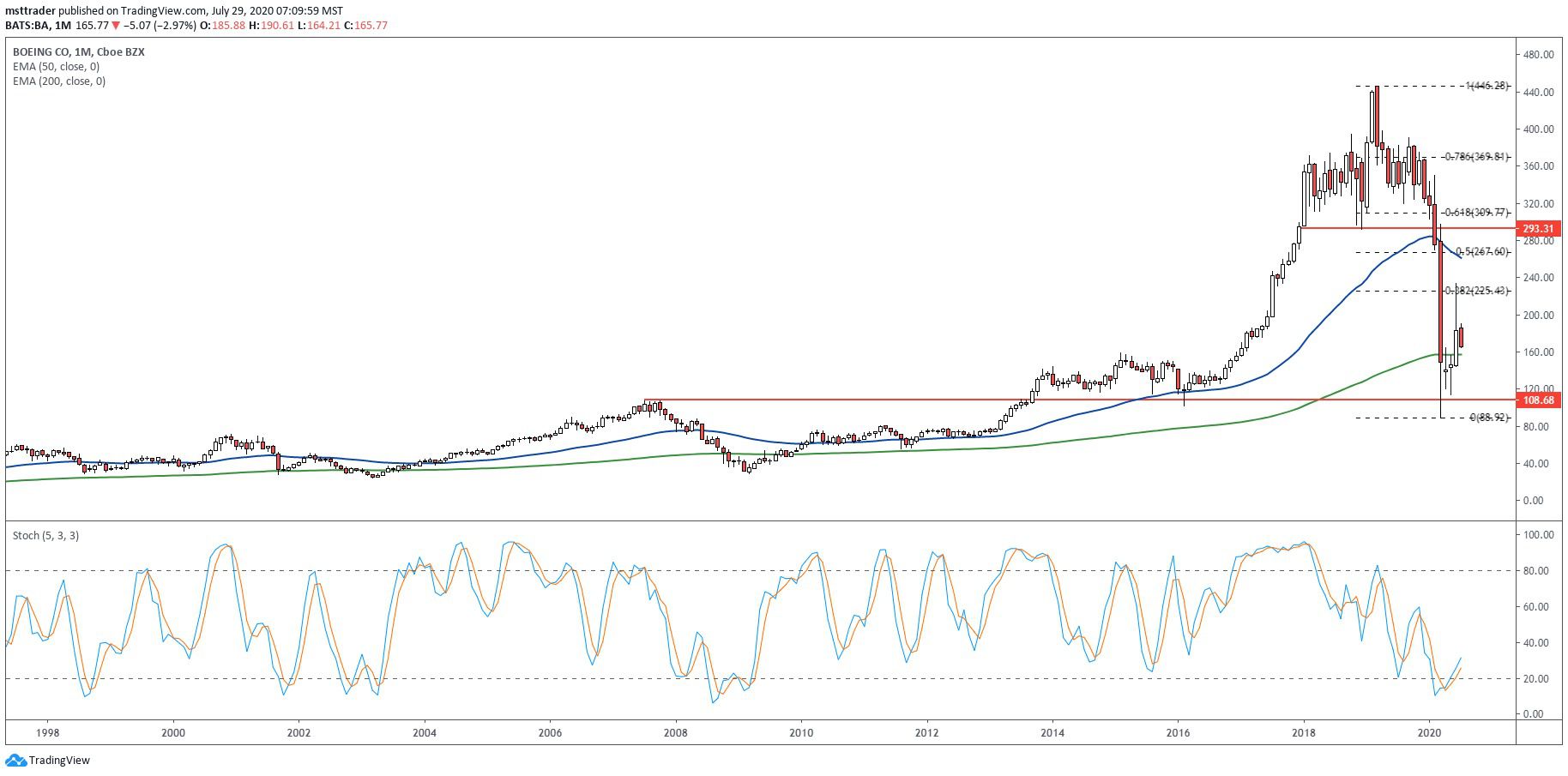

Boeing’s Long-Term Chart (1997 – 2020)

TradingView.com

A long-term uptrend topped out at $60.50 in 1997, then in 2001, in an escape attempt that failed, which gives a broad double top that broke down in 2003. That marked a climatic selling, in advance of an upward trend, which has posted higher gains during the mid-decade bull market. These impulse buys topped near $108 in 2007, a decline that accelerated during the economic collapse of 2008. The stock posted a six-year low, near $30 in 2009 and turned over in the new decade, back to before 2013.

Immediately escape has failed to generate upside-down until 2017, when the stock took off in a powerful advance, which posted a record $446 in March 2019. An Ethiopian 737-MAX jetliner and crashed, forcing a worldwide grounding, which is still in force as we head into the second half of the year 2020. The price action has completed a multi-year double top in February and broke support near$ 300, generating a heartbreaking sale, which was stopped at a seven-year low in March.

Boeing In The Short-Term Chart (2018 – 2020)

TradingView.com

The decline settled at 2013 break of support, while the rebound in June reversed at the .382 Fibonacci sale retracement level. Price action is now set to 200-month exponential moving average (EMA) – if this level does not hold, Boeing is at risk of failure by the March lows. It may already be too late, because the 17-month downtrend has carved the outline of an Elliott five-wave decline, with the three months of the recovery, marking the fourth wave countertrend. If yes, Boeing stock may not bottom until the trading well into the double digits.

A bottom is the lowest price negotiated or issued by a financial security, commodity, or index inside a particular referenced period of time. The processing time may be a year, a month, or even a intraday period, but when it is referenced in the financial media or education, this term refers to a small point of interest.

The balance volume (OBV), the accumulation-distribution indicator also warns of difficulties to come, first to the collapse of a multi-year low in May and then zooming to an all-time high, a month later. Aggressive selling pressure in the last two months, has generated a failure of the OBV in small groups, with shareholders to leave the vessel after having put an end to hopes of a quick recovery and 737-MAX aircraft’s certificate of airworthiness. Unfortunately, there may not be demand for the airliner after it returns to the sky, with many analysts now expecting the subsidence of air travel in 2025.

The Bottom Line

Boeing is trading sharply lower after the giant aerospace missed second quarter earnings estimates, and the stock could test the March lows in the coming months.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com