Blink Charge Of Co. (BLNK) shares has increased by more than 20% after the company has received a new grant to deploy 200 flash Fast Level 2 charging stations across the mid-Atlantic region, including Virginia, Maryland, West Virginia, and Washington, d.c. The three-year project is scheduled to begin in October, with the appropriate identification of the electric vehicle (EV) charging locations that are designed to encourage the adoption of evs.

Last quarter, Clin Support Co. turnover has increased from 125% to $ 1.29 million, beating the consensus estimates of $ 100,000, and a GAAP earnings per share (EPS) loss of 11 cents per share, missing consensus estimates by two cents per share. The company continues to sign contracts for the new charging stations with cities such as Portland and private companies such as the Sent of Technology.

Blink Charge Co.’s gains come amid a broader rally in the electric vehicle stocks, including Tesla, Inc. (TSLA), Nikola Corporation (NKLA), and NIO Inc. (NIO), among others. While many of these gains have been attributed to the speculation, China has recently set the ambitious goal of achieving 25% of car sales being electric by 2025, which compares to only 5% of its auto sales.

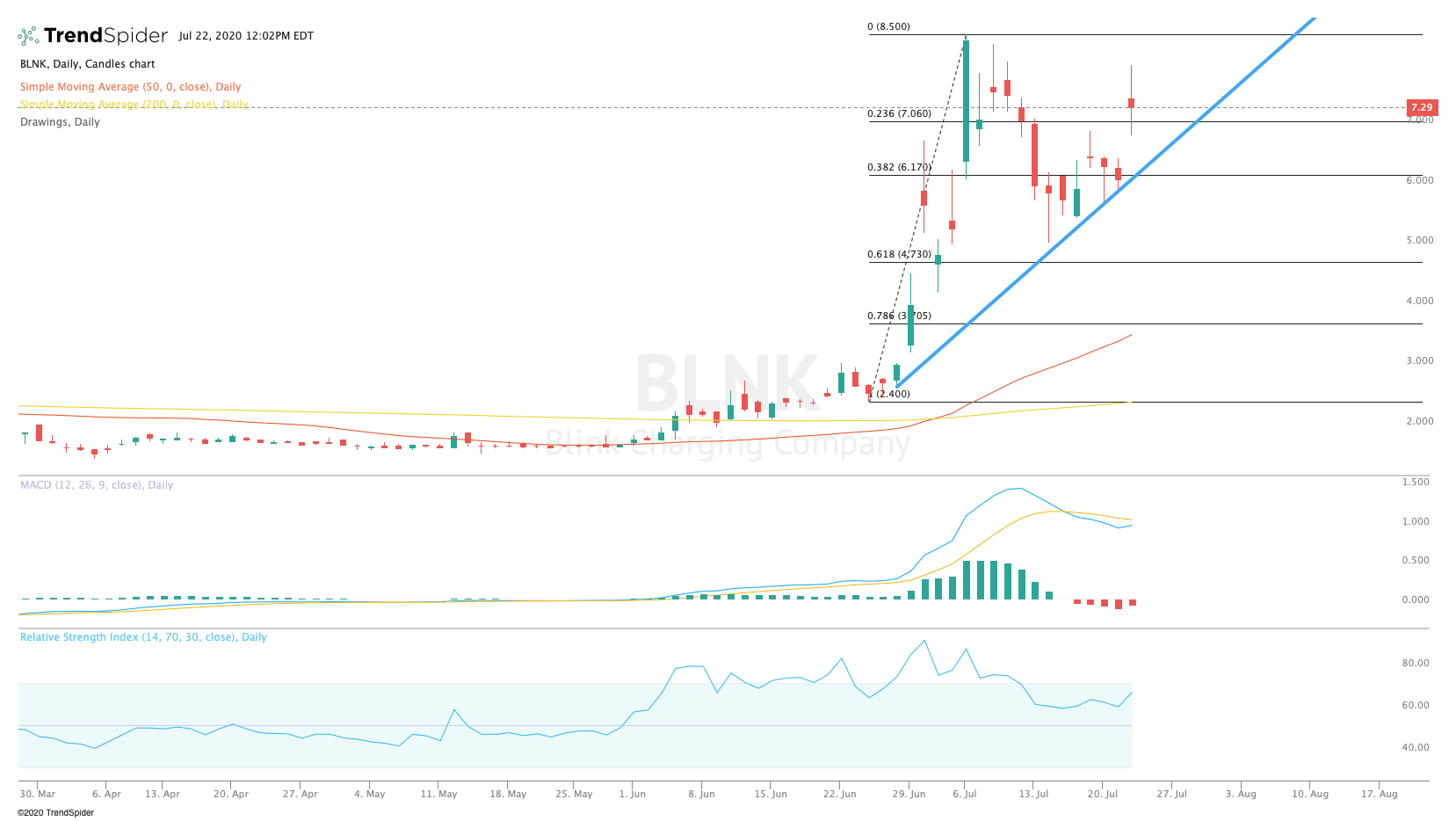

TrendSpider

From a technical point of view, Clin Support Co. stock rise significantly towards its highs of $8.50 over the course of Wednesday’s session. The relative strength index (RSI) has risen to levels that are overbought with a reading of 66.3, but the moving average convergence divergence (MACD) could see short-term bullish crossover. These indicators suggest that the stock could see a consolidation before a move higher.

Traders should watch for consolidation below prior peaks of $8.50 in the coming sessions. If the stock moves lower, traders should look for support near the Fibonacci levels of $6.17, or before the bottom of $5.00. If the stock breaks out higher, traders could see a tendency to the freshness of all-time highs.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com