Key Points

- Biogen said it was buying Reata Pharmaceuticals for $7.3 billion, expanding its rare disease treatment portfolio.

- Biogen will pay $172.50 per share for Reata, a premium of 59 % over Thursday's closing price.

- Reata won FDA approval this year for the only US treatment for Friedreich's Ataxia.

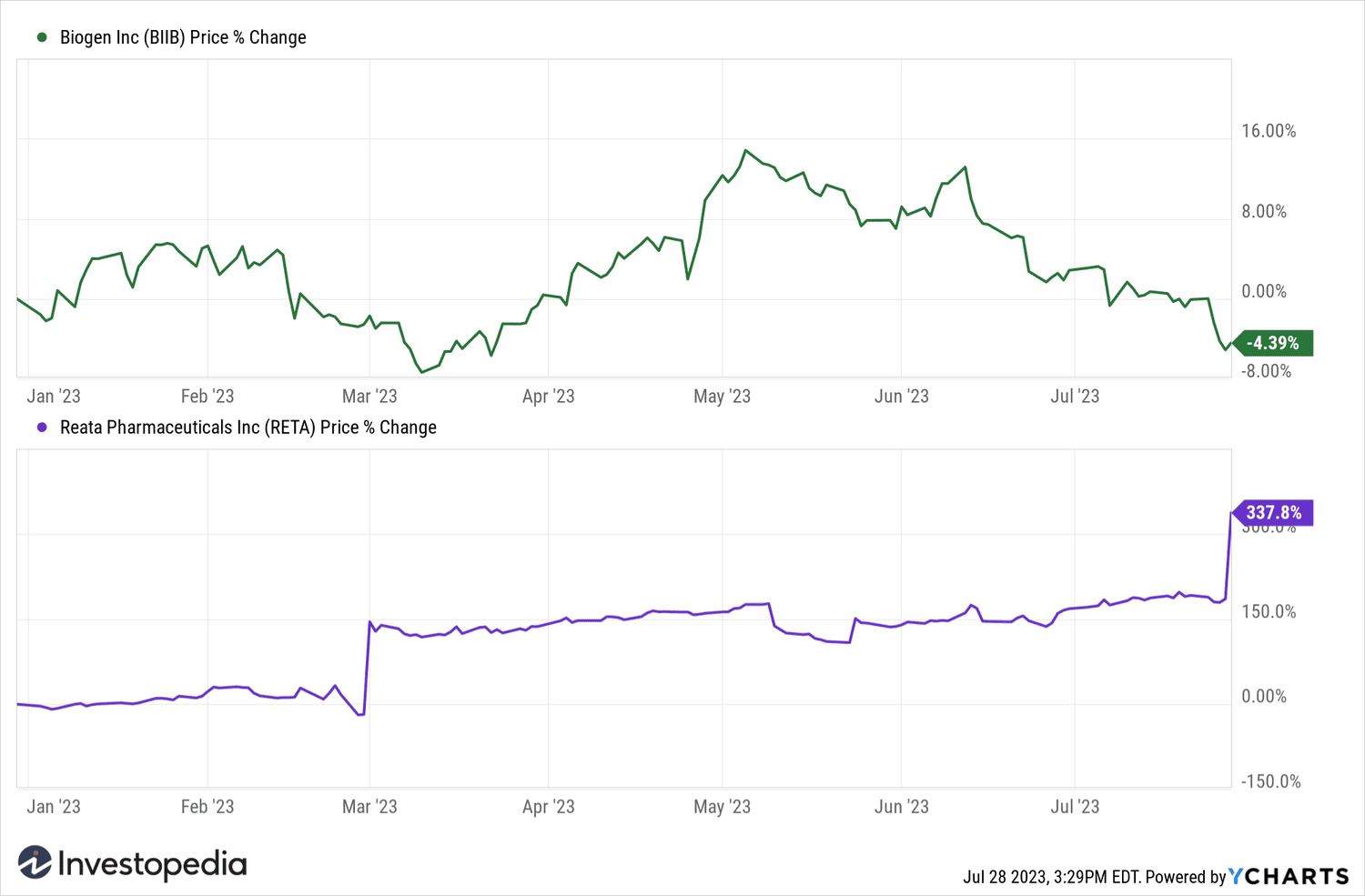

Shares of Biogen (BIIB) and Reata Pharmaceuticals (RETA) rose after Biogen announced that; it was buying the therapeutics maker for $7.3 billion, including debt, to expand its portfolio of rare disease treatments.

The deal values Reata at 172, $50 per share, a 59% premium to Thursday's closing price.

Reata received Food and Drug Administration (FDA) approval earlier this year for its drug, Skyclarys. It is the first US treatment for Friedreich's Ataxia, a rare genetic condition that damages the nervous system, including the spinal cord and parts of the brain. Biogen explained that the life-shortening disease affects approximately 5,000 patients in the United States.

Biogen CEO Christopher Viehbacher, called the acquisition of Reata “a unique opportunity for Biogen to strengthen our near-term growth trajectory.”

Reata CEO Warren Huff said that Biogen's expertise and business footprint “make it the optimal choice to help Skyclarys realize its full potential.”

The transaction is expected to close at fourth trimester.

Reata Pharmaceuticals shares have jumped 54% on Friday to their highest level since November 2020 following the news. Biogen stock gained 0.9% but remained down for the year.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com