Points to remember

- Big Lots posted a lower-than-expected loss and decline in sales, and shares surged.

- The company saw “some sequential improvement”; in demand even as its customers were under financial pressure.

- CEO Bruce Thorn said that while the environment remains challenging, the discount retailer is now ready to “start playing games.” the offensive”.

Big Lots (BIG) shares climbed up more than 26% on Tuesday after the discount furniture and home goods retailer posted a loss and lower-than-expected sales as customer demand improved.

Big Lots reported a loss of $3.24 per share in the second quarter of fiscal 2023, beating analyst estimates. While revenue fell 15.4% to $1.14 billion, it also beat forecasts. Same-store sales fell 14.6%. The company said a net decrease in the number of stores, partially offset by new stores and relocations, was responsible for a drop in sales of about 80 basis points (bps).

CEO Bruce Thorn noted that Big Lots continues to face “a very challenging environment, in which our primary low-income customer remains under significant pressure and has limited capacity for higher discretionary purchases.” He added, however, that the company “saw some sequential improvement in the quarter.” Thorn said Big Lots has benefited from its strategy to “capture great deals, communicate unmistakable value, increase store relevance, win through omnichannel and increase productivity.” “.

He explained that even though the consumer While the environment will probably remain difficult and lead to negative comparable sales in the second half, “we are now in a position to start playing on the offensive”.

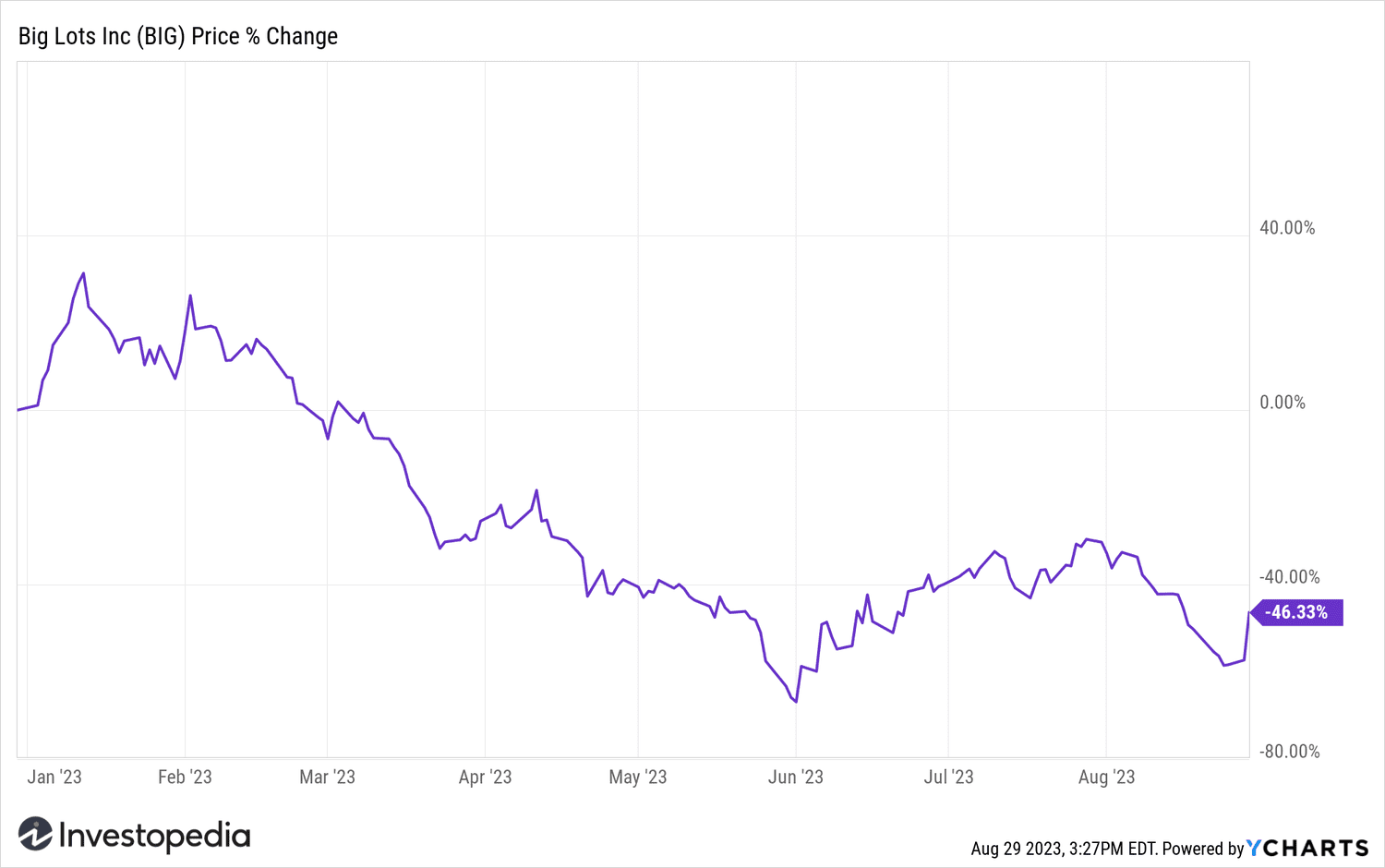

Despite Tuesday's gains, the Big Lot shares were still 46% lower for 2023.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com