Takeaways

- BlackRock& Net outflows increased in the third quarter due to investor strategies and in response to rising interest rates.

- An increase in assets under management (AUM) and advisory fees has driven BlackRock's growth. earnings per share (EPS).

- BlackRock CEO Larry Fink said the investment management firm expects more funds to come from clients once interest rates stabilized.

Net outflows from BlackRock (BLK) soared in the third quarter due to low-fee institutional index equity strategies and client response to Federal Reserve interest rate hikes. br>

The investment firm reported net outflows of $49 billion over the period, with $19 billion coming from a single international client. Net inflows were $2.57 billion, down 85% from last year. Investors withdrew $13 billion from long-term investment funds, the largest amount since the start of the pandemic in 2020.

Assets under management (AUM) increased 14% to $9.1 trillion, although this figure is lower than the $9.4 trillion reported by BlackRock for the second quarter.

The increase in assets under management and Rising advisory fees helped BlackRock beat profit estimates, reporting adjusted earnings of $10.91 per share. Revenue rose nearly 5% to $4.52 billion, broadly in line with forecasts.

BlackRock Chairman and Chief Executive Officer (CEO) Larry Fink said that for the first time in nearly 20 years, “clients are getting a real cash return and can wait for more policy and market certainty before taking any investment.” new risks”. He attributed this phenomenon to the firm's negative fund flows during the 2000s. Fink added that BlackRock is “positioning itself for a resurgence in allocation activity” as rates rise. interest rates stabilize.

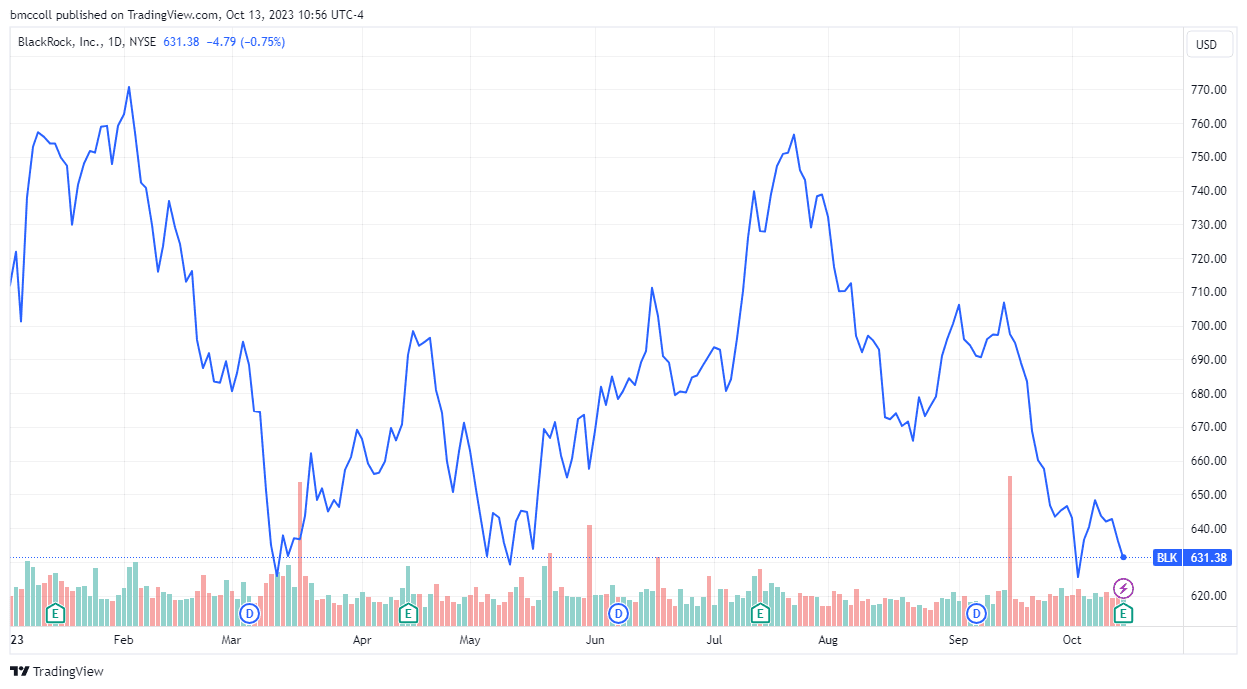

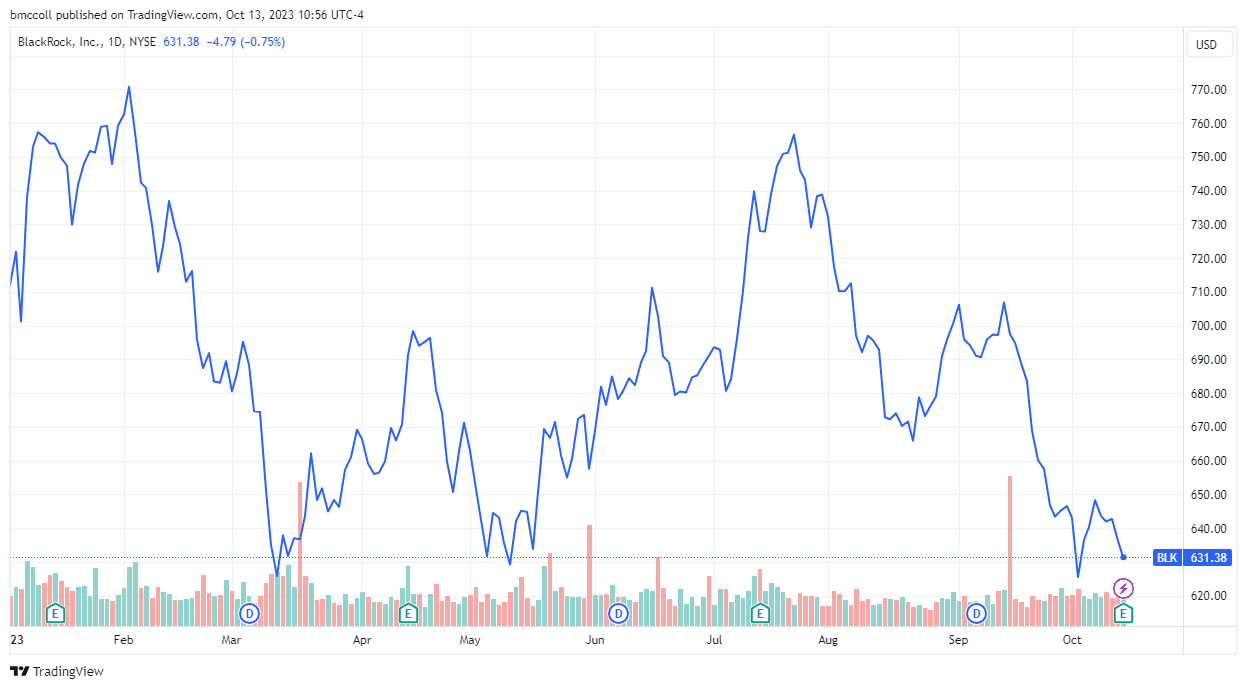

BlackRock shares fell early Friday and were down about 10% for the year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com